Bitcoin price has traded downward for the second session in a row, hanging precariously within the $95k support mark. The crypto market bellwether had recently been on a resurgence after initial consolidation in late November. However, it has realised only 1.4% in gains the entire week, a meager return in a normal market, let alone a rallying market. This signals potential exhaustion of the upside momentum, in which case a reversal could be in the offing.

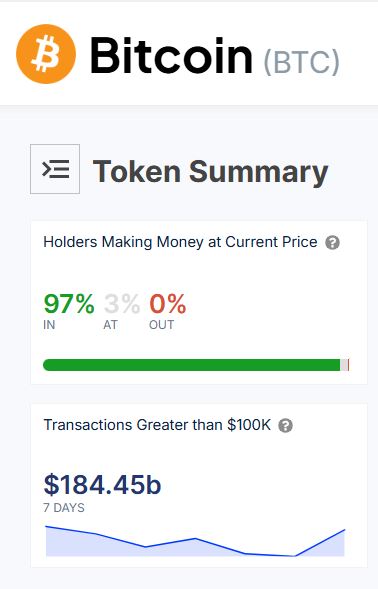

BTCUSD is almost completing the formation of a double-top pattern on the daily chart, signaling bearish control. A break below the psychological support mark of $95k would certainly inject a degree of fear, uncertainty, and doubt into the market. As per IntoTheBlock data, 97% of BTC holders are “In the Money”, while 3% are “At the Money”. This raises the prospect of profit-taking if the price breaks below $95k.

Meanwhile, Coinanalyze reports that the value of BTC open interest declined by 0.54 percent in the last 24 hours. That signals that investors are losing confidence in the coin’s near-term performance. However, the perpetual future rose by 0.52 percent in the same timeframe, which signals a favourable upside potential for BTC price in the long term.

The momentum on Bitcoin price calls for continuation of the downside, with the pivot price at $95,030. With the sellers in control, the price is likely to go lower and test the first support at $95,010. A stronger downward momentum will break below that level and could test $94,000.

Alternatively, moving above $96,030 will favour the buyers to take control. In that case, Bitcoin will likely encounter the first resistance at $96,793. Extended bullishness will breach above that mark, invalidating the downward momentum. Meanwhile, the price could build a stronger upward momentum to test $97,775.

This post was last modified on Dec 03, 2024, 18:29 GMT 18:29