- Summary:

- Uber earnings report shows that the company posted a huge net loss for the operational quarter on the back of poor sales growth an done time IPO payouts.

The shares of Uber Technologies Inc fell nearly 10% on the day after it reported a humongous net loss of $5.24billion. Adjusted sales also came in much lower than expected, as was the adjusted revenue which came in at $2.87billion versus the $3.05 billion that the markets were expecting. This figure represents an annualized increase of 12%; the slowest the company’s revenues have grown since inception. The company forecasts that it may suffer an adjusted loss of up to $3.2 billion this year. Investors are apparently not amused by the figures, hence the premarket selloff.

Uber has only been listed in the secondary market for three months and attributed majority of the loss to compensations paid out in stocks, after it completed its IPO and eventual listing. Uber’s shares are down 14% from IPO price and are currently trading at $38.85.

The company plans to cut 400 marketing staff as part of turnaround measures announced by CEO Khosrowshahi. He believes that the company’s losses would reduce within the next two years, and expects to increase its gross bookings to $67 billion for the year.

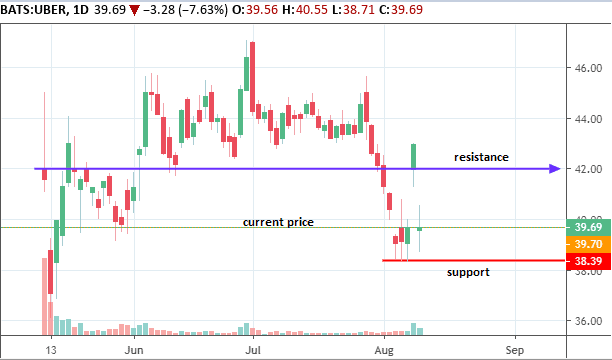

Technical Play for Uber

The stock opened with a huge gap but has recovered slightly and is now testing a major support-turned-resistance level at just under the $40 mark. An upside break of this level will open the door for a test of $41.50 – $42, while a break to the downside will bring the $38.30 and $36.50 – $36.80 price levels into focus.