- Summary:

- Is Rivian a good investment? Our analysis explains it using long-term forecasts for the next 10 years, check Rivian stock price prediction.

Table of Contents

- What is Rivian?

- Rivian Stock Symbol

- Rivian Stock Fidelity

- Rivian Latest news

- Rivian Stock Price Today

- Rivian Stock Price Prediction 2024

- Rivian Stock Price Prediction 2025

- Rivian Stock Price Prediction 2030

- Rivian Stock Price Prediction 2040

- Is Rivian a good investment?

- How to buy Rivian stock?

- Should I buy Rivian stock?

- How much is Rivian stock?

- When can I buy Rivian stock?

- What is Rivian stock trading time?

Rivian stock price(NASDAQ: RIVN) registered the largest single-day gain in its history on June 23, 2024 when it rose by 23 percent. The rise was triggered by news of a $5 billion investment by German motor giant, Volkswagen. That saw RVN stock price rise to $16.35, the highest level since mid-February. However, the stock price has since declined to trade at $13.95 as of this writing. In this article, we’ll take a shot to predict the future price action of Rivian stock and determine if Rivian is a good buy at the current price.

Rivian stock price hit all-time lows of $8.32, sending a bearish signal across the market. However, the stock received a boost in early May when the State of Illinois announced that it would invest $872 million in the company to enable it expand its plant in the city of Normal. Furthermore, RIVN had an even better run in May, gaining 22.7 percent to register its first monthly gain of 2024. News of its deal with Volkswagen on June 23 helped propel the RIVN stock price to 23 percent in June.

The VW deal, which will be inform of a joint venture (JV), will see Volkswagen invest $5 billion in the EV company in phases up to 2026. In exchange, the German auto giant will access Rivian’s IP software, electrical infrastructure expertise. In addition, the two companies will work together on upbeat confidence among investors, much as skepticism remains over the company’s fundamentals.

However, Rivian’s stock price declined two days after the historic deal after it affirmed its 2024 production guideline. The company stated that it expects to deliver between 13,000 and 13,300 units in the second quarter of the year. It also expects total production in 2024 to be 57,000, below analysts’ forecast of $80,000. The company has delivered between 26,600 and 26,900 units heading to the end of the first half of 2024.

As per its first quarter 2024 financials, the company reported losses translating to $1.45 per share. Furthermore, the revelation that the company incurred losses of about $38,000 per unit does not sit well with many investors. However, Volkwagen’s $5 billion investment brings an additional cash cushion on top of its $7.9 billion in the bank. It also means that Rivian will be able to reduce the software cost per vehicle.

What is Rivian?

Rivian is an American electric vehicle and adventure travel firm that designs and produces electric cars. It was Founded in 2009 and is located in Plymouth, Michigan. The company has attracted substantial investment from Amazon and Ford, among others, and aims to become a leader in sustainable transportation.

The production of its initial offerings, the Rivian R1T truck, and the Rivian R1S SUV, started in late 2021. In the long run, Rivian intends to provide mobile adventure gear and expand to a global market.

Rivian Stock Symbol

In September 2021, Rivian started delivering its R1T pickup truck. This was a massive moment for the company and an edge over its competitors like Ford and Tesla. It was the first ever completely electric pickup truck. Shortly after this feat, Rivian had a successful IPO in November 2021 at a $66.5 billion valuation. Rivian IPO price was $78, and the stock was listed as a RIVN symbol on Nasdaq.

Rivian Stock Fidelity

In July 2021, Rivian closed its private funding round with a $2.5 billion investment. This round was led by corporate giants like Amazon, Ford, and D1 Capital Partners. Other participants included Fidelity Management & Research Company, along with a few other capital management firms.

Rivian Latest news

The Volkswagen JV will see Rivian receive $ billion initially in form of an unsecured loan convertible into stock. $ 2 billion will be in form of cash and loans, and two-$1 billion investments will be advanced to Rivian in 2025 and 2026.

A series of Federal and State government interventions in recent days have favoured Rivian. On May 14, US President Joe Biden announced a quadruple tariff hike on China-made EVs from 25 percent to 100 percent. This is potentially a major turning point for US EV makers like Rivian, as it will ensure that they have an upper hand against Chinese imports.

On March 1, it was reported that the State of Illinois had committed to invest $827 million in Rivian to help the company expand the capacity of its production plant in Normal. The news came about a month after the company suspended indefinitely plans to build a $5 billion plant in Georgia. RIVN stock price rose by more than 10 percent two days after the announcement. The Normal plant is critical to Rivian’s growth plans, with its R2 and R3 models set to be produced at the plant ahead of delivery from 2026.

