- Summary:

- Bitcoin price returned above $95k support and recorded its first successive three-day gain since mid-Dec. Is a retest of $100k in imminent?

Bitcoin price rose for the third successive day on Thursday, driven by upbeat investor sentiment around the coin’s upside prospects in 2025. BTC was up by 2.2% at the time of writing and traded at $96,580, recording its first successive three-day gain since December 17.

The crypto market has been in an extended consolidation since the last half of December. Therefore, a return above the psychological $95k mark raises the prospect of retesting the six-figure price level.

Bitcoin Signals Recovery

Notably, Bitcoin’s underperformance in the aforementioned period was reflected in the ETF market, where its 11 spot ETFs saw their inflows decline by about a third. Bitcoin’s spot ETFs attracted $4.5 billion in inflows, a substantial decline from November’s $6.4 billion.

However, the transition to the new year presents renewed optimism around the coin, with expiring contracts amid heightened expectations of the regulatory environment in the United States. That could catalyse increased demand for BTC and inject fresh impetus into the price momentum. Bitcoin recorded $5.30 million on December 31, signaling a potential recovery.

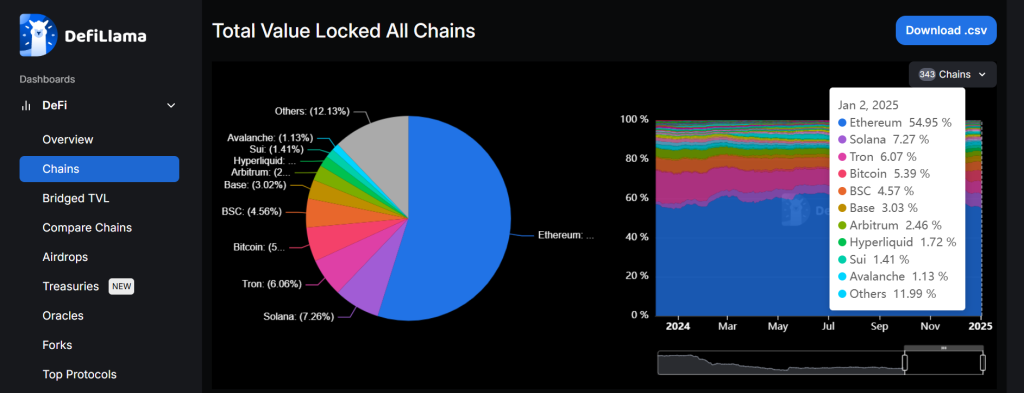

An often overlooked segment in Bitcoin price analysis is its DeFi performance. For a long time, Bitcoin’s DeFi performance has been pale shadow of its muscle as crypyo market’s leading asset. However, it has since seen its Total Value Locked (TVL) rise from 1.05% in October 2024 to 5.3% of the market share as of this writing. A continuation of the trend could help drive up Bitcoin price significantly.

Bitcoin Price Prediction

Bitcoin price pivots at $95,510 and the momentum indicator favours the continuation of the upside. That will likely see the coin move to the first resistance at $97,000. However, a stronger upside momentum could breach that barrier and potentially test $97,910.

Conversely, moving below $95,510 will shift the momentum to the downside. That could establish the first support at $94,430. An extended control by the sellers could break below that level and invalidate the upside narrative. Also, that could clear the pathway to test the second support at $94,290.