- Summary:

- Tesla stock steadies after Q1 earnings as Elon Musk announces reduced DOGE involvement. Focus shifts to 2025 Model 2 launch..

Tesla stock (NASDAQ: TSLA) steadied after its Q1 results, with sentiment improving as CEO Elon Musk announced plans to reduce his role at the Department of Government Efficiency (DOGE). The company also reaffirmed that development of its next-generation EV remains on schedule, helping shift attention back to its product roadmap after months of political distraction.

Musk said his work with DOGE would “drop significantly” starting May, noting that most of the initiative’s efforts were complete. The update followed growing concern from shareholders over his divided time, especially as Tesla’s global market share faced pressure from rising competition.

The stock has fallen more than 30% year-to-date, weighed by weak delivery numbers and margin compression. But Musk’s comments appear to have bought the company some breathing room — at least for now.

Tesla Refocuses on Core Operations Ahead of Model 2 Launch

Tesla confirmed it plans to introduce a new, lower-cost electric vehicle within the next two months. Production is expected to begin in the first half of 2025, marking a critical step in the company’s effort to expand into more price-sensitive markets.

Often referred to as the “Model 2,” the vehicle is expected to become a key pillar in Tesla’s push to regain ground against aggressive pricing from Chinese automakers. The move signals a shift back to fundamentals, even as questions remain around execution and timing.

Tesla Technical Outlook: Levels to Watch

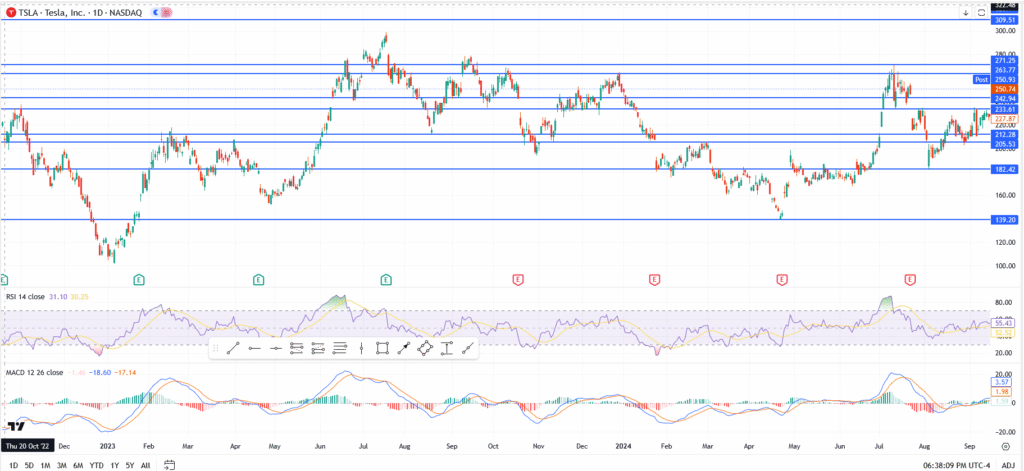

Tesla bounced off support at $227.87 following earnings. Price is now testing the $233.61 level — a minor pivot that needs to be reclaimed for bulls to regain short-term control.

Above that, resistance stands at $242.94 and $250.74. A breakout beyond those zones would open room toward $263.77, but momentum remains cautious.

On the downside, a close below $227 could trigger a retest of $212.28, with $182.42 as the next major floor if sentiment deteriorates.

RSI remains muted near 43. MACD is flat. Momentum is improving, but far from confirmed.

Conclusion: Sentiment Stabilised, But No Breakout Yet

Musk’s decision to pull back from government work removed one layer of market doubt. The Model 2 timeline helped reinforce the longer-term story.

But the chart is still stuck in range. Bulls need to break $243 to flip the trend. Until then, this remains a relief bounce, not a reversal.