- Summary:

- The Bybit report also looks at indicators across the futures, perpetuals, and options markets benchmarked against pre-U.S. election levels.

Bybit, the world’s second-largest cryptocurrency exchange by trading volume, published a new derivatives analytics report in collaboration with Blocks Scholes indicating a retreat in ETH perpetual positions while it sustains a lead over BTC in options open interest.

Analysts noted the impact of BTC’s pullback from the $100K threshold and ETH from $4K on derivatives markets in past week’s data, attributing the decline in ETH open interest to lacklustre spot prices. Investors, while still in high spirits, curbed their enthusiasm as reflected in lower funding rates.

The report also looks at indicators across the futures, perpetuals, and options markets benchmarked against pre-U.S. election levels.

Key Insights:

Perpetuals: ETH yields gains to BTC

ETH perpetual open interest has declined sharply as overleveraged long positions were liquidated, driving a drop in funding rates. In contrast, BTC perpetual activity remained stable through Dec. 2024, with a brief spike during BTC’s surge above $100K last week.

Funding rates: the reset from bullish excess

Perpetuals funding rates have stabilized around 0.01% after a wave of liquidation of overleveraged long positions in perpetual swaps. This adjustment followed the significant unwinding of leveraged long positions, reflecting more cautious market sentiment. Despite the decline, funding rates remain neutral, indicating a recalibration in leveraged exposure without extreme bearish sentiment post-flash sell-off.

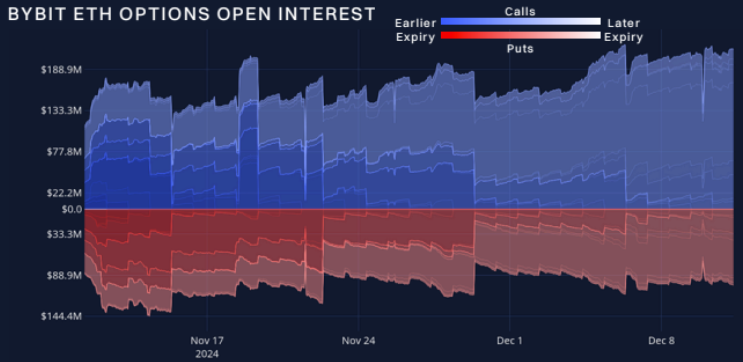

Options: ETH on an outperforming streak over BTC

Sources: Bybit, Block Scholes

Open interest in ETH maintains its bullish trends with end-of-year expirations on the horizon. Influenced by the recent movement in spot prices, however, trading volumes have subsided. ETH options exhibit an inverted term structure in contrast to BTC’s flat shape, driven by realized volatility exceeding forward-looking expectations.

Access the Full Report:

The joint weekly report deciphers signals and trends from spot trading volumes, and futures, options, and perpetual contracts. Read the full report here.