The cryptocurrency market is experiencing intense volatility, with Bitcoin (BTC) slipping to a four-month low of $76,867 earlier today before rebounding above $80,000. Solana (SOL) and XRP have also seen sharp declines, with SOL struggling to hold support and XRP briefly dipping below $2 before rebounding.

Bitcoin’s latest selloff has driven it to its lowest level in four months, as investors react to concerns over tariffs, economic slowdowns, and disappointment in the U.S. government’s crypto strategy.

Solana has been a top-performing cryptocurrency, but the recent crypto market downturn has put SOL under pressure. Investors were excited about Solana’s potential inclusion in a U.S. crypto reserve, but the broader selloff has weighed on its price.

XRP saw extreme volatility, briefly plunging to $1.89 before rebounding above $2. This price action comes amid discussions about the U.S. potentially including XRP in its strategic crypto reserve.

Bitcoin’s drop to $76,867, its lowest level in four months, is more than just a price fluctuation—it’s a signal that the crypto market is at a critical juncture. This decline has shaken investor confidence, leading to increased volatility across the market. Altcoins like Solana (SOL) and XRP have followed BTC’s lead, slipping to key support levels, with traders scrambling to determine whether this is a buying opportunity or the start of a prolonged correction.

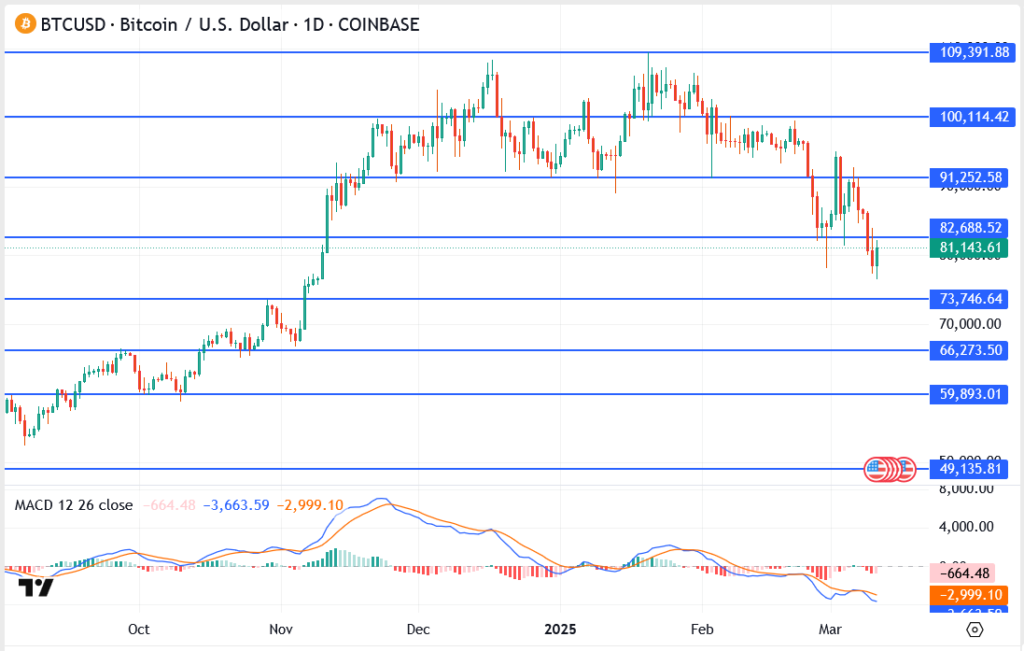

The impact of Bitcoin’s drop extends far beyond just its price. A weaker BTC often drags down the entire crypto sector, traders are closely watching macro trends, regulatory news, and liquidity levels to gauge the next big move. If Bitcoin fails to reclaim its $82,688 resistance, further downside could bring renewed selling pressure across the board.

However, if BTC stabilizes and pushes back above $91,252, it could trigger renewed interest in altcoins and broader market recovery. The coming days will be crucial in determining whether crypto’s short-term momentum shifts back to the upside or if another leg down is coming. For now, all eyes are on Bitcoin’s next move, as it will set the tone for what’s next in the market.

This post was last modified on Mar 11, 2025, 16:40 GMT 16:40