- Summary:

- XRP price previously rose to three-and-a-half year highs, but profit taking took its toll. Here's why I expect it to bounce back.

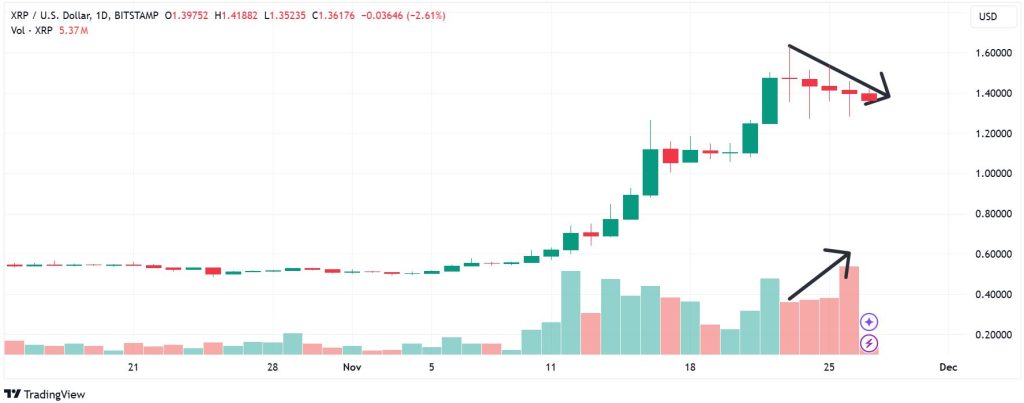

XRP price has been on a decline for the last four days, mirroring the wider crypto market trajectory as profit-taking exerts downward pressure. The asset traded at $1.35 at the time of writing, down by 2.7% on the daily chart. Notably, it spiked to three-and-a-half year highs of $1.63 on Saturday, but never quite settled in the $1.50 territory. Consequently, that level has emerged as a key barrier en route to the $2 mark.

A return to $1.500 mark would mean a 10% rise by XRP from its current level. A key warning sign to that move is the rise in trading volume in during the recent decline. A rise in the daily traded volume alongside dropping prices signals strengthening downward momentum.

However, the trend seems to be shifting, as CoinMarketCap data shows a drop in the traded volume by 13.8% in the last 24 hours. That could provide support XRP price by slowing down the rate of the decline. Meanwhile, Cryptoquant shows that XRP exchange reserve has been on the downward trajectory in the past seven days and is down by 1 percent in the last 24 hours. A decline in the exchange reserve shows reduction in selling pressure, which typically provides tailwinds to the price.

XRP price prediction: A Return to $1.400 In the Near-term

XRP price pivots at $1.369 and the momentum signals the buyers are in control. With The upward momentum is likely to push the price higher to meet the first resistance at $1.400. However, extended bullish control will breach that barrier and potentially test $1.430.

Alternatively, moving below $1.33 will signal the onset of bearish control. With the sellers in control, the price could move lower to find initial support at $1.345. However, a stronger bearishness could break below that level, invalidating the upside narrative. Also, the momentum could extend losses and test the second support at $1.29.