- Summary:

- Suzlon share price dips to ₹53.35—Is it a buying opportunity or more downside ahead? Key support and resistance levels coverd here.

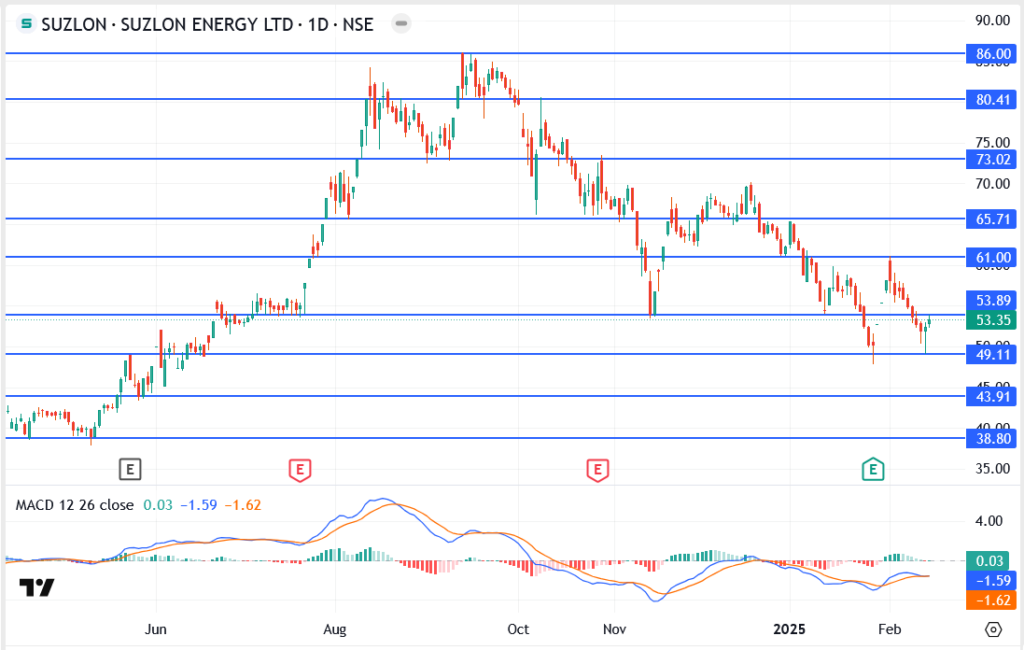

The Suzlon Energy (NSE: SUZLON) share price has been on a bit of a rollercoaster lately. After hitting a high of ₹86 in 2024, the stock has steadily slid downhill, shedding over 35% of its value. Today, Suzlon is trading around ₹53.35, struggling to find its footing as investors debate whether this is just a temporary dip or the start of something more serious.

What’s Behind Suzlon’s Recent Slide?

Suzlon’s recent slide can be attributed to several factors. After its impressive rally in 2024, profit-taking by early investors has weighed on the stock. Broader sector weakness in renewable energy, driven by shifting market sentiment and caution toward growth stocks, has also played a role. Additionally, rising production costs and policy uncertainties in the clean energy space have added pressure.

Technical Analysis: Key Levels to Watch

From a technical perspective, Suzlon’s chart shows the stock at a critical juncture.

- Immediate Support: ₹49.11 – A break below this level could accelerate the decline toward ₹43.91.

- Major Resistance: ₹53.89 – Bulls need to clear this level for the stock to retest ₹61 and regain upward momentum.

- MACD: The indicator is hovering around neutral territory, with a slight bearish bias. If momentum weakens further, it could signal more downside.

Long-Term Outlook: Is This Just a Correction?

Even though Suzlon has faced some difficulties lately, the outlook remains optimistic. India’s National Green Energy Mission, along with the increasing demand for wind power, may provide the company with the support necessary for expansion in the years ahead.

That said, it’s not all smooth sailing. Intense rivalry and supply chain issues may sustain the stock’s pressure for a bit longer. Traders should stay sharp and keep an eye on key events—like earnings reports and policy changes—to get a clearer picture of where Suzlon is headed next.