- What is the outlook of the Nio stock price in the near term? We explain what to expect in 2024, 2025, and 2030 and risks ahead.

NIO Inc. (NYSE: NIO) stock price has had a relatively good run in recent days, gaining 10.7% in the last five sessions and 8.8% in the last month. However, at $4.27, the stock is still down by 4.7% year-to-date. Despite some short-term recoveries, NIO has remained trapped in a bearish cycle, weighed down by intense EV competition, declining profit margins, and concerns about the broader Chinese economy. Nio stock price declined to five-year lows of $3.02 on April 9, but has gained 40% in the last three weeks to recover its footing.

While the company continues to expand its battery-swapping infrastructure and introduces cost-competitive EV models, investors remain cautious about its long-term profitability. With growing pressure from Tesla, BYD, and other EV manufacturers, NIO must prove that it can sustain growth in an increasingly saturated market.

This article was initially published in April 2023 and has been regularly updated to reflect the latest developments regarding Nio.

Tesla vs NIO

Nio and other EV companies have struggled in the past few months for several reasons. First, there are concerns that the EV industry is getting crowded. There are hundreds of companies in the industry, like Li Auto, BYD, and Xpeng, that are building electric vehicles. As such, investors are worrying about demand in the industry since Nio manufactures premium cars.

To take on the tightening competition, Nio launched its lower-priced model, the Onvo L60 on May 15. The model is meant to rival Tesla’s Model Y and has a price tag of about 250,000 yuan, or about $34,500. Most Nio Models typically cost around 300,000 yuan. In addition, Nio says that the Onvo L60 is about 10 percent cheaper than the Model Y. Furthermore, it is energy-efficient, resulting in a longer range.

These are key factors in a market riddled with cutthroat competition as EVs become more mainstream. Nio has manufactured about 500,000 units since its founding about 10 years ago, and the launch of a cheaper model points to its focus on expanding its portfolio to increase its sales figures.

Earlier, NIO had already started to offer incentives to its customers. The incentives have more to do with phasing out the first-generation stock than competing with its rivals in price cuts. The company intends to make the complete transition to its second-generation platform NT 2.0, by accelerating the sales of its old stock.

NIO Inc. Reports Delivery Numbers

Nio delivered 41,094 units in Q1 2025, a 40.1% year-on-year growth. Looking ahead, Citi Bank forecasts that the company will deliver 63,000 vehicles in the second quarter of 2025, in what would be its best quarter in history.

Meanwhile, Nio began delivering its Firefly model in China, in the last week of April 2025. The vehicle is the cheapest of its models yet, with its starting price at $16,470 in China. The company expects to expand Firefly’s market to 16 new territories by the end of the year. The model is designed along a similar business strategy as Nio’s other brands, enabling owners to swap their batteries. The battery-as-a-service (baas) model means that customers buy the vehicle as a separate entity, with the battery available on hire. That strategy has made it more affordable to the mass market, and could help it break into profitability. In total, the company projects to deliver 440,000 vehicles in 2025, with about half of that coming from its cheapest brand to date, the Onvo. However, that figure could be a challenge if the current trade tariff war persists.

China announces EV incentives

In June 2024, the Chinese government announced that it will offer incentives worth an equivalent of roughly $1,400 to those who trade their fossil fuel vehicles for EVs, fuel-cell vehicles and plug-in hybrid vehicles. The move is likely to boost EV sales in the world’s second-largest economy, and NIO stands to benefit. However, BYD is likely to benefit more from the incentives, as it produces lower-priced EVs, meaning that the incentive will account for a larger percentage of its product prices.

As per the latest NIO stock news, the company is accelerating the development of its network of battery swap stations. This is expected to increase the revenue of the Chinese EV maker significantly. The company has rolled out around 10 of its next-generation battery swap stations in China. These charging stations could be ideal for long-distance travelers while also boosting the company’s revenue.

