- Summary:

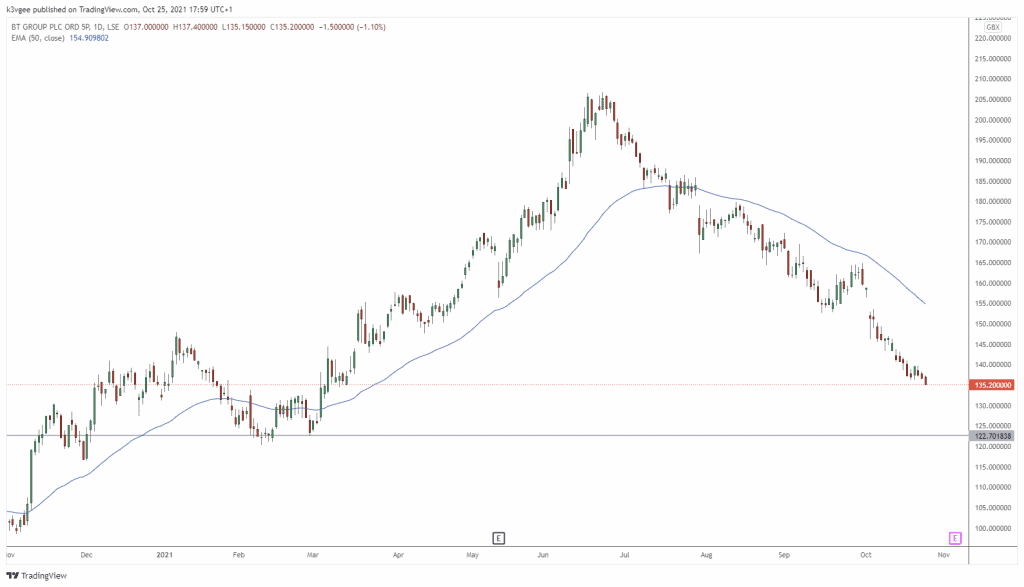

- The price of BT saw a revival from in 2021 to trade above the 200p level but the share price has now unwound almost all of the gains.

The price of BT saw a revival from in 2021 to trade above the 200p level but the share price has now unwound almost all of the gains. Two analyst downgrades in the last two weeks have hurt the share price further.

Deutsche Bank analysts lowered their price target on BT from 140.0p to 125.0p last week, saying that risks were “inflating not abating”. With tongue firmly in cheek, the bank said its downgrade of BT to ‘sell’ in June “could have been better timed” as the shares ramped higher above the 200p level. News that Patrick Drahi had acquired a 12% voting stake boosted the stock.

“Our concern was infrastructure competition which could see Openreach broadband lines fall by 4-6.0m in a base to worse-case overbuild scenario,” Deutsche Bank said.

“Including the risk to retail (business-to-business and business-to-consumer), we estimated that alt-network build (including from Virgin Media O2) could take group EBITDA down by £1.0-1.6bn, offsetting any boost from circa £1.0bn capex reduction when BT’s 25.0m FTTP project comes to an end by Dec 2026.”

HSBC also lowered their target to 125p, saying: “BT’s ambition and its investment plans are unquestionably bold. The company and its networks are set to be transformed within five years, creating much opportunity, in our view.”

“And yet at this stage, the BT investment case rests largely in the hands of others. Specifically, the extent to which Virgin Media O2 decides to wholesale its network and whether Sky decides to use that network.”

BT Price Forecast

From a technical standpoint, the price targets of 125p are looking like a magnet at the moment. The previous 2021 lows are near the 122p level and the share price has the ‘falling knife’ dynamic. These types of formations usually take time to secure a base before any recovery and the points mentioned by the bank analysts summarize the headwinds for BT. The previous cluster of price action around the 125p level will be an ideal spot to start a recovery as the sell-off has been steep and may be reaching oversold territory.

BT Price Chart (daily)