- Summary:

- Silver price nears $33 as bulls target $35. Will XAG/USD break higher or face a pullback? Key levels and market trends in focus.

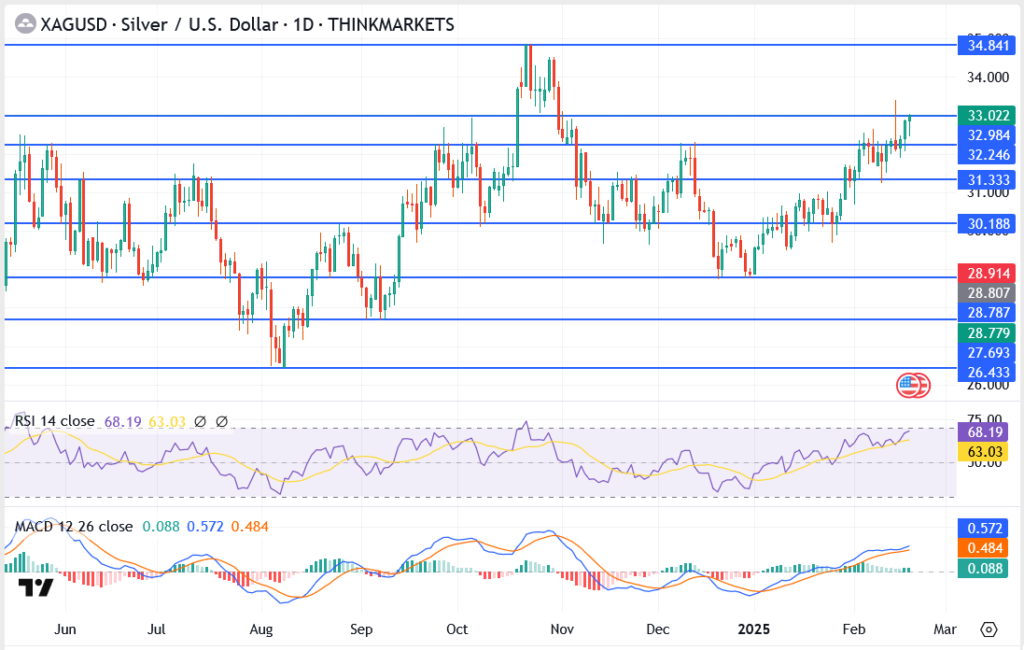

Silver (XAG/USD) is pushing higher, trading around $32.98 per ounce, as bullish momentum continues. The precious metal has benefited from strong investor demand, geopolitical uncertainties, and growing expectations of a Fed rate cut later in 2025.

However, silver remains volatile, recently spiking to $34.00 before retracing. The question now is whether XAG/USD can extend its rally toward the 10-year peak of $35, or if sellers will regain control.

Silver Price Drivers

Silver prices are rising due to Fed rate cut speculation, which weakens the U.S. dollar, boosting demand for metals. Geopolitical tensions between the U.S. and Russia are further driving safe-haven interest, while industrial demand from the EV and solar sectors adds support amid forecasts of a 2025 supply deficit.

XAG/USD Technical Analysis

- Silver Resistance Levels

- $33.02 – Immediate resistance

- $34.00 – February high

- $34.84 – 10-month peak

- $35.00 – Major psychological level

- Silver Support Levels

- $32.24 – Minor support

- $31.33 – Key demand zone

- $30.18 – Critical support

Silver Price Outlook – Will XAG/USD Break $35?

Silver’s next move depends on Fed policy, economic data, and global tensions. If buyers push XAG/USD past $34, the next target is $35, a level last seen in 2012. A breakout could attract more momentum traders, driving prices higher.

On the flip side, if silver struggles to hold above $32.98, we might see a pullback toward $31.33, where buyers could step in again. The RSI is nearing overbought levels, so some cooling off wouldn’t be surprising.

Final Thoughts

Silver is looking strong, but traders should watch for signs of exhaustion. If it clears $34, we could see more upside. If not, a dip toward $31.33 might be next. Either way, it’s shaping up to be an interesting week for XAG/USD.