- Summary:

- Bitcoin price momentum has waned in recent days and multiple metrics signal consolidation. How low can it go?

Bitcoin price extended its decline on Tuesday, recording its first successive daily loss in two weeks. The coin was down by 0.4 % at the time of writing and traded at $97,110 at the time of writing, bringing its losses in the last two days to more than 4%. The crypto market is consolidating after a long period of rally, with the total market capitalization slipping to $3.47 trillion, the lowest in a week.

On-chain metrics show that 97% of BTC holders are “In the Money”, with 3% “At the Money”. This is an existential threat to the price recovery, as the current market sentiment could trigger a selloff. Also, most investors have already prized in the Trump rally, leaving little motivation for a repeat of a similar upward momentum.

The long-term sustainability of Bitcoin price above $95k will largely depend on spot ETF trading and institutional adoption. Bitcoin ETFs have reported positive netflows for the last two weeks, and stood at $110 billion as of this writing, including $483 million in the last 24 hours. Furthermore, Trump’s economic policies and the impending changes at the Securities and Exchange Commission (SEC) are likely to encourage greater institutional adoption of crypto.

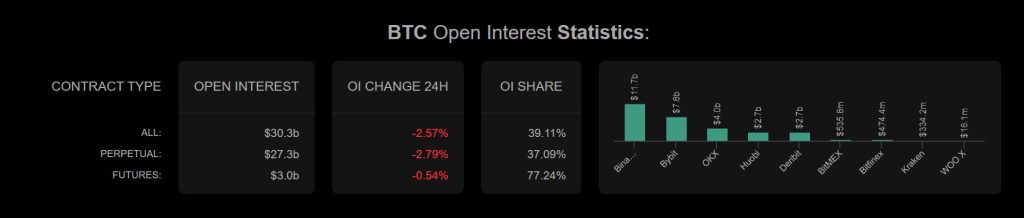

However, Bitcoin price will likely be under pressure in the near-term, going by its Open Interest data. According to Coinanalyze, the value of BTC open futures contracts fell by 0.54% in the last 24 hours. In addition, perpetual contracts fell by 2.79% in the same time frame. These figures signal declining investor confidence in BTC price upside.

Bitcoin price prediction

Pivot: Bitcoin price pivots at 97,300, and the sellers in control if resistance stays at that level. Otherwise, the upside will prevail.

Resistance: With the buyers in control, BTCUSD will likely move upward to meet the first resistance at $97,380. However, a stronger upward momentum will break above that level and potentially test 98,105.

Support: The coin will likely find the first support at $96,510. Breaking below that level will invalidate the upside narrative. Also, the resulting momentum could take the price lower to the second support at $96,00.