- Summary:

- AUD/USD climbs above 0.6370 as US dollar weakens. Key levels, market drivers, and what’s next for the Australian dollar?

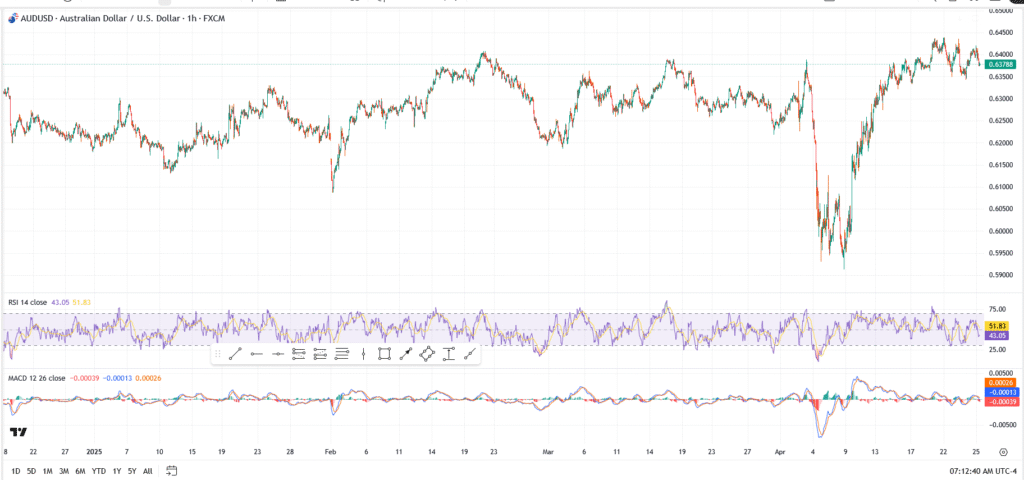

AUD/USD extended its upside momentum today, climbing above 0.6370, as the USD weakened across the board. The move marks a solid rebound from the sharp April dip, with the bulls now eyeing a break above the 0.6400 handle, a level that has capped several recent advances.

Stronger Australian trade data and resilient commodity prices, both of which tend to favour the Aussie, also boosted risk appetite. However, with the market still digesting the broader impact of US interest rate direction, the pair remains vulnerable to short-term reversals, especially if sentiment wobbles.

Technical Outlook: Key AUD/USD Support and Resistance Levels

Immediate support:

- 0.6320-Minor pullback zone

- 0.6260-deman zone from mid-April bounce

- 0.6200- double bottom base before the breakout

Upside resistance:

- 0.6400-psychological barrier and local high

- 0.6450- neckline of March breakdown

- 0.6525- February peak and trendline resistance

The current structure shows a potential continuation setup, but the price needs to decisively clear 0.6400 to unlock room towards 0.6450. Failure to hold 0.6320 could lead to a bigger breakout zone around 0.6260.

What’s Driving The Australian Dollar Today?

The Australian dollar has found fresh tailwinds as USD strength starts to unravel. Wednesday’s weaker-than-expected US PMI data dented confidence in the Fed’s hawkish stance, while Australian economic indicators, including commodity export data, remain robust.

China, Australia’s top trading partner, has also hinted at more infrastructure spending, which supports Australian iron ore exports. Add in subdued US yields and the case for short-term AUD strength becomes stronger, though geopolitical and Fed event risk remain key headwinds.

Outlook: What’s Next for AUD/USD?

The short-term bias turned constructive with the pair regaining ground after last week’s washout below 0.6100. But bulls need to clear 0.6400- 0.6450 to signal a real shift in medium-term momentum. If not, the Aussie risks stalling or worse rolling back toward the 0.6200- 0.6250 zone if dollar strength returns.