- USDINR forecast 2025 is bullish as a slowdown in the Indian economy, multiple RBI rate cuts and trade tariff war weigh in.

The Indian Rupee (INR) displayed strength in the first three quarters of 2024, but ran out of stream in the last quarter of the year, with the downward momentum spilling over into 2025.

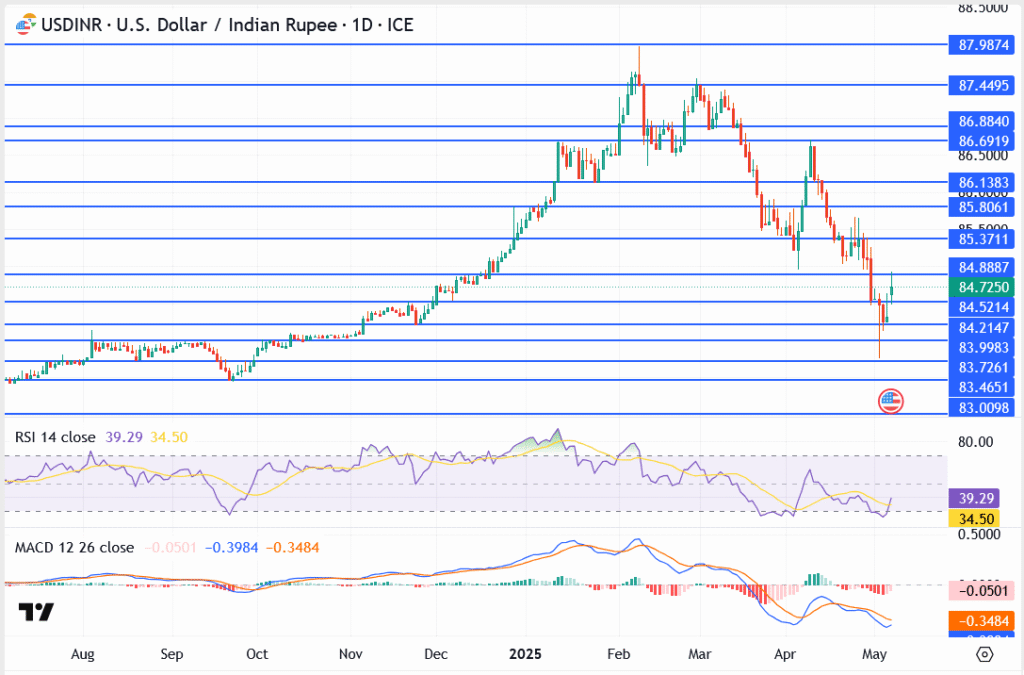

USDINR had a strong start to 2025, rising to peak an all-time high of 87.97 on February 10, 2025. However, but has since declined from that height, down by 1.29% in the last in the last month. The pair trades at 84.47 as of this writing, near five-month lows.

In addition, it is on course to register the second successive monthly decline, having previously been on a five-month winning streak. The dollar lost 2.32% against the rupee in March and is down by 1.02% on the last day of April.

This article was originally written in December 2024 and updated on May 7, 2025, to reflect recent developments, including Operation Sindoor, USD/INR price movements, and the impact of renewed U.S. tariff policies under President Trump. All technical levels and market commentary are based on the latest data available at the time of writing.

USDINR Outlook in 2025

Multiple interventions by the Reserve Bank of India supported the rupee for a significant portion of 2024, keeping the rate below 84.30 for the first nine months. However, the dollar’s safe haven status and weakness in the Indian equities market finally broke the rupee’s resistance in the fourth quarter.

2025 is turning out to be a different year, with different key factors at play. The key focal factors around the currency pair in 2025 will be global trade tariff wars, crude oil prices, Indian economic growth trajectory and Fed and RBI policy decisions. Also, the US economy faces turbulence in the face of its shifting trade policies. The world’s largest economy contracted YoY by 0.3% Q1 2025, adding to the pressure on the US dollar.

In addition, the geopolitical developments around India’s relationship with Pakistan could weigh in on the USDINR pair. An attack in the contested Kashmir region left 26 tourists dead in late April, and there’s an underlying risk of an escalation. As of this writing, Pakistan claims it has “credible intelligence” that India plans to attack it. An eruption of military action between the two nations could potentially be disruptive to their economies, but could provide tailwinds to USDINR.

