- Summary:

- Ethereum price recently rejected breaking below USD 3,200 support and a retest of USD 3,500 amid rising ETF inflows could confirm a reversal.

Ethereum price continues with its recovery towards the psychological $3,500 support mark amid a wider market bearishness. ETH has lost 15% of its value in the last week, but a rejection of a breakout below the $3,200 support and a retest of the $3,400 mark signals a strengthening of the upward momentum and a potential reversal of recent losses.

ETF data signal Ethereum price rebound

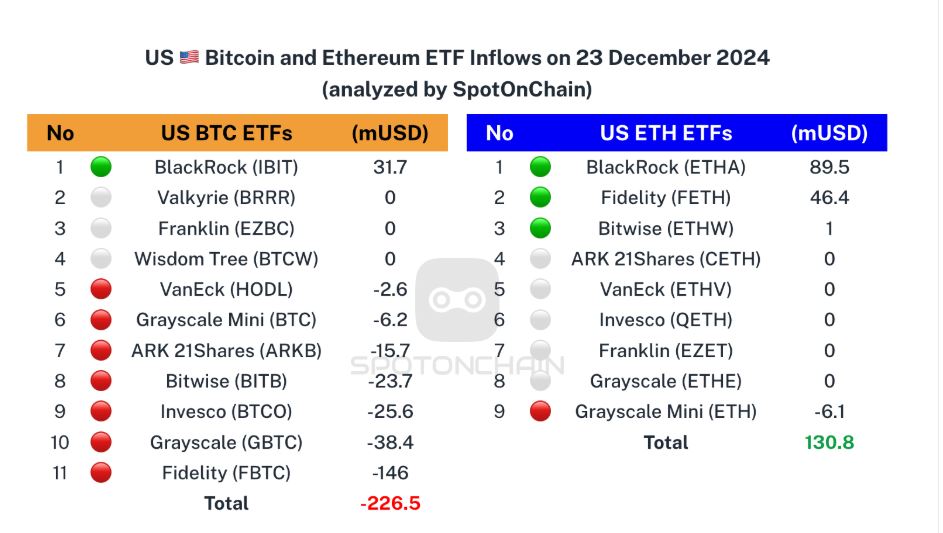

Despite Bitcoin’s status as the market bellwether, altcoins showed us in early December that they had what it takes to sway market sentiment. Therefore, BTC price slump below $95k may not necessarily drag altcoins downward for a long period. According to analytics site, SpotOnChain, Ethereum’s ETF inflows have recently been on the rise as Bitcoin ETFs record net outflows.

As per the data seen below, Bitcoin’s 11 ETFs recorded -$226 million in net outflows while ETH’s nine ETFs had +$130.8 million in net inflows. That signals investor inclination toward ETH, which adds support to Ethereum price upside.

BlackRock’s iShares Ethereum Trust (ETHA) had the largest inflows on Monday, receiving $89.5 million worth of investments. Only Grayscale Mini ETH ETF had a net outflow of $-6.1 million. In contrast, seven of Bitcoin’s ETF had net outflows, with BlackRock’s IBIT’s +$31.7 million ETF the only one with a net positive inflow.

Ethereum price prediction

The Money Flow Index (MFI) momentum indicator on Ethereum price is at 78 and calls for further upside. ETH price will likely head upward if action stays above the pivot at $3,377 mark, which aligns with the Volume Weighted Moving Average (VWMA). That could result in gains to encounter the first resistance at $3,466. However, extended control by the buyers could clear that barrier and test $3,531.

On the other hand, moving below $3,377 will signal a shift in the momentum toward the downside. In that case, ETHUSD will likely find the first support at $3,330. Breaking below that level will invalidate the upside narrative. Also, a stronger downward momentum could extend the decline and test $3,232.