Rivian announced in mid-April that that it laid off 1% of its workforce, the second time in 2024 that the company reduced its headcount. This is not surprising for a company that is keen on trimming costs in a market experiencing a sharp slump. EV market leader, Tesla, sent home 10% of its workers in April.

As per the most recent Rivian news, the company delivered 13,588 units, having produced 13,980 units in the first quarter of 2024. Although this was a decline in production of 20% from the previous quarter’s figures, it exceeded market forecasts which expected 13,800. According to Rivian management, that figure was within its expectations. The company expects to deliver 57,000 units for the full year, far-below analysts’ forecast 80,000.

Also, Rivian announced in March that it will start producing a cheaper, smaller R2 model from 2026, and that could open up a new market. The company also paused construction of its $5 billion Georgia plant indefinitely to save cash and focus on producing the R2 model. The company’s cash reserves have dropped significantly from $11.78 billion in 2023 to $5.97 billion, signalling a strain on its resources. However, the strategic move to produce the R2 model is likely to pay of, considering that it has already secured over 68,000 reservations.

Rivian Stock Price Today

RIVN is trading at $13.34 as of this writing, down by 7.9% in the intraday session. Despite its recent rally, Rivian stock price is still about 83 percent below its IPO price of $78. Furthermore, it trades at 61 percent below the YTD high price of $21.94 recorded in January. If you’re wondering who owns Rivian, then you should know that the majority of the electric carmaker’s stock is owned by institutional investors (62%). The remaining Rivian stock is owned by company insiders.

Rivian Stock Price Prediction 2024

NASDAQ: RIVN has recovered significantly from its all-time lows of $8.37, and currently trades slightly above the 50-MA price of $10.60, but below the 200-MA price of $15.09. In the near term, it needs to stay above the 50-MA mark for it to maintain its recent upward momentum. Furthermore, a return above the current 200 MA will be a strong buy signal, that could build the momentum to retest the YTD highs. However, a break below the support at $8.30 will signal strong bearishness.

In the meantime, I’ll keep sharing updated Rivian stock price forecast and my personal trades on my Twitter where you are welcome to follow me.

The higher-for-longer interest rate decision by the Fed is likely to continue impacting sales, in which case the Rivian stock price could head lower to test the critical support level of $8.30. However, this is predicated upon the overall macroeconomic situation in the US. If the equities market improve and interest rates are lowered, the stock could go edge higher.

Rivian Stock Price Prediction 2025

With Rivian’s latest production capacity, the EV maker will produce slightly more vehicles than last year. The JV with Volkswagen will certainly play a big part in defining Rivian’s performance, with reduced losses per unit, at least until 2026 when the R2 and R3 models come out. Furthermore, the company is still obligated to supply Amazon with 100,000 units by 2030. A successful delivery of these numbers could help prop up the company’s outlook and improve its revenues significantly. Also, expanding the Normal plant’s annual production capacity from 150,000 units to 215,00 units will come in handy.

Rivian Stock Price Prediction 2030

Many analysts expect a new all-time high in US equities by 2030. Although the asset prices in 2030 could be anybody’s guess but considering the current growth of Rivian Automotaive, Inc. we can take a shot. If the company keeps adding new vehicle categories in its portfolio, then I expect the Rivian stock price to retest its IPO price of $78 before 2030. The optimal operation at the Normal plant and construction of the Georgia plant could help the company turn around its revenues and increase its capacity to take on competition from the likes of Tesla and Chinese EV models.

Rivian Stock Price Prediction 2040

A lot can happen in the world till 2040, therefore, it’s very difficult to predict RIVN stock price 16 years from now. Wars, famines, recessions, and hyperinflation are like slow poison for any business. If Rivian evades all of them and keeps growing then I expect it to give Tesla a tough time by 2040. Many people are already comparing Rivian R1T with Tesla cyber truck.

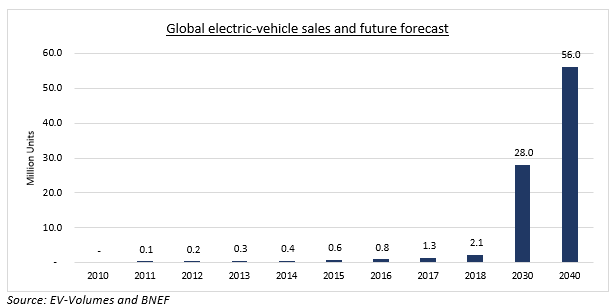

Also, despite its troubles in 2024, the global EV demand is projected to grow at a compound annual growth rate (CAGR) of 23.4% from 2024 to 2032. The transition from fossil fuel-run cars to EVs has gathered traction and the momentum will likely continue picking up as governments shifts towards the “green” agenda.