RBI Interventions Limit Indian Rupee Losses Against the Dollar

USDINR has been on a strong uptrend since December 2024, driven by a strong demand from importers and high rate of foreign institutional outflows from Indian equities markets.

However, multiple interventions by the Reserve Bank of India (RBI) helped keep the rupee stable during a period when the dollar generally gained against major currencies. The central bank net-sold $36 billion in the second half of 2024, underlining a strong aggression towards the dollar.

Strong economic data and a positive outlook on the Indian economy helped the rupee hold off the dollar for the most part in 2024. Also, weak demand for oil, underlined by China’s economic struggles, put a lid on the USDINR pair. However, the last quarter of the year brought headwinds, with weak earnings and exits by foreign institutional investors from Indian equities markets weighing down on the rupee.

However, improved output by the Indian economy pushed the rupee to have strong show in March, gaining 2.3% in the month. The period saw increased institutional inflows as the Nifty 50 Index gained 6.3% and the Sensex went up by 5.76%. However, the trade tariff war ignited by the United States in late March has seen the rupee lose traction, with the USDINR pair assuming a choppy pattern in recent days.

Impacts of Interest Rates And Trade Tariff War

In December 2024, the Reserve Bank of India (RBI) revised downward its 2025 forecast for Indian GDP growth from 7.2% to 6.6%. That could be the lowest growth rate in four years and signifies a likely continuation of the release of soft economic data, which will support gains by USDINR.

In line with this, the RBI cut interest rates by 25 basis points to 6.25% in February 2025, the first rate reduction in five years. The central bank announced another 25 basis points cut on April 9, taking the baseline lending rate to 6.0%. That adds propulsion to USDINR and deeper cuts could follow if India and the US do not reach a deal to resolve the 26% tariff imposed on the latter.

Furthermore, the high tariff rate makes Indian exports to the US less competitive and could result in reduced dollar inflows into the Indian economy. However, the impact of the RBI rate cut could be offset by the likely cuts by the Federal Reserve.

The Fed was initially expected to make only two rate cuts in 2025. Nonetheless, recent back-to-back soft macroeconomic data, underlined by Non Farm Payrolls (NFP) numbers miss and unemployment rate spike in February and March have raised the prospects of more cuts.

The dollar’s troubles are compounded by US President Donald Trump’s comment in early March that the US economy is in a “transition,” which has been interpreted by some analysts as denoting a potential recession. Furthermore, the impact of US tariffs and counter-tariffs by affected trading partners like China, Canada, Mexico and the European Union could limit gains by the greenback.

Impact of Oil Prices on the Rupee

India is the world’s third-largest imported of crude oil, and the product’s price oscillations have a significant impact on the rupee. Dollar-denominated crude oil has experienced a slowdown in demand for the last year, as China’s economic growth declined.

According to the International Energy Agency (IEA), demand for the commodity is projected to rise by 1.05 million barrels per day (bpd) to a total of 104 million bpd in 2025. The growth is attributed to the recovery of China’s economy as stimulus measures yield fruits. A spike in the demand for oil could increase the price and fuel gains by USDINR.

That said, Russian Deputy Prime Minister Alexander Novak said that the OPEC+ oil cartel could reverse its decision to raise production in April if the demand continues to be weak. Crude oil prices dropped to six-month lows in early March, pushed by concerns over the impact of the trade tariff war.