NIO Keeps Expanding In The West

Nio (NYSE: NIO) is also expanding its business in Europe. It has already opened a battery swap station in Germany, where it expects to gain market share. The company has also launched two swap stations in Norway, one of the biggest EV countries in the industry. The company has established more than 10 NIO battery swap stations in the EU.

Also, the company plans to launch its cheaper brands known as Firfly and Alps in Europe sooner than previously expected. As per the company president, Firefly will be launched in Europe by 2025.

The EV company currently has 60 power swap stations in Europe, and by the end of 2025, Nio hopes to have over 4,000 battery swap stations globally, with over 1,000 overseas. The vast majority of the stations (3,239) are currently in China.

NIO vs Tesla vs BYD

The EV price war which was initiated by Tesla due to falling sales, are now weighing on the profits of the whole industry. As a result, the recent NIO earnings report reveals that the Chinese EV company’s losses are expanding. In fact, the company recently had to layoff 10% of its workforce.

The company also has to contend with rival Chinese EV manufacturer, BYD’s supercharger technology, which is capable of charging batteries to full charge in about five minutes. That means the latter’s technology is able to take fossil fuel vehicles head-on, and is an existential threat to Nio’s battery swap business.

It is worth mentioning here that NIO is only one of the few electric vehicle manufacturers betting big on battery-swapping technology. Tesla CEO Elon Musk has already discarded the idea after some consideration. Nevertheless, NIO still remains optimistic about the future of the technology and intends to expand its battery-swap network globally.

Will Nio stock go up?

There are several factors that could drag the Nio stock price lower in the coming months. While 2025 has started on a shaky footing for EV companies due to the trade tariff wars, there are emerging signs that the two key protagonists, the United States and China could find a compromise in the coming weeks. The US currently has a blanket 25% tariff on all vehicles imported into the country, and a harsher145% tariff on all goods imported from China. That has subdued demand, but a breakthrough in the talks could bring tailwinds to the broader automobile industry and Nio stock price momentum.

On the downside, competition in the EV industry is growing rapidly recently. Nio is now competing with more than 400 EV companies in China alone. Some of the top competitors are BYD, Li Auto, and XPeng. This means that, ultimately, the company’s growth will slip in the coming months.

With these factors simultaneously at play, profit margins will almost certainly reduce, while losses could pile up. With increased supplies, the EV market has also diversified the models coming out of production lines. This has also increased the demand for raw materials, which could lead to a spike in the cost of production.

For a company that has been struggling to reduce its costs to align with the slow growth in revenue, an increase in material costs is bad news. While this is not exclusive to Nio in the EV market, it places it at a disadvantage against competitors with stronger balance sheet like BYD, XPeng and Li Auto.

NIO Stock Performance: Long-Term Bearish Trend with Short-Term Support

NIO stock price declined sharply between mid-March and early April 2025, hitting five-year lows of $3.02. However, it has since recovered some of the losses, rising to $4.24 as of this writing. At the current price, NIO stock price is above its 50-day SMA ($4.16), but remains below its 100-day SMA ($4.29) and 200-SMA ($4.60). That signals that the upward momentum is not stable, and a break below the psychological $4.00 support mark could invite bearish control.

NIO’s Key Developments 2024

- Company Dismisses Layoff Rumors: NIO has firmly denied widespread rumors of mass layoffs, calling them “ridiculously untrue.” The company has reported the matter to authorities, reinforcing its commitment to business stability.

- Strengthening Global Partnerships: A senior NIO Europe executive has been appointed as the inaugural chair of a new working group within the China Chamber of Commerce to the EU (CCCEU). This initiative aims to strengthen China-EU cooperation in the automotive sector, which could provide strategic advantages in European markets.

- Product Updates & Market Strategy: NIO has unveiled the 2025 ET5 Champion Edition in China, featuring design enhancements and improved technology. Meanwhile, industry sources suggest that the ES7 model may soon be discontinued, possibly making way for newer innovations within the lineup.

- Technological Advancements: In a major leap forward, NIO has introduced steer-by-wire technology in its flagship ET9 model. Developed in collaboration with a leading global supplier, this system eliminates the traditional mechanical link between the steering wheel and front wheels, paving the way for advanced autonomous driving features.

