- Summary:

- Bitcoin price rose past the psychologically significant level of USD 95k, with its metrics hinting at a near-term return to six figures.

Bitcoin price returned to a key psychological support level on the last day of 2024 as it wound up a fruitful year with +2.6% gains. Bitcoin traded at $94,586 at the time of writing, down from an intraday high of $95,117. A retest of the $95k mark raises the prospect of a return to the six-figure territory, the hallmark of Bitcoin’s exploits in 2024.

BTC struggled in December, ultimately registering a monthly loss of -1.7% after having previously registered successive three-month gains. Also, the momentum on Bitcoin price is still below the Volume Weighted Moving Average (VWMA) level of $98,119 on the daily chart. That has resulted in weak traction that has limited the coin’s upside momentum.

According to Coinglass, Bitcoin had a netflow of -192.19 coins that left exchanges in the 24 hours preceding this writing. A negative netflow signals a reduction in selling pressure among investors. A continuation of that trend could strengthen Bitcoin price’s upside momentum.

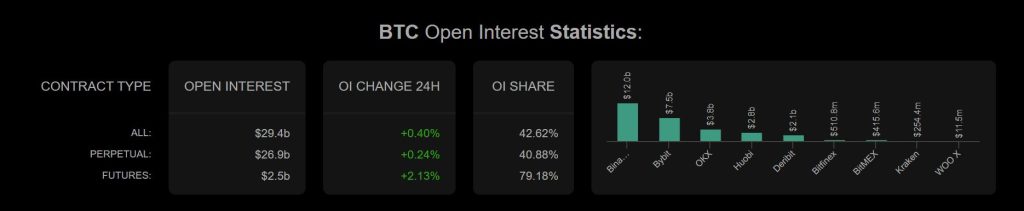

Meanwhile, BTC open interest also rose in the last 24 hours, signifying growing investor confidence in the asset. According to Coinanalyze, BTC recorded a +0.24% growth in perpetual contracts and a +2.13% rise in futures contracts in that time frame. Ultimately, Bitcoin price trajectory will be influenced significantly by fundamentals surrounding crypto regulatory environment under the incoming Trump administration.

Bitcoin Price Forecast

Bitcoin price pivots at $94,290 and the upside will prevail if action stays above that level. The coin will likely encounter the first resistance at $95,555. However, extended control by the buyers could breach that barrier and take the price higher to test the second resistance at $96,580.

Alternatively, moving below $94,290 will shift the momentum to the downside. With the sellers in control, the BTCUSD pair is likely to find the first support at $93,095. Also, the upside narrative will be invalid if the price breaks below that level. Furthermore, a stronger downward momentum could lead to more losses and test $91,950.