- Summary:

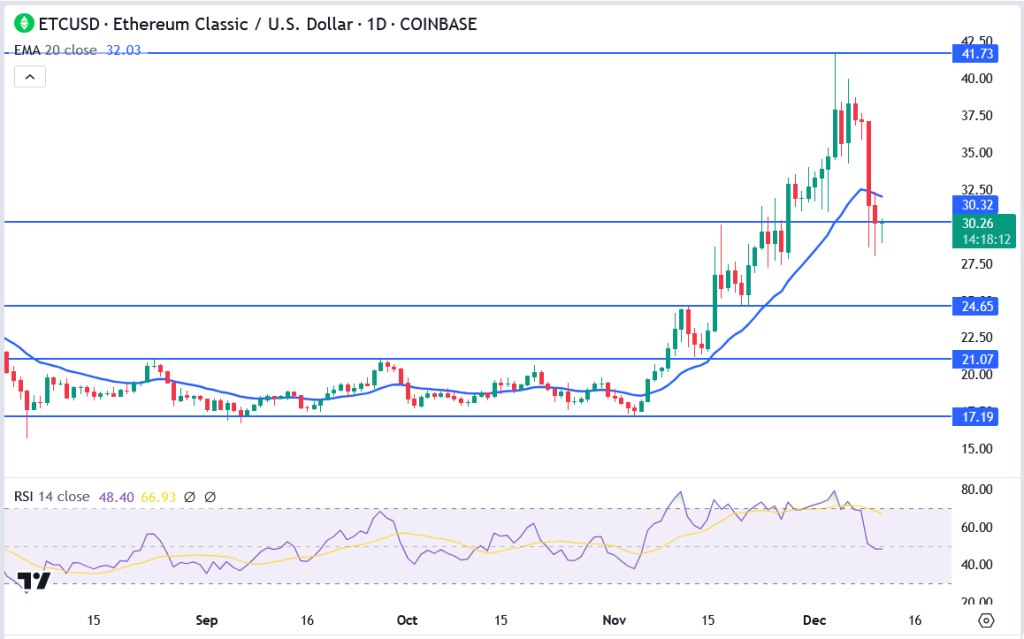

- Ethereum Classic is testing key support at $30 after a sharp correction from $41.73. Discover what’s next for ETC in this detailed breakdown.

Ethereum Classic (ETC) has seen a notable correction after reaching a two-year high of $41.73. ETC is trading at $30.32, hovering above a critical support zone. While the price action shows signs of consolidation, traders are eyeing the next big move. Will ETC hold support at $30 or slide further?

Chart Analysis: Key Levels to Watch

- Resistance Levels:

- $32.03: 20-day EMA acting as immediate resistance.

- $37.50: Psychological level and intermediate target.

- $41.73: Recent high and key breakout zone.

- Support Levels:

- $30.26: Immediate support critical for maintaining bullish momentum.

- $27.50: First major support if $30 breaks.

- $24.65: Key lower support in a bearish scenario.

What’s Next for Ethereum Classic?

ETC’s price action suggests consolidation around $30, with traders waiting for a breakout. A move above $32.03 could reignite bullish momentum, targeting $37.50 and eventually $41.73. However, failure to hold $30 could trigger a sell-off toward $27.50 or lower.

For long-term investors, Ethereum Classic remains a strong candidate due to its PoW mechanism and miner adoption. Watch for increased trading volumes and macro market sentiment for potential entry points.