Royal Dutch Shell has decided to deliver $7billion to shareholders from the sale of its Permian assets, as the oil major aims to cut its emissions in half by 2030.

The move comes amid pressure from activist hedge fund Third Point Capital, which yesterday called for the break-up of Shell. The company’s CIO Dan Loeb accused the company of attempting to “do it all” and said a breakup of fossil fuels and green business segments would reduce emissions and improve capital allocaitons.

But Shell’s CEO Ben Van Beurden hit back at what he said was “symbolism”.

“The reality is that without companies like us who are significant providers of energy.. without our skills, our scope and scale to convert the energy system the energy transition will be a whole lot more difficult and may not even happen at the pace needed,” Van Beurden said.

Third Point Capital’s investment in Shell is said to be worth $750 million.

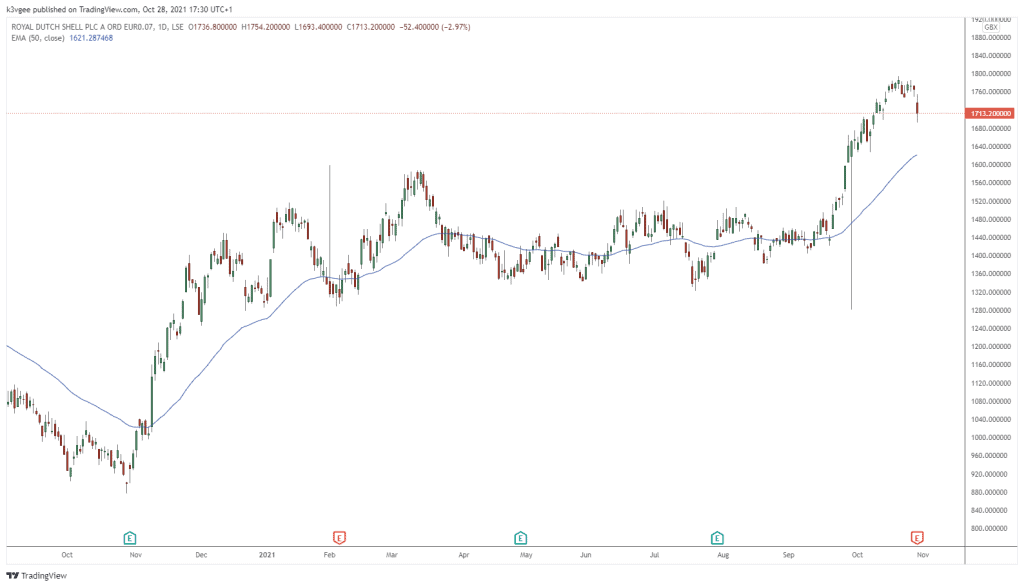

The RDSA share price has dropped from a recent high of 1795p and now trades at 1713p. The price now has that resistance at the 1800p level and support will come in at the March highs of 1600p if the price continues lower.

This post was last modified on Oct 28, 2021, 17:34 GMT+0100 17:34