- Summary:

- Silver prices rise near $30.18 during Trump inauguration week. Explore key resistance at $31.33, support at $28.91, and market outlook.

Silver prices have climbed higher this week, coinciding with Donald Trump’s inauguration anniversary. This timing has sparked renewed interest in the metal as investors reflect on how silver performed during his presidency and what lies ahead for the market.

Currently trading near $30.18 per ounce, silver is gaining momentum thanks to weaker U.S. dollar dynamics and rising demand expectations. The rally marks a promising start to the year for the precious metal, which holds value both as a safe-haven investment and an industrial asset.

Why Is Silver Moving Higher?

- Weaker Dollar: A declining U.S. dollar has enhanced silver’s appeal to global purchasers, aiding its price increase.

- Industrial Demand Forecast: Silver’s application in sustainable technologies like solar panels and electronic devices persists in fostering positive expectations for its upcoming demand.

- Historical Significance: Trump’s presidency saw significant volatility in silver prices, particularly during the pandemic, and this week’s movement has rekindled interest in those market patterns.

Silver Chart Analysis: Key Levels to Watch

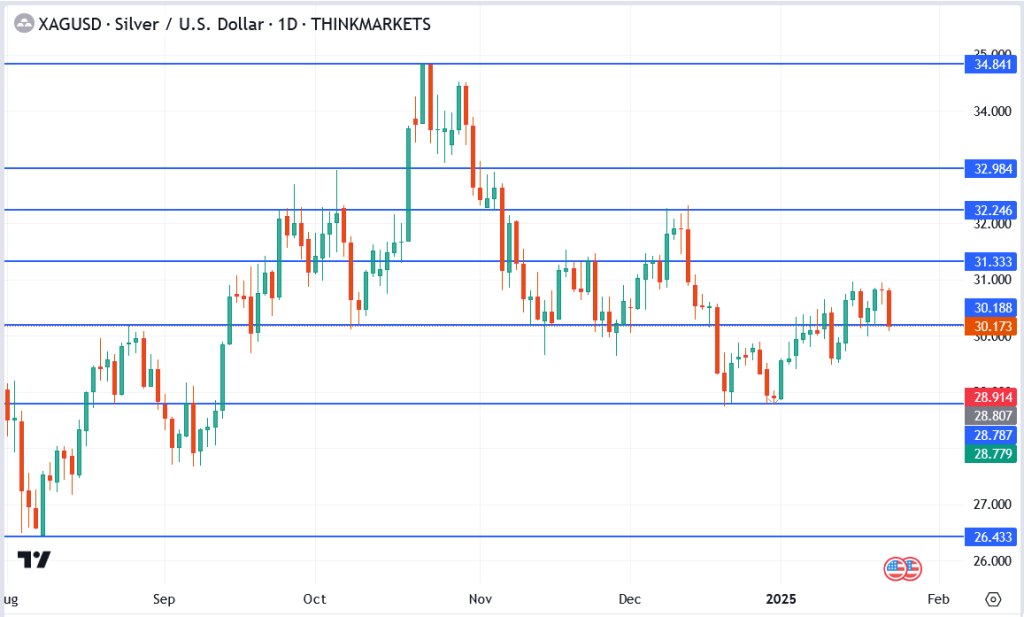

Silver’s price action this week highlights critical technical levels:

- Resistance at $31.33: Silver is facing a strong resistance level at $31.33. A break above this could open the door to further gains toward $32.25 and $32.98.

- Support at $28.91: On the downside, the metal has firm support at $28.91, which could act as a safety net if prices pull back.

- Range Between $30 and $31: Recent price action suggests silver is consolidating in a tight range, with buyers and sellers closely contesting control around the $30 mark.

What Lies Ahead for Silver?

Silver’s prospects appear promising because of its distinctive position as both an inflation hedge and an essential industrial metal. The drive for renewable energy and cutting-edge technologies is expected to maintain a consistent demand for silver in the long run.

For traders, silver’s recent price levels offer plenty of opportunities. If prices manage to break above $31.33, the metal could see a fresh wave of buying interest. At the same time, support levels below $30 provide a reliable entry point for cautious investors. Watching the interplay between industrial demand and economic conditions will be key to navigating silver’s path in the coming weeks.