- Summary:

- Ethereum price has struggled to find its rhythms above USD 3,500 mark despite the recent rally. However

ETH price rallied on Wednesday, gaining 10% on the daily chart to breach the $3,500 mark. The move was significant, as the mark has served as a long-term resistance level for Ethereum price. The crypto altcoin has only breached that barrier twice on the daily chart since the November 5 US presidential elections.

Ethereum price path to $3,800

Ethereum price has recently formed a cup-and-handle pattern, signaling a potential bullish breakout. After a consolidation period during which it oscillated between$3,550 and $3,250, ETH broke out decisively to the upside of the “handle” following Wednesday’s 10% surge. The breakout was confirmed on Thursday with another price action above $3,500.

By measuring the depth of the “cup” formed between November 12 and 21, we get a target price of approximately $438. Adding that figure to the handle’s breakout aligning with cup’s brim at $3,449 takes the minimum price target to $3,887.

However, for the thesis to hold, Ethereum price will need to build adequate momentum to break past the psychological resistance at $3,600 and $3,700. Approximately 9% of ETH holders are currently Out of Money, according to IntoTheBlock. These investors currently have no incentive to sell, and are likely to hodl their ETH until they get out of their loss-making positions.

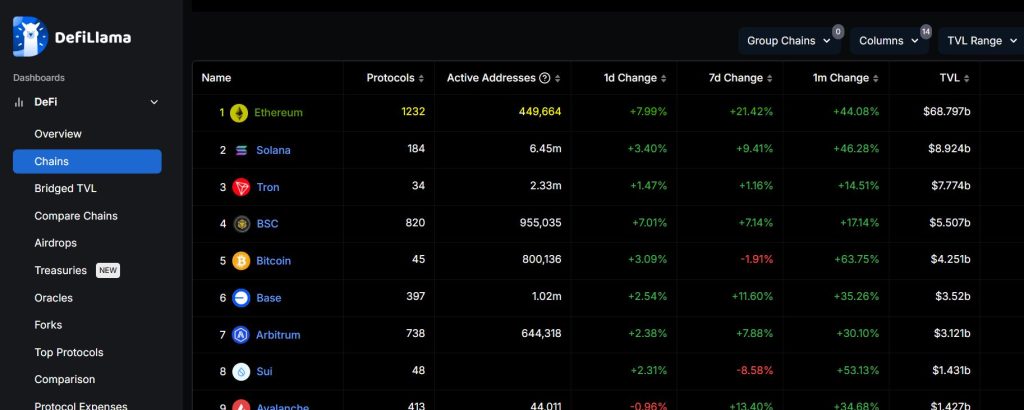

Meanwhile, Ethereum chain’s DeFi TVL has risen significantly in recent days. As per DeFiLlama data, the TVL rose by 21% in the last week and 8% in the 24 hours preceding this writing. That denotes increasing demand for ETH, which augurs well for the upside.

Ethereum price near-term prediction

Pivot: ETH price currently pivots at $3,540. The upside will prevail above that level. A break below the pivot will favour the sellers to take control.

Resistance: Immediate resistance is likely to be at $3,605. However, a stronger bullish momentum will breach that barrier and potentially test $3,660.

Support: Initial support is likely to be at $3,485. However, if the sellers extend their control, the price could break below that level , invalidating the upside narrative. Also, the resulting momentum could send the price lower to test the second support at $3,430.