Tesla’s Global Boycotts and Stock Collapse Boost NIO’s Momentum

NIO’s rally also comes amid Tesla’s global turmoil. The EV giant faces a widening consumer boycott in China and Europe, fueled by customer dissatisfaction, price cuts, and labor disputes. Tesla’s stock has dropped significantly in recent weeks, with investors growing concerned about shrinking margins and slowing global EV demand.

As Tesla struggles, Chinese EV makers like NIO are gaining traction, benefiting from rising domestic sales and increasing government support. This shift has boosted confidence in NIO’s ability to capture more market share, adding momentum to its recent breakout.

Updated on 25/5/2025

Nio Launches New ET5 and ET5 Touring With 1,055km Range, No Price Increase

Nio has just shaken up the EV market again, unveiling updated versions of the ET5 and ET5 Touring that go further, look sharper, and come loaded with smarter features, all without raising prices. The starting point remains $41,100, which is already grabbing attention in a price-sensitive market.

Nio ET5 Range Now Tops 1,000 Kilometres

One of the most talked-about upgrades is the new battery option that stretches the driving range to an incredible 1,055 kilometers. That puts the ET5 right up there with some of the longest-range electric vehicles available in China right now, and it’s likely to turn heads among drivers still anxious about battery limits.

Major Interior Upgrades for Both ET5 Models

Inside the cabin, Nio has gone all in. The new models run on Qualcomm’s latest Snapdragon 8295 chip, which makes everything from navigation to voice control faster and more responsive. Buyers will also find a panoramic head-up display, upgraded ambient audio, and even an optional zero-gravity seat designed for full-body relaxation.

Nio Keeps Pricing Unchanged Despite Upgrades

What stands out most is the pricing strategy. While other EV makers are either trimming features or raising prices, Nio is adding more value without asking for more money. That’s rare in 2025 and could be a strategic play to pull in new buyers and keep existing ones from jumping ship.

Deliveries Begin Immediately Across China

Nio is not wasting time. Deliveries for the updated ET5 and ET5 Touring have already begun in the Chinese market. With more range, better tech, and no bump in cost, Nio’s latest release might be its smartest move yet in a year where every EV sale counts.

NIO Stock Outlook Mid 2025: EV Tariff Tensions Weigh on Chinese Automaker

NIO Inc. stock (NYSE: NIO) continues to struggle as geopolitical risks and renewed U.S.-China tariff tensions weigh heavily on Chinese EV manufacturers. With the U.S. mulling stricter import regulations and tariffs on electric vehicles sourced from China, investor sentiment has soured.

Tariff Tensions and EV Sector Concerns

The Biden administration is reportedly considering new tariffs on Chinese-made EVs and battery components. This comes amid a broader review of supply chain risks, particularly in strategic tech sectors. NIO, with its heavy reliance on the Chinese domestic and global export market, remains particularly vulnerable.

Additionally, U.S.-listed Chinese firms face delisting pressure and stricter audit requirements, further complicating investor sentiment.

NIO Stock Forecast 2025: More Uncertainty Ahead?

By 2025, NIO will face continued competition from Tesla, Li Auto, and BYD, alongside increasing regulatory challenges in China. While the company’s expansion into Europe and battery-swapping technology is promising, profitability remains a major concern.

Most analysts have a 2025 price target range of $6.50-$9.50, but this assumes significant revenue growth and cost-cutting efforts. If NIO fails to control expenses, the stock may remain below $5.00. If you want to test, you can check the ATFX trading demo account.

