- Summary:

- Gold slips below $3,300 as US-China optimism lifts risk sentiment. Here’s what’s driving prices down and key support levels to watch next.

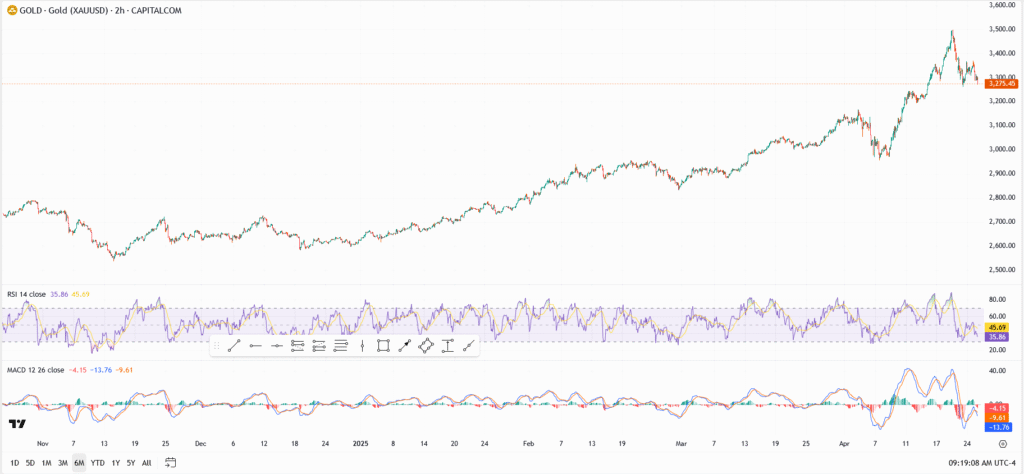

Gold (XAU/USD) pulled back below $3,280 on Thursday, snapping its bullish streak as the U.S. dollar regained ground and risk sentiment saw a brief uptick following renewed talks between the U.S. and China. The metal is now trading nearly $200 off its all-time high, as traders rotate out of safe-haven assets and reassess the likelihood of rate cuts this summer.

Despite the pullback, gold remains one of the top-performing assets of 2025, buoyed by sticky inflation, central bank buying, and geopolitical hedging. With markets still on edge over trade risks and Middle East tensions, the floor for gold prices appears to be rising — but the upside momentum is clearly taking a breather.

Gold Technical Analysis: Key Levels to Watch

- Resistance levels:

- $3,320 – previous high from mid-week rally

- $3,385 – short-term double top

- $3,450 – recent all-time high (ATH)

- Support zones:

- $3,210 – key Fib level and rising demand zone

- $3,100 – March consolidation base

- $2,970 – trendline support from the Feb-March uptrend

Gold is losing steam but still above critical support. The setup suggests a cooling phase, not a collapse, unless $3,100 is broken decisively.

What’s Behind the Gold Price Dip Today?

The pullback comes as the U.S. dollar rebounded slightly and hopes of a diplomatic breakthrough between the U.S. and China dimmed some safe-haven appeal. A stronger greenback typically weighs on gold, which is priced in dollars and becomes less attractive to foreign buyers when the currency rallies.

Still, the macro backdrop remains gold-friendly: central banks continue accumulating reserves, real yields are regressing again, and inflation remains above many G20 targets. For long-term bulls, this correction may be a recalibration, not a trend reversal.

Is Gold Still a Buy in 2025?

Gold’s 25% rally this year has reignited the classic debate: is this the start of something bigger, or has the metal already topped out? Historically, parabolic moves like this don’t sustain without pauses, and that’s exactly what we’re seeing now. For now, the smart money appears to be hedging with caution in the short term, but keeping long-term exposure intact.