- Summary:

- Ethereum price resisted pressure to break below USD 3,600, signaling a reversal trend, but its DeFi performance is a potential limiter.

Ethereum price returned to the upside on Thursday, halting two days of loss-making with a 1.7% gain at the time of writing. Ethereum retested the $4,000 mark earlier in the week, but Bitcoin’s slide has injected a bearish sentiment in the market. According to IntoTheBlock, ETH price has a strong correlation with Bitcoin price, its 30-day correlation coefficient at 0.71.

ETH price completed the formation of a double-top pattern on Wednesday. Therefore, today’s gain signals rejection of a break below the $3,600 support, raising the prospect of a trend reversal.

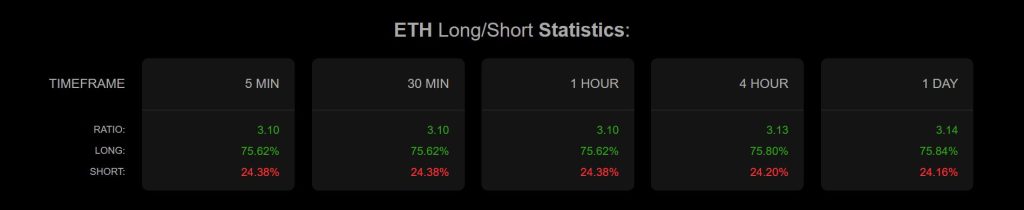

Also, Coinanalyze reports that Ethereum had a strong Long/Short ratio of 3.14 in the 24 hours preceding this writing, signaling growing investor confidence in the asset. A Long/Short ratio is obtained by dividing the value of long positions against those of short positions. A reading above 1.0 shows that investors are betting that the asset will likely appreciate in the future. That could create a positive sentiment in the market, which could add fuel to Ethereum price upside momentum.

As previously discussed here, Ethereum price recently broke out to the upside following the formation of a cup and handle pattern. Therefore, the reversal at the $3,600 mark means that the $4,665 price upside target is still valid.

However, ETH’s upside will also be influenced by Ethereum chain’s DeFi performance. According to DeFiLlama, the blockchain registered a 4.2% decline in its DeFi TVL in the last day and is down by 4.55% in the last seven days. A recovery in that sector could help spur ETH price recovery.

Ethereum price prediction

Ethereum price pivots at $3,655 and the Money Flow Index (MFI) indicator calls for further upside. With the buyers in control, ETH will likely drive up to meet the first resistance at $3,720. However, a stronger upside momentum could break above that level and test $3,800.

On the downside, moving below 3,655 will favour the sellers to be in control. That could establish the first support at $3,600. A break below that level will invalidate the upside and could potentially result in further losses to test $3,545.