- Summary:

- Bitcoin price has recently consolidated around the USD 97K territory, but what do on-chain metrics tell us? Is there hope for the upside?

Bitcoin price edged up on Wednesday, snapping its two days of losses to gain 1% and trade at $97,682 at press time. Bitcoin has consolidated around the $97k territory for the last two days, triggering profit-taking in the broader cryptocurrency market. Notably, the coin’s traded volume declined by 17% in the last 24 hours, underlining weak upward momentum.

On-chain metrics call for Bitcoin price upside

Despite the recent decline in buying appetite, most BTC investors are hodlers. According to CoinMarketCap analytics, 71.1% of investors have held their Bitcoin for more than one year. This signifies confidence that the coin will likely appreciate in value in the coming days.

Meanwhile, Glassnode reported this week that $99,559 is the largest accumulation level for Bitcoin price, with approximately 125,000 BTC accumulated. However, the current BTC price has broken below that level, sending it to the second-largest accumulation level highlighted by Glassnode, in the $96K-$98K band, which had 120,000 BTC accumulated. This adds credence to the view that Bitcoin price consolidation is winding up.

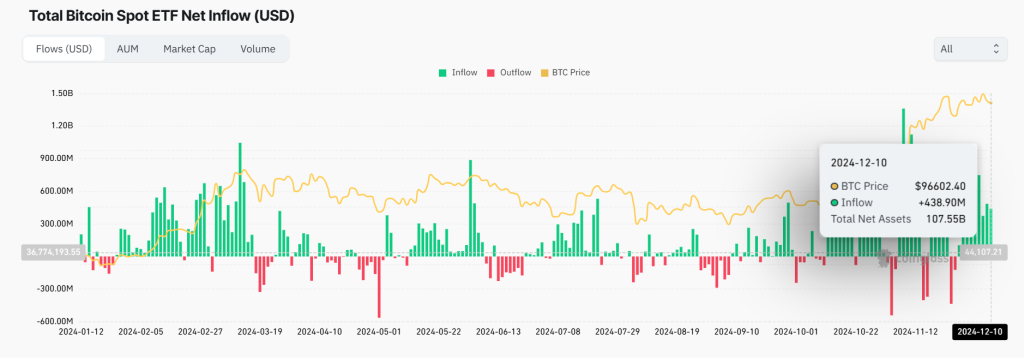

Nonetheless, the prevailing market sentiment is still largely pro-Bitcoin, and the current consolidation is driven by profit-taking. Also, Coinglass data shows that Bitcoin Spot ETF continues to record net positive inflows despite the recent decline in the price. That signals investor confidence in the coin’s upside potential.

Similarly, the value of Open Interest contracts grew by 0.68% in the last 24 hours as per Coinanalyze data. That adds credence to the positive assessment of BTC price upward momentum in the coming days.

Bitcoin price prediction

Pivot: Bitcoin price pivot is at $97,280, and the upside will prevail if action stays above that level. Conversely, moving below that level will shift the momentum to the downside.

Resistance: Immediate resistance will likely be at $98,160. However, a stronger upside momentum will breach that barrier and potentially test $98,720.

Support: BTCUSD is likely to find the first support at $96,820. A break below that level will invalidate the upside thesis. Also, an extended control by the sellers could break below that level and go to the second support at $96,345.