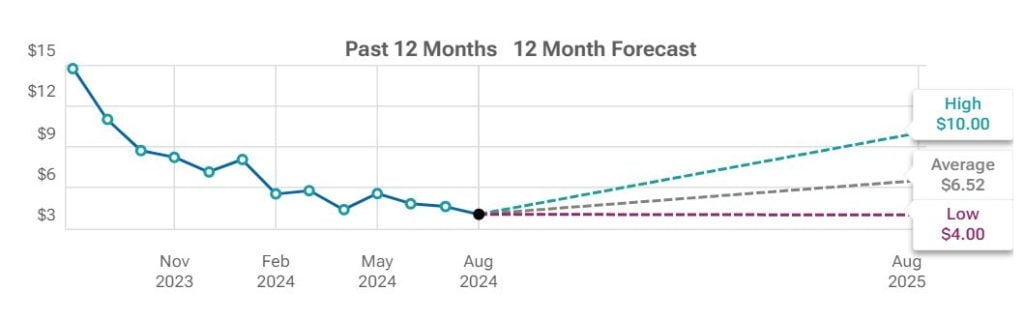

Nio analysts forecasts

According to analysts at Tipranks.com, NIO stock currently has a rating of a “moderate buy” based on the analysis of 10 analysts, with an average price target of $6.52. The high price target is $10.00 while the low target is at $4.00. The average price target is 62% above the current price as of this writing, signaling it as a potential good buy with room for growth.

NIO Stock Forecast 2030: Will It Survive the EV Shakeout?

By 2030, the global EV industry is expected to be dominated by fewer, more profitable players. NIO must establish itself as a leader in battery-swapping infrastructure while competing with legacy automakers entering the EV space.

- Bullish Scenario: If NIO successfully scales its battery-swapping technology, expands in Europe, and achieves profitability, the stock could reach $30-$50 by 2030.

- Bearish Scenario: If NIO struggles with cash flow and competition, it may trade closer to $10-$15.

NIO Stock Forecast 2040: A Speculative Long-Term Bet

Predicting NIO’s price in 2040 is difficult, but if the company remains a leading EV player, its valuation could exceed current expectations.

- If NIO achieves mass adoption of battery-swapping and dominates key EV markets, the stock could reach $80-$120.

- If competition or financial struggles force consolidation, NIO may not survive as an independent company by 2040.

Nio stock price history

As shown below, the Nio share price has had a roller-coaster as a public company. The company went public in 2018, and its stock price collapsed to an all-time low of $1.20. At the time, there were concerns about the company’s existence as a going concern.

It then started a spectacular rally in November 2019 as the firm geared towards the launch of its products. Since then, it jumped by more than 5,400% and reached an all-time high of $66.99. Today, the stock is about 1,570% below its all-time high price.

Nio Share Price History

Is Nio a good buy-and-hold stock?

While Nio is a good company, it is also highly risky. As a Chinese company, there are concerns about the accuracy of its financial results. In the past, we have seen Chinese companies publish inaccurate numbers.

Another concern is that the company could be delisted in the US. If this happens, many American investors will be left holding the bag. Also, there are concerns about rising competition in the EV industry as companies like BYD, Xpeng, Geely, and Zeekr take market share. However, the Chinese government has proven its support for its burgeoning EV industry, with Nio being one of the major beneficiaries of government financing. This could help steady the company amidst rising competition.

Nio stock short interest

Short interest refers to the number of shares held by short-sellers, who bet that a stock will go down. The current Nio short interest stands at just $191 million, which is substantially lower than its level of $878 million a year ago. At its peak, the value of shares held by short-sellers was over $4 billion.

Is the Nio stock overvalued?

Like most EV stocks, Nio is currently overvalued. This loss-making company with less than $4 billion in annual revenue is valued at almost $35 billion. The company’s price-to-sales ratio is 5.89, making it overvalued. However, this overvaluation can be justified if the company maintains its growth.

Final Thoughts: Is NIO a Buy or a Risky Bet?

NIO remains a high-risk, high-reward stock. The company has a strong vision, but its execution has been inconsistent. The EV industry is growing, but it’s also becoming highly competitive, with Tesla, BYD, and new entrants constantly pressuring margins.

While NIO’s stock price could see short-term gains if earnings impress in March 2025, the long-term picture depends on profitability, battery-swapping adoption, and global expansion. For now, NIO remains a speculative investment rather than a safe long-term bet.

This article was originally published on InvestingCube.com. Republishing without permission is prohibited.