- Summary:

- The Boeing stock price has been in a strong bearish trend in the past few months as concerns about its turnaround persist

The Boeing stock price has been in a strong bearish trend in the past few months as concerns about its turnaround persist. As a result, the BA share price is trading at $175, about 37% below its highest level in 2021 and 60% lower than its all-time high. As a result, the firm’s market cap has dropped to more than $103 billion.

Why has BA stock crashed?

Boeing is going through tough challenges as it attempts to boost its image following the 737 Max crisis. As a result, the company has lost market share from Airbus in some segments, and its total revenue has dropped dramatically. For example, its annual revenue was $101 billion in 2018 and $62 billion in 2022. It has also made losses worth more than $15 billion in the past three years.

The company should be having a good year. Covid vaccines have helped slow the spread, and most countries have abandoned their restrictions. At the same time, the war in Ukraine has pushed most governments to boost their defence spending, which will benefit Boeing. Also, it has solved its 737 Max crisis.

However, Boeing is seeing higher costs as commodity and labour prices rise. The prices of steel, aluminium and other metals it uses have all risen due to the crisis. The rising costs are notable because, under contracts, the company will not be able to negotiate with its customers. The firm has also struggled because of the rising supply chain challenges. This means that it faces margin compression this year.

Meanwhile, analysts are optimistic about Boeing. For example, those at Baird expect that the Boeing stock price will rise to $306, while those at UBS see it rising to $290. Other analysts who are bullish on the BA stock price are from JP Morgan, RBC, and Jefferies.

Boeing stock price forecast

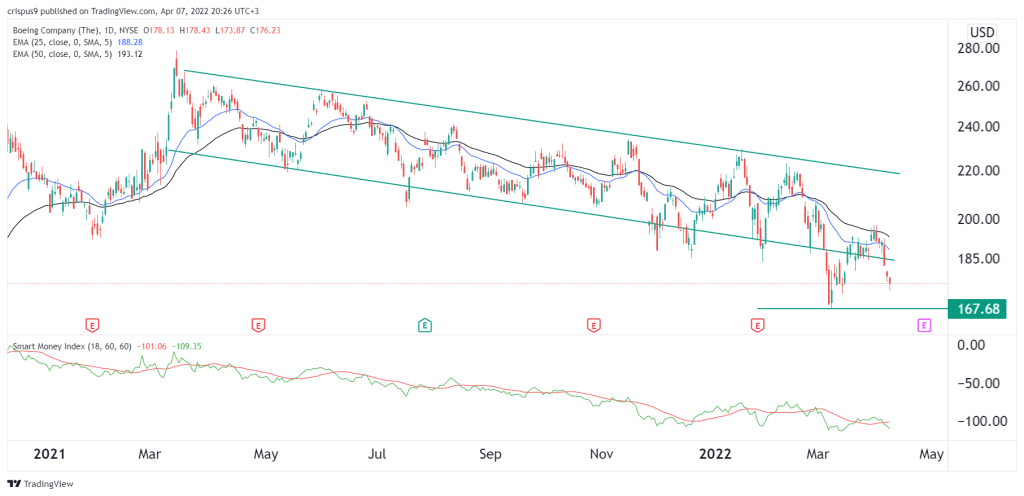

The daily chart shows that the Boeing share price has been in a strong bearish trend in the past few months. The stock has moved below the descending green channel, which is a bearish sign. It has also dropped below the 25-day and 50-day moving averages, while the Smart Money Index (SMI) has been in a strong bearish trend.

Therefore, Boeing’s path of the least resistance is downwards, with the next reference level being at $167, which was the lowest point this year. A move above $191 will invalidate this view.