- Summary:

- Solana price has been struggling for the last two weeks, swapping places with Ethereum. We tell you why SOL is likely to stay subdued.

Solana price inched up on Friday but signaled struggles in an attempt to retest the $240 mark. SOLUSD has had a torrid performance in the last week, gaining less than 1% at a time when the rest of the crypto market rallied. Notably, the crypto market bellwether BTC price rose past the milestone $100k level during that period, with the crypto market cap rising to a historic $3.7 trillion.

Notably, Solana price is still up by 135% year-to-date, but it has underperformed in the last two weeks, typified by rejection near the $260 mark. SOL swapped places with Ethereum during that period, underlining their tightening competition in terms of utility. ETH, the second-largest crypto asset, has recently retested $3,900 level for the first time since May, as its DeFi performance spiked significantly.

Solana has presented a formidable competition against Ethereum, with reduced latency, enhanced security and lower transaction costs. That had endeared Solana to developers, resulting in increased utility for SOL coin. Also, Solana chain’s DeFi Total Value Locked (TVL) has risen by 45% to $9.499 billion in the last month.

Meme coins have played a big part in SOL price gains this year, thanks to the Fun.pump phenomenon. However, the current crypto rally has seen investors give greater attention to Bitcoin and altcoins with practical utility, denying meme coins their sparkle. That has resulted in reduced activity in the Solana ecosystem, putting downward pressure on SOLUSD.

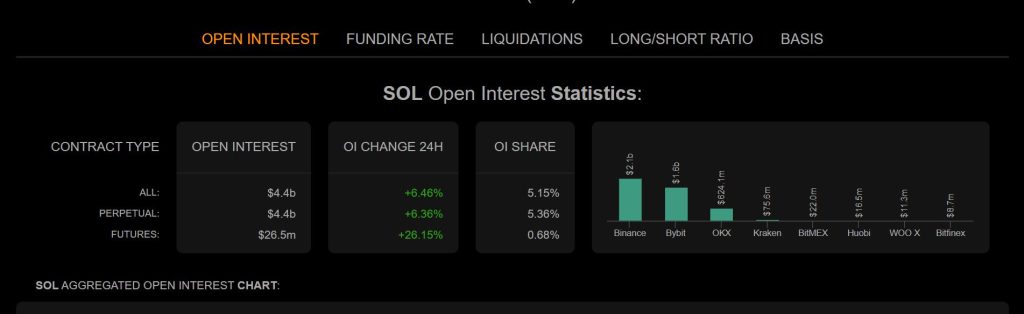

Despite its gains today, the Average Directional Index (ADX) signals weakness in Solana price upside. The indicator reading is 14, which is below the mean level of 20. That said, open interest data shows that the value of SOL perpetual contracts grew by 6.36% in the last 24 hours to $4.4 billion. Futures grew substantially by 26.15% in the same period. These figures show growing demand and investor confidence in the coin’s future performance.

Solana price prediction

Solana price pivots at $240, and the downside will prevail if resistance persists at that level. The first support will likely come at $234. However, extended bearishness could break below that level and send the price lower to test $230.

On the other hand, moving above $240 will swing the momentum towards the upside. With the buyers in control, initial resistance will likely come at $243. However, a stronger upward momentum will break above that level and test $247.