Is Rivian a good investment?

Rivian stock has already plunged 92% from its November 2021 peak of $179.47. It is highly unlikely that the price can have a similar downward rally in the near future. Therefore, I consider Rivian a good investment for at least a short term in anticipation of a relief rally. Furthermore, the company has proven its ability to match sales with steady revenue growth, much as it still spends a significant portion of its earnings on production. After producing 24,337 vehicles in 2022 it produced 57,232 units in 2023 with revenues hitting $4.43 billion.

Also, while the company has been hemorrhaging funds (it accumulated losses amounting to $5.43 billion in 2023), its growth strategy seems to be working, and could help it start generating profits. Also, it still sits in a relatively strong position, with $9.37 billion in cash at the end of Q1 2024.

Rivian’s market cap has declined by about 90 percent from a peak of just over $100 billion in 2021 to about $10.09 billion as of this writing. These figures are quite unimpressive and it doesn’t help that it finds itself extending its loss-making spree in an EV market whose level of competition is tightening by the day. With new entrants from China offering lower prices, Rivian, like other US EV makers, finds itself at a crossroads.

Specifically, the company may be forced to cut prices significantly to reach the mass market, while its production figure remain relatively low, below 60,000 units per year. Worse still, its less-expensive mass-market model, the R2 SUV, won’t be ready for delivery until the first half of 2026. The company also intends to expand to external markets, which could broaden its revenue stream.

One of its key strategies in its expansion plans is the sale of the new, smaller R2 model, which is expected to be cheaper at $45,000 per unit. Rivian reported that it received 68,000 reservations within 24 hours of R2 the announcement, and expects the demand to grow to as much as a million units per year across the world.

In a surprise announcement, Rivian CEO Robert Scaringe revealed that the company will add new models, the R3 and R3X to its production line. The two will cost between $37,000-$43,000 and are expected to attract more buyers, as the company focuses on giving customers more options.

How to buy Rivian stock?

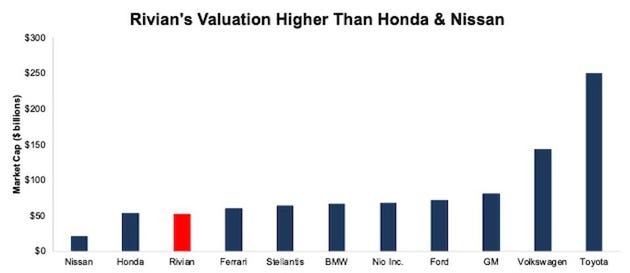

If you’re wondering how to buy Rivian stock, then you should know that it is listed on the Nasdaq stock exchange as RIVN. You can also invest in Rivian stock CFDs and derivatives on different platforms like eToro and Robinhood. The current price presents a good buying opportunity as Rivian was very overvalued at its IPO. Its IPO valuation made it even bigger than Honda and Nissan.

Should I buy Rivian stock?

If you believe in Rivian’s vision and consider its technology better than Tesla, then Rivian stock at its current price could be a nice buy. However, the stop loss must be kept under January 2023 low of $15.28. The company will announce its Q4 2022 earnings on 28th Feb. A positive earnings report can send the stock price above $25, however, a significant drop in revenue could make things really ugly.

How much is Rivian stock?

Rivian stock trades at $8.80 as of this writing. After rallying for a long period, the US equities markets are flashing signs of a potential correction, and this could increase pressure on the economy. Coupled with higher-for-longer interest rates and high inflation, Rivian sales are likely to take a hit, and this will almost certainly affect the stock price. Based on the current Rivian stock price of $8.80 and outstanding shares of 969 million, current market cap of Rivian Automotive, Inc. is $8.5 billion. At its peak, the company was valued more than $100 billion, meaning that it has lost more than 90% of its value.

When can I buy Rivian stock?

You can buy Rivian stock at the current price as it has very little downside but massive upside potential. This provides a great risk to reward ratio, which investors often consider before investing in any stock. Tesla’s current market cap is $597 billion, therefore, Rivian at $18 billion market cap, seems to be a great buy.

What is Rivian stock trading time?

As mentioned earlier, Rivian stock trades on the NASDAQ stock exchange, which is the second largest exchange in the world. NASDAQ trading hours are 9:30 am to 4:00 pm Eastern Standard Time and no trades take place over the weekend. Rivian is listed on the exchange under the ticker symbol RIVN.