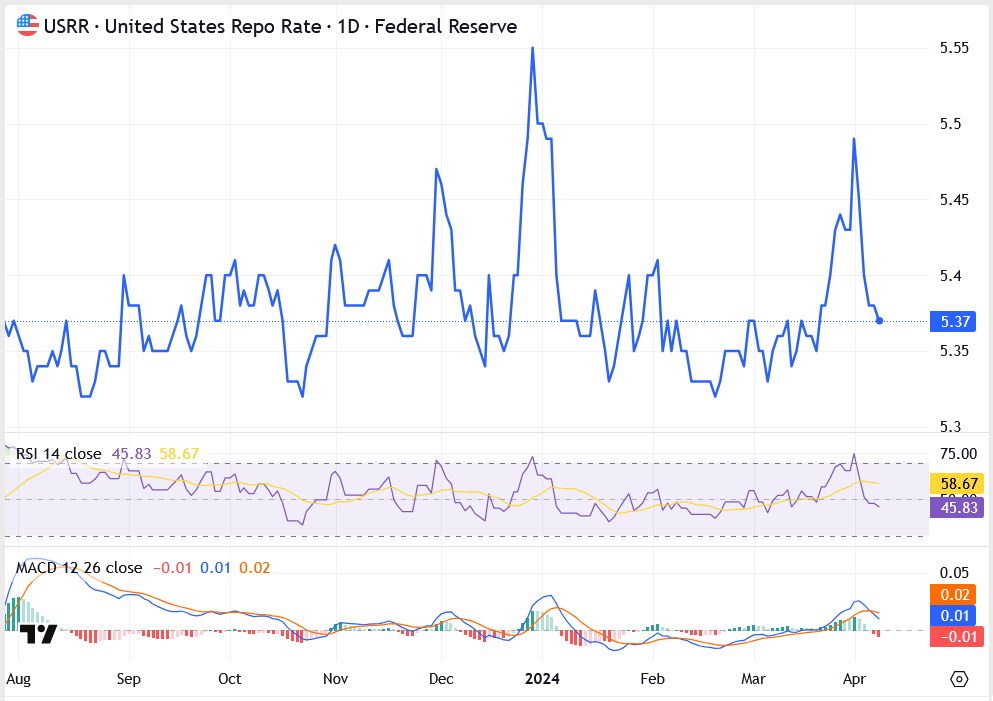

The U.S. overnight repo rate eased to 5.37% today, retreating from the temporary spike above 5.50% seen in late March. The decline signals a normalization in short-term liquidity after quarter-end funding pressures pushed rates higher last month.

With no immediate intervention from the Federal Reserve, traders interpret the decline as a return to baseline funding conditions, though uncertainty over upcoming inflation data and Fed communication keeps short-term rate expectations fluid.

US Repo Rate Technical Analysis

- Current Rate: 5.37%

- Resistance Levels: 5.45% – 5.51% – 5.54%

- Support Zones: 5.34% – 5.30% – 5.25%

- RSI: 45.83 – trending lower from 58.67, signaling cooling momentum

- Trend: Neutral to bearish short-term bias below 5.45%; support at 5.34% holds intraday

Outlook: Lower Repo Rate Eases Tensions but Fed Path Remains Unclear

The drop in the repo rate reflects improved interbank liquidity after the Q1 rollover, but it’s not yet a signal of policy change. Fed officials remain cautious, balancing resilient job data against slowing consumption.

With inflation data due next week, market participants are watching whether core prices continue decelerating. A print below expectations could revive speculation of a June rate cut—potentially dragging repo rates lower.