Silver prices are consolidating near the $30 mark, reflecting cautious optimism among investors amid broader market uncertainties. The precious metal has been treading water, caught between the tug-of-war of geopolitical tensions and a softer U.S. dollar. As we edge closer to the year’s end, the question arises: will silver regain its momentum, or is the current range here to stay?

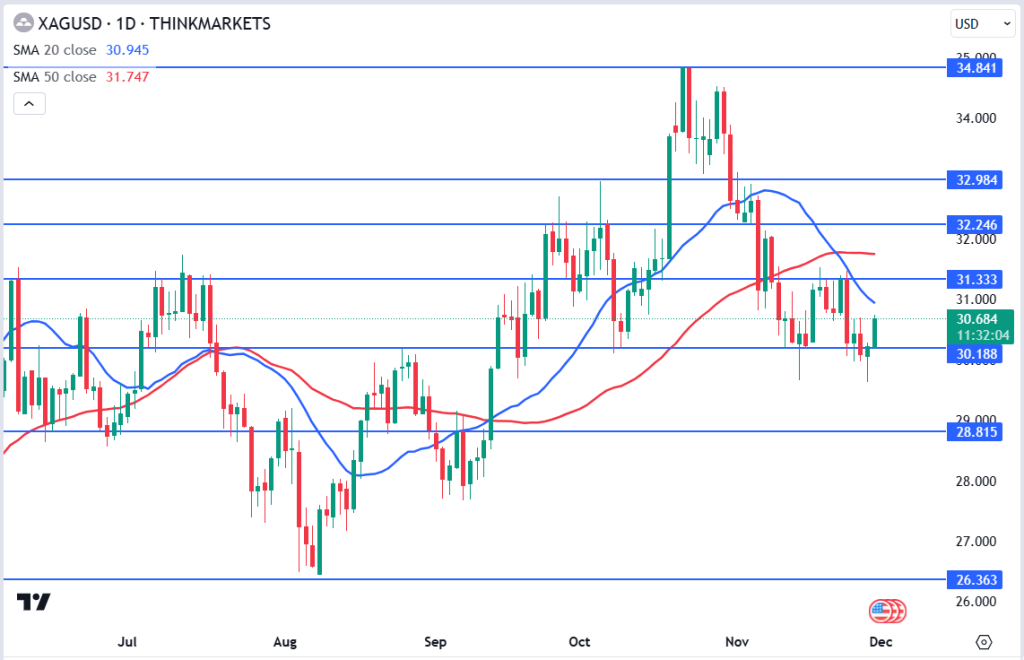

Silver (XAG/USD) prices appear range-bound for the time being, oscillating between the $30 support and the $31.33 resistance. A clear breakout in either direction could define the metal’s trajectory as 2024 draws to a close.

For now, all eyes are on external factors, including economic data and geopolitical developments, to gauge whether silver can escape its current consolidation phase. Traders should monitor key levels closely for signs of a breakout or potential retracement.

This post was last modified on Nov 29, 2024, 10:42 GMT+0100 10:42