- Summary:

- Solana price has been on a downtrend since its record highs. Does a 5 percent daily gain a return above USD 220 signal reversal?

Solana price rose Wednesday, returning to the upside with a 4.5% spike on the daily chart to trade at $225 at the time of writing. The crypto coin broke down decisively below the $240 mark on Monday after a prolonged consolidation within the $230-$241 range. SOL price rang bearish bells after going below $220, and a return above that level strengthens the sentiment around its upside prospects.

Solana price on-chain metrics and technical indicators signal weak momentum

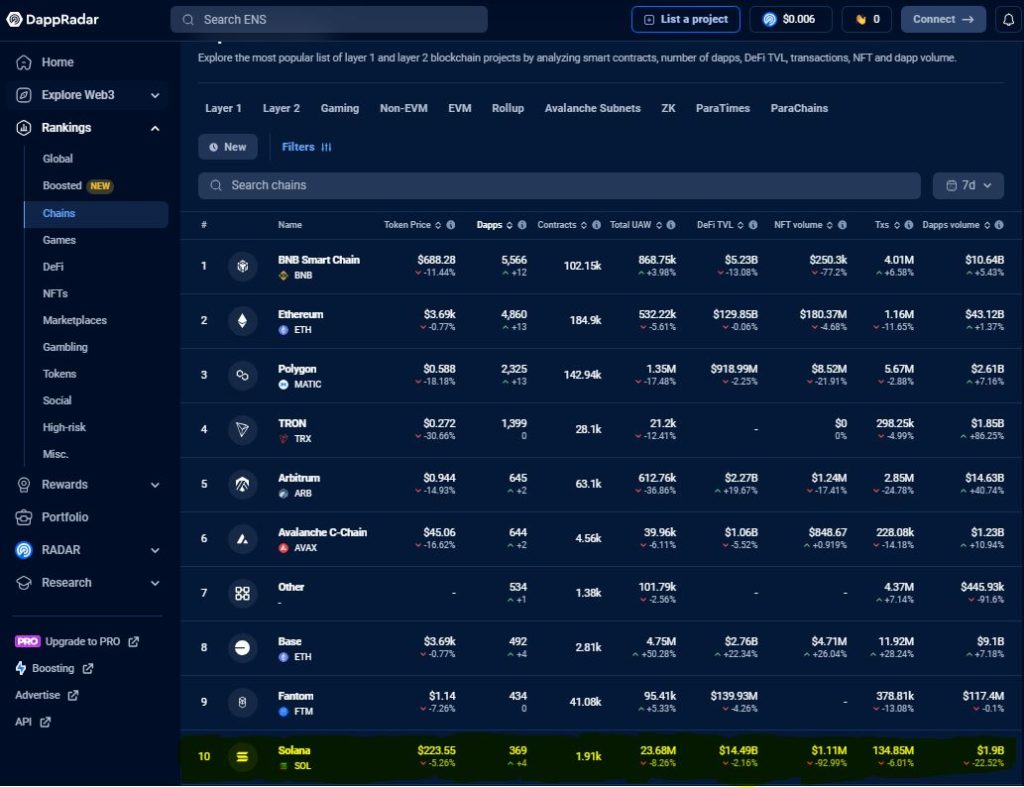

The Solana blockchain ecosystem has experienced a substantial decline in developer activity in the last week. According to analytics site, DappRadar, Solana’s dApp volume was down by 22.52% in the last seven days, generating $1.9 billion in that period. Also, the number of Unique Active Wallets (UAW) dropped by 8.26% to 22.68 million in the reporting period.

Despite SOL’s recent troubles, the Solana ecosystem is still the most active dApp chain. At 22.68 million, the UAW figure is substantially above the closest challenger, Base, which had 4.75 million UAW.

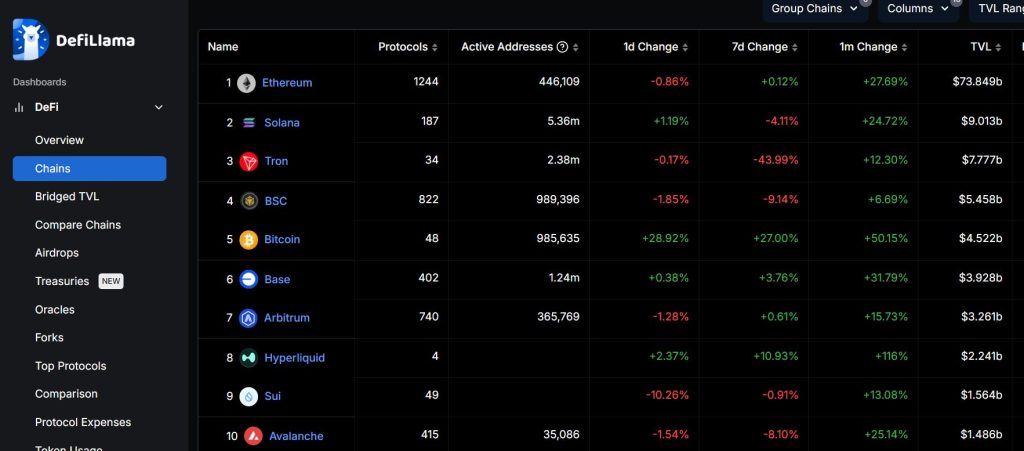

However, declining DeFi activity has brought downward pressure on Solana price. As per the DeFiLlama data, Solana chain’s DeFi TVL declined by -4.11% in the last seven days to stand at $9.013 billion. In contrast, Bitcoin realized a +27.00% growth in that time space to hit $4.522 billion. Ethereum has by far the largest DeFi TVL at $73.849 billion, accounting for 57% of the market share as per DeFiLlama data.

Solana price trades below the Volume Weighted Moving Average (VWMA) level which is at $233 on the daily chart. Also, it is marginally below the 20-Exponential Moving Average (EMA), which is at $229.29 in the daily time frame. A return above that level could confirm today’s gain as a potential reversal signal.

Solana price prediction

Pivot: Solana price pivots at $222 and the buyers will be in control if the action stays above that level.

Resistance: The first resistance is likely to be at $226. However, an extended bullish momentum could break above that level and test $230.

Support: The first support will likely be at $219. Breaking below this level will invalidate the upside narrative. Also, the resulting momentum could extend the decline and test the second support at $216.