- Summary:

- Manappuram Finance surges as Bain Capital takes a strategic stake, boosting investor confidence. Is ₹260+ the next target?

Manappuram Finance Ltd. (NSE: MANAPPURAM) is one of India’s leading gold loan and non-banking financial companies (NBFCs). It rallied to ₹235.24 and tested multi-month highs after a major investment from Bain Capital. The deal, which gives Bain a strategic influence over key decisions, including the right to nominate top executives like the CEO, has sparked a wave of investor confidence.

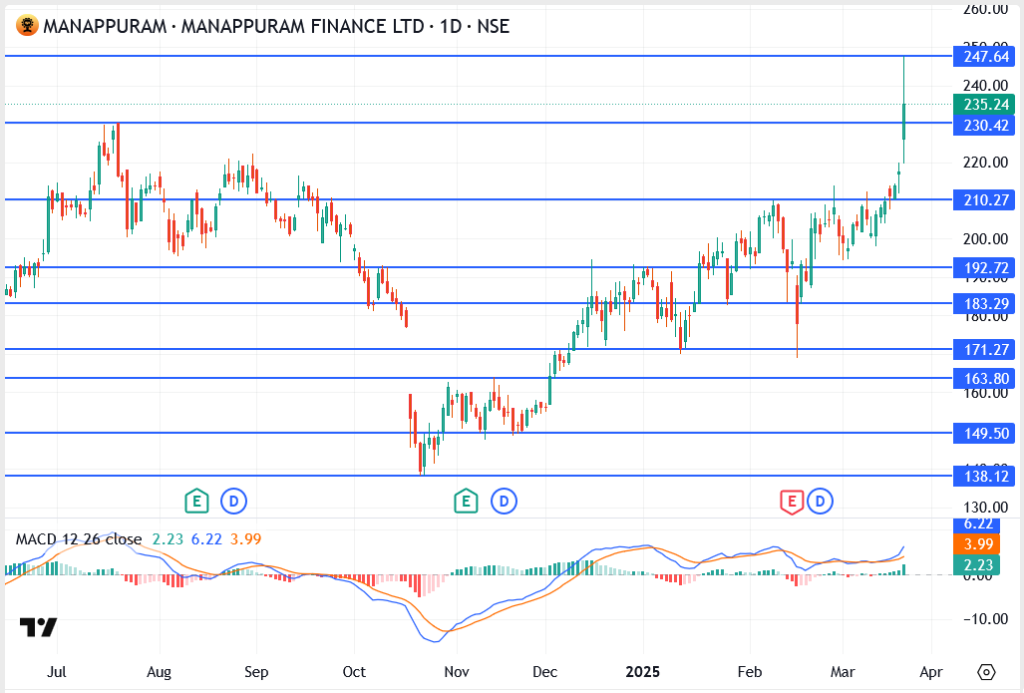

Manappuram Finance Stock Price Action

Today, shares are trading around ₹235.24, hitting fresh multi-month highs. Strong institutional buying, technical breakouts, and bullish sentiment in the financial sector have driven the recent uptrend.

- Yesterday’s Close: The stock broke above ₹230.42, confirming strong momentum.

- Today’s High: ₹247.64, testing a key resistance zone.

- Current Price: ₹235.24, consolidating gains after a steep rally.

- Volume Surge: High trading volumes indicate strong market interest and fresh accumulation.

Manappuram Finance Chart Analysis – Key Levels to Watch

- Resistance Levels:

- ₹247.64 – Immediate resistance; a breakout could send the stock toward ₹260+.

- ₹275 – ₹280 – Long-term target if momentum sustains.

- Support Levels:

- ₹230.42 – Immediate support; holding this level could confirm a new uptrend.

- ₹210.27 – Strong demand zone; bulls will likely defend this area if a pullback happens.

Final Takeaway: Can Manappuram Finance Sustain This Bull Run?

Manappuram Finance has firmly entered bullish territory, with ₹230 now acting as key support. If the stock breaks past ₹247, it could aim for ₹275 and beyond in the coming weeks.

However, if a correction sets in, ₹230 and ₹210 will be crucial to watch. With strong sector momentum, a growing gold loan market, and institutional backing, Manappuram Finance could be a stock to watch for continued upside!