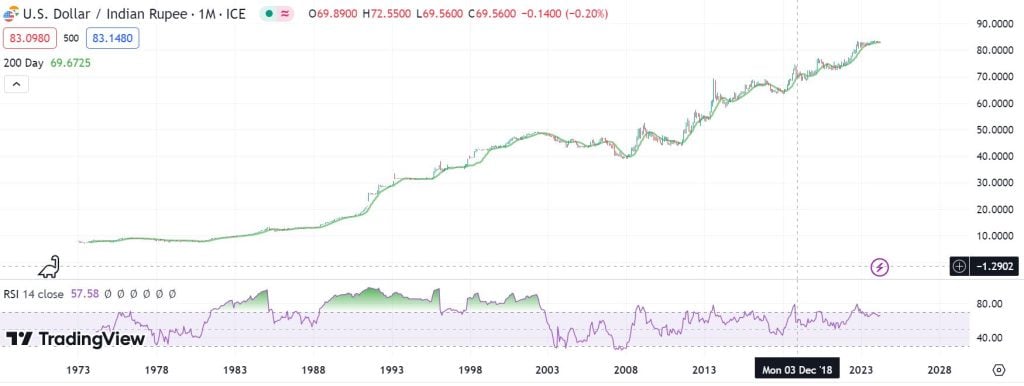

USD/INR Historical Chart

USD to INR trading dates back to 1973 when the pair was floated in the forex market at an opening price of $1 to 7.98 rupees. By late 1983, the currency pair rose past the psychological level of 10 rupees to the US Dollar. Between then and April 2002, it rallied by 376.41% to 48.76 rupees.

After retracing to 39.9 rupees in November 2007, the USD/INR has been on an uptrend since then. The pair surged to an all-time high of 83.47 on November 10th, 2023. Before attaining its all-time highs, the USD/INR tasted the 76.45 price mark in March 2020, just as the coronavirus pandemic was sweeping through the world.

As the US Federal Reserve started to hike rates, Indian rupee started to slide against the US Dollar. In October 2022, the pair surged to a new all-time high of 83.28. This ATH was refreshed in 2023. However, the dollar’s rally in 2024 saw it hit a new ATH on March 22.

Strain on Indian Equities Markets

There was has been a notable selloff in the Indian stock markets by foreign institutional investors, leading to elevated dollar demand since the fourth quarter of 2024. The trend has been exacerbated by elevated US treasury bond yields, and it might take a while before we see. Therefore, we are likely to see the USDINR stay on the rise in the medium term, with marginal gains by the rupee.

Operation Sindoor Triggers USD to INR Volatility: Will the Rupee Hold in May 2025?

Something shifted this week on the USD/INR chart. After weeks of sliding lower, the pair bounced off ₹83.00, a level traders had been quietly watching. Now it’s back around ₹84.70, trying to find its footing, but this doesn’t feel like a confident rally.

The move coincides with rising chatter around U.S. tariffs again. Trump’s back in the White House, and markets are adjusting fast. A stronger dollar makes sense in that context, especially with crude oil creeping up and India still heavily reliant on imports. That said, the rupee isn’t giving up easily.

- Support held firm at ₹83.00, with minor floors at ₹83.46 and ₹83.72

- The current zone around ₹84.52 is being tested — again

- Resistance above lies at ₹84.88, and a tougher one near ₹85.37

- RSI bounced from oversold (34.50) but stays muted

- MACD still negative — no real trend shift confirmed

April Recap: Operation Sindoor Shakes Sentiment as Rupee Recovers

April didn’t end quietly. Operation Sindoor, India’s surgical strike on terror camps across the border, dominated headlines in the final stretch of the month. While markets initially shrugged off the geopolitical flare-up, the Indian rupee managed to stage a sharp recovery, helped by a weakening U.S. dollar and softer global yields.

USD/INR dropped from above ₹86.00 to as low as ₹83.00, catching many by surprise. But the bounce late in the month suggested the rupee’s strength was more tactical than structural.

