In a week where Tesla has hit highs above the $1,000 per share mark, Chinese EV maker NIO is looking to kickstart its own price gains.

However, positive developments have included a recent ratings upgrade from investment bank Goldman Sachs, and better-than-expected Q3 delivery numbers.

Goldman analyst Fei Fang says the next six months will see “strong volume expansion” with:

Profits should also benefit thanks to the ET7, which Fang says is expected to be “China’s priciest car model launched by a domestic brand.”

Nio delivered 24,439 vehicles in Q3, which was higher than its forecast of 22,500 to 23,500 vehicles. Deliveries have doubled on a year-over-year basis and September saw a new all-time monthly record of more than 10,000 vehicles.

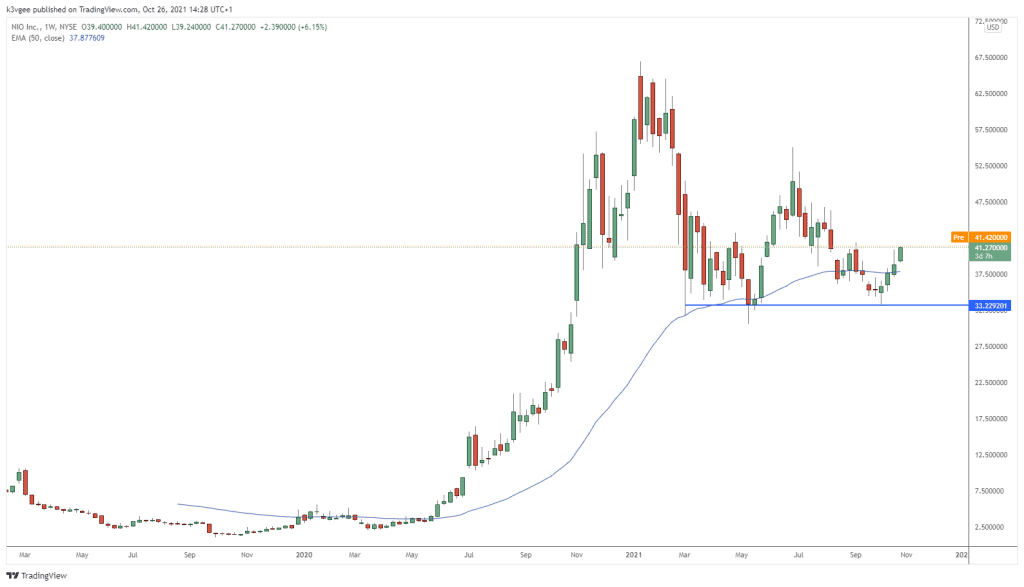

The price of NIO has found a good base around the $33 level and has pushed higher to the $42 level above the moving average. A third round of support is a good sign for the stock and it should look to target the resistance near $53. The all-time high in NIO is around the $66 level.

This post was last modified on Oct 26, 2021, 14:42 GMT+0100 14:42