- Summary:

- Bitcoin’s halving market rotation—will Ethereum and Solana lead the next rally? Key price levels and predictions for BTC, ETH, and SOL.

Table of Contents

- Bitcoin Consolidates Gains After Halving — Is a Breakout Coming?

- Bitcoin Chart Analysis

- Ethereum Price Struggles Near $1,800 as Bulls and Bears Tug War

- Ethereum Chart Analysis

- Solana Reclaims $80B Market Cap — Meme Mania or Smart Money Rotation?

- Solana Chart Analysis

- Final Take: Rotation, Patience, and the Waiting Game

Bitcoin has held above $94,000 after its highly anticipated halving, but the explosive breakout traders hoped for has yet to materialise. Instead, the market feels coiling — a calm before the next directional wave.

Ethereum is showing mixed signals, hovering below $1,800, while Solana continues to attract capital in the meme coin frenzy, driving its market cap closer to the $80 billion mark. Across the board, crypto sentiment remains cautiously optimistic.

Bitcoin Consolidates Gains After Halving — Is a Breakout Coming?

Bitcoin is trading at $94,603, holding near its post-halving highs with signs of resilience but not yet breakout energy. The RSI on the 2-hour chart is pushing above 65, and MACD momentum remains tilted to the upside. But the bulls are clearly pausing at resistance near the psychological $95,000–96,000 zone.

This sideways chop isn’t uncommon after a halving. Historically, Bitcoin consolidates before making a sustained run, often months later. The supply shock narrative remains intact, but price action now depends heavily on broader liquidity, ETF inflows, and whether macro risk assets stay buoyant.

Bitcoin Chart Analysis

- Support levels: $91,200 / $88,000

- Resistance levels: $96,400 / $100,000

A clean move above $96K could unlock a run toward six figures. But for now, BTC is ranging, not raging.

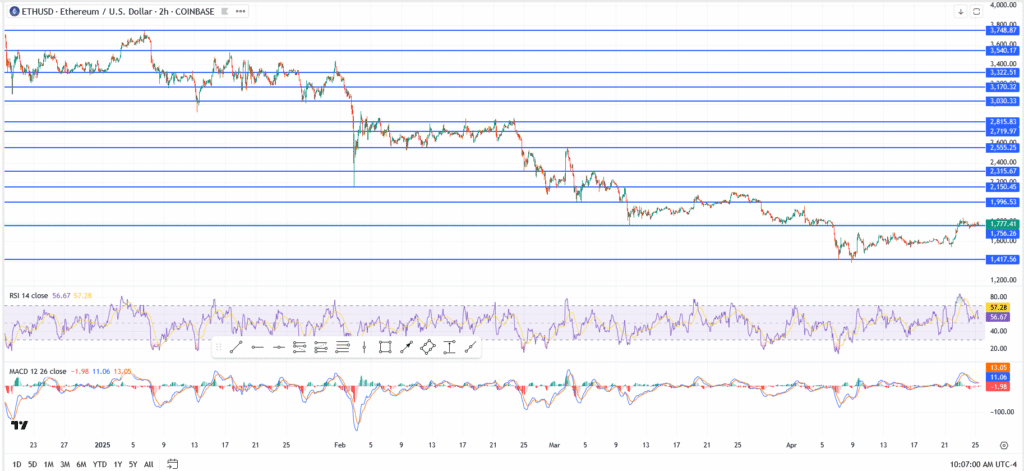

Ethereum Price Struggles Near $1,800 as Bulls and Bears Tug War

Ethereum opened Friday under pressure, trading just below the key $1,800 level despite posting a modest daily gain. Momentum is stalling at a critical pivot, with the RSI hovering near 56 and MACD flattening out, signalling indecision rather than drive. For bulls to regain control, ETH needs a clean reclaim of $1,800 — not just a wick above it, but a firm close and hold.

Institutional flows are picking up, with spot ETH ETFS recording $63.5 million in net inflows on Thursday, the highest in three weeks. Open interest has climbed to $9.8 billion, suggesting positioning is building on the long side.

This isn’t a complete reversal, but it’s far from a breakout. Ethereum sits in a delicate spot, and the next 48 hours will likely dictate whether bulls push through resistance or fold under pressure.

Ethereum Chart Analysis

- Resistance: $1,800 → $1,836 → $1,876

- Support: $1,745 → $1,700

Institutions are buying dips, but on-chain weakness limits upside.

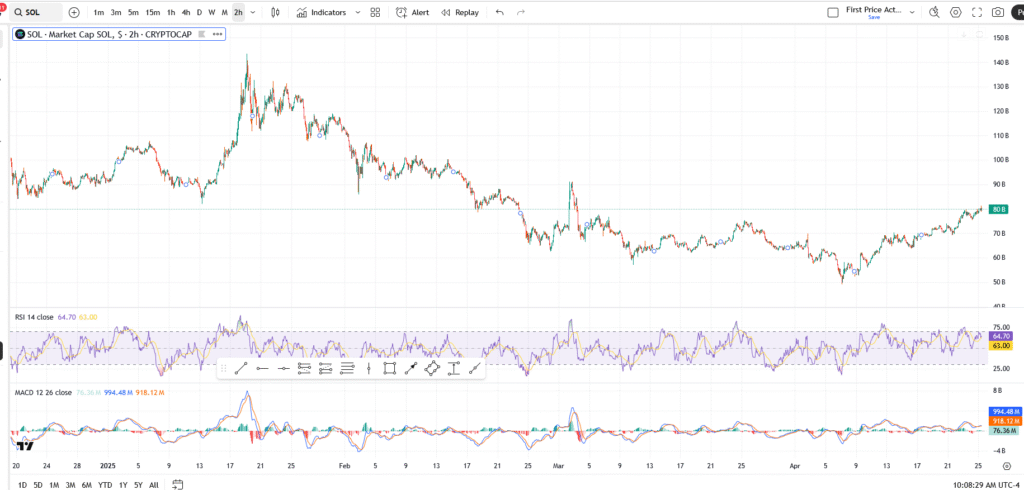

Solana Reclaims $80B Market Cap — Meme Mania or Smart Money Rotation?

Solana’s total market cap is hovering around $80 billion, and price action has turned sharply higher over the past week. Traders are rotating into SOL amid meme coin launches and growing developer activity on the chain.

Solana’s strength stands out especially as Ethereum struggles to maintain utility metrics. Meme coins like WIF and BONK are attracting massive volumes on Solana-based DEXs, contributing to rising transaction count and fee revenue on-chain.

Solana Chart Analysis

- Resistance levels: $85B → $91B

- Support levels: $74B → $70B

If Solana breaks above $85B with volume, it could front-run the next altcoin cycle.

Final Take: Rotation, Patience, and the Waiting Game

Bitcoin’s halving may be over, but the impact is just beginning. While BTC consolidates, ETH and SOL are fighting for market dominance beneath the surface. Ethereum has institutional tailwinds but weak on-chain metrics, while Solana thrives off retail energy and alt-season hype.

This isn’t a euphoric melt-up — it’s a calculated rotation. And when one of these three breaks decisively, the rest will likely follow.