Updated on 25/5/2025

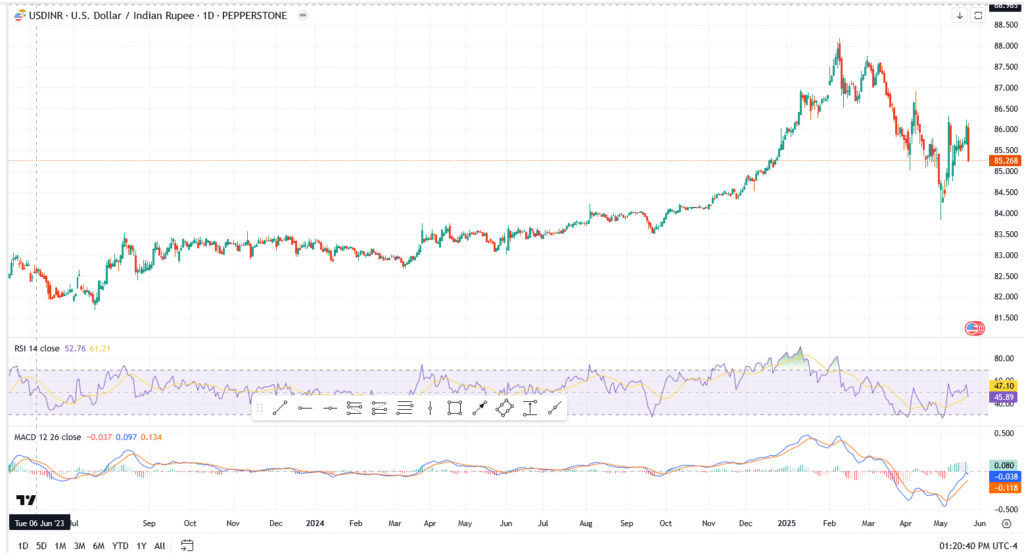

USD/INR Weekly Outlook: Rupee Stabilises Below 86 as Tariffs and Tensions Collide

After a chaotic start to May, the Indian rupee is finally catching its breath. USD/INR settled near 85.26 on Friday, marking a pause in what had been a sharp rebound fueled by U.S. policy surprises and local geopolitical jitters. The pair has been coiling just beneath key resistance, with traders eyeing next week’s data and political headlines for direction.

Last week, two stories dominated the rupee narrative.

The first was Washington. President Trump’s renewed tariff push on Chinese imports reignited inflation fears and lifted the dollar across the board. That alone sent the greenback surging, and USD/INR followed.

Though Operation Sindoor was launched earlier this month, its ripple effects are still being felt across markets. It was a patriotic move, but it injected geopolitical risk into the rupee just as traders were already spooked by global uncertainty. Foreign fund flows turned cautious, and risk appetite shrivelled.

Technical Picture: USD/INR Stuck Between 84.20 and 86.20

- Price bounced cleanly off 84.20 last week, confirming it as short-term support

- The 85.50 level has become sticky — price is struggling to break through

- RSI is hovering around 47, signalling a lack of conviction from either side

- MACD has flipped slightly bullish, but momentum is still weak

- A decisive close above 86.20 opens room to retest 87.00

- On the downside, a break back below 84.90 would invite a drop to 84.20 again

Upcoming Week: Focus on Fed Speak and Oil Prices

With no major Indian data on deck, the rupee will likely take its cues from the U.S. dollar and crude oil. Any hawkish Fed commentary could firm the dollar further. Meanwhile, rising oil prices, which crept higher last week, remain a thorn for India’s trade balance.

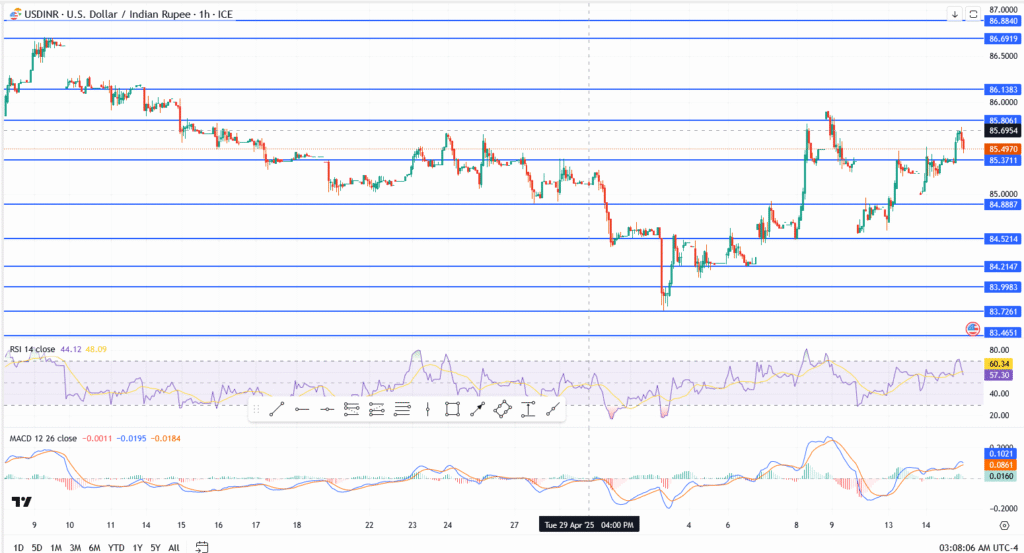

USD/INR Price Today: Rupee Pressured Ahead of US Retail Sales, Resistance Holds at 85.80

