- Summary:

- Solana price has risen by 13 percent in the last week, leapfrogging BNB coin into the fifth position on crypto market cap rankings.

Solana price returned to the upside on Monday, breaking a two-day losing streak to trade at $215.15 at the time of writing. The coin has faced resistance at the $220 mark in the last three days, and breaking above that level could take it to three-week highs.

SOL price has risen by 13% in the last week, leapfrogging BNB coin into the fifth position on the crypto market capitalization ranking. SOL’s market cap stood at $103 billion as of this writing.

The upsurge in Solana price is supported by the positive sentiment surrounding potential approval of its ETF spot application. SOL’s applications were suspended by the Securities and Exchange Commission (SEC) late last year, and it is a frontrunner in the race to become the second altcoin to have its ETF approved.

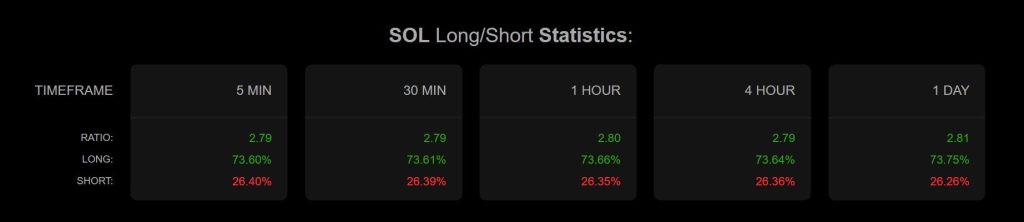

A spot ETF approval could help spur up Solana price as it could expand the crypto coin’s market reach to institutional investors. Meanwhile, the coin’s long/short ratio on the last day stood at 2.81; as seen on the Coinanalyze chart below, the coin’s momentum is bullish-leaning.

Also, DeFiLlama reports that Solana’s DeFi TVL rose by 10.2% in the last seven days. That signals increasing utility for SOL which could add propulsion to the upside. Solana chain’s DeFi TVL stood at $9.47 billion, the second-largest after Ethereum’s.

Solana price prediction

Solana price pivots at $214.50 and the Relative Strength Index signals that the buyers are in control. The momentum will likely meet the first resistance at $217. Breaking above that level will strengthen the upside and could take SOL higher to test $220.

Conversely, moving below $214.50 will favour the sellers to take control. That will likely see the establishment of the first support at $212. The upside narrative will be invalid if the price breaks below that level. Also, the resulting momentum could extend the decline and test $209.20.