The Hang Seng index made a bullish breakout above a key resistance level, helped by the rebounding tech stocks. HSI, the blue-chip Chinese index, rose to a high of H$21,682, which was its highest level since April 22 this year. It has risen by over 18% from its lowest level in May. At the same time, it has diverged from US indices like the Dow Jones and Nasdaq 100 that have retreated in the futures market.

The Hang Seng index has had a difficult period in the past few months as China has led a crackdown on technology companies. This crackdown has hit some of the most important companies in the country, like Tencent, JD.com, Alibaba, and Meituan. As a result, these firms have become shells of their former selves. For example, Alibaba’s market cap has dropped from an all-time high of over $600 billion to less than $300 billion.

Hang Seng is now rising after positive information from Chinese regulators. After investigating DiDi for months, the regulators have now given it the go-ahead to onboard new customers and continue running its operations as usual. The regulatory clarity is positive for tech companies in the Hang Seng index because it signals that the other firms could be safe as well.

The new regulatory clarity comes at a time when the Chinese economy is still struggling due to Covid-19 lockdowns. Tech companies led the HSI index rally on Tuesday. Alibaba Health shares rose by over 5.4%, while JD and Alibaba rose by over 4%. Other tech names like Lenovo Group, Tencent, and Meituan also rose.

Another notable gainer was Hong Kong Exchange after its London Metals Exchange got sued for halting nickel trading in February. On Monday, it was sued by Elliot Management. Later on, the company was sued by Jane Street, one of the biggest market-makers. The company is seeking $15.34 million.

The LME’s arbitrary decision to cancel nickel trades during a period of heightened volatility severely undermines the integrity of the markets and sets a dangerous precedent that calls future contracts into question.”

said Jane Street

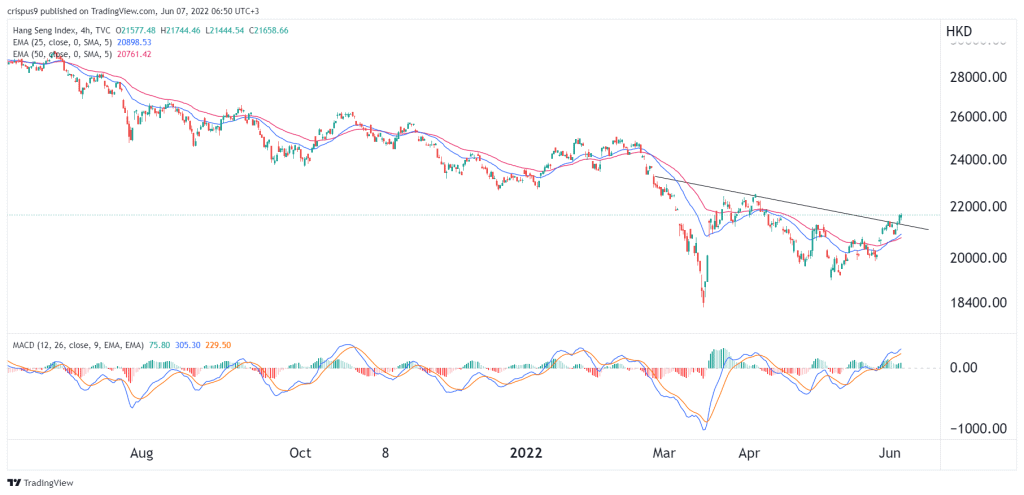

The four-hour chart shows that the Hang Seng index has been in a strong bullish trend lately. It managed to move above the important resistance level that is shown in black. The index has also moved above the 25-day and 50-day moving averages while the MACD has continued rising.

Therefore, after the bullish breakout, there is a likelihood that the Hang Seng index will gain further momentum as investors target the initial resistance at H$21,666. This view is in line with my previous forecast for Hang Seng. On the flip side, a drop below the support at H$21,325 will invalidate the bullish view.

This post was last modified on Jun 07, 2022, 08:37 GMT+0100 08:37