The rupee isn’t getting much breathing room this week. On Thursday, USD/INR was holding steady just under 85.70, with traders mostly on pause ahead of fresh economic numbers from the US.

Retail sales and PPI figures are due later today, and they could move things fast, depending on how they shake up Fed rate expectations.

What’s Happening on the Chart?

- Buyers stepped in around 85.37, keeping things stable so far

- But 85.80 is proving tough to crack — it’s acted like a ceiling all week

- If that level breaks, next upside target is 86.13

- RSI is slipping — currently near 44

- MACD? Still in positive territory, but it’s losing punch

So, no clear breakout yet and honestly, price looks stuck unless something changes in the data narrative.

Behind the Move: All Eyes on the US

The dollar has stayed resilient this week, partly thanks to firm yields and cautious risk tone. Traders are holding off on big bets ahead of the US April retail sales and PPI reports, both expected to drop later today.

If those numbers come in hot? Dollar demand likely spikes. Weak prints? Could see a pullback.

Meanwhile, crude has been creeping higher, which doesn’t help the rupee’s cause. And there’s still no sign of RBI stepping in, at least not yet.

Quick Take: Choppy, Waiting for a Trigger

Until the data lands, expect more of this chop between 85.37 and 85.80. If bulls manage to clear that upper range, the next target opens at 86.13, maybe even 86.61 if momentum builds. But if the dollar softens, USD/INR could slip back to 84.88 or lower.

It’s all about the next data drop now.

What will be USD to INR Rate in 2027?

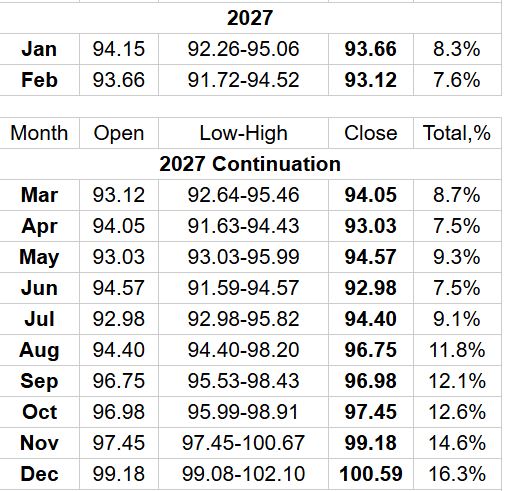

Long Forecast’s USD to INR forecast 2027 suggests the start of the year around 94.15 rupees. It expects the currency pair to average 92.98 by mid-year before rallying further to 100.59 by the end of the year. The prices can go much higher if the global economy enters a prolonged recession after the ongoing deflationary measures.

It is important to note that the targets for September 2025 have already been met, while the price pattern on the daily chart indicates that there is a high potential for the October 2025 price target of 83.95 to be met in the second half of 2024. As it is, this makes the USD to INR forecast 2025 above quite viable, albeit with some minor differentials. It is crucial to conduct your own individual research.

USD to INR Forecast 2030

A feasible USD to INR forecast for 2030 is informed by the economic health of India and the US, Fed and RBI’s monetary policy, and the demand for the US dollar as a safe haven. Hence, a strong dollar will likely push USD to INR to a new record high, depending on the key drivers.

However, as an emerging market, India’s currency has the potential to strengthen further in the coming years. From that perspective, USD to INR forecast 2030 will be for the pair to remain within a range for several years.

How to trade USDINR

To trade USDINR, one needs to open an account with a reputable forex broker. When researching the best broker, it is helpful to consider their spreads, commissions, and other fees. It is also possible to trade the currency’s derivatives in the form of USDINR futures.

This article was originally published on InvestingCube.com. Republishing without permission is prohibited.