- Summary:

- Gold price analysis 2024–2025: XAU/USD hits an all-time high at $2,942. Key levels in focus as traders eye the $3,000 mark.

Table of Contents

Gold prices have experienced a significant upward trajectory, influenced by escalating geopolitical tensions, concerns over inflation, and emerging economic policies. In early 2025, prices surged beyond $2,900 per ounce, prompting speculation that $3,000 might be imminent. As various factors come together to support gold, the question on many people’s lips is: How much further can it rise?

Various current events, including U.S. tariffs and conflicts in the Middle East, have heightened investor interest in secure assets such as gold. This article analyzes the main factors fueling the current rally and highlights what to monitor in the coming months.

How U.S. Tariffs Are Boosting Gold Demand

A key driver of gold’s increase is the announcement that U.S. tariffs on steel and aluminium will be implemented on March 12. These tariffs will increase the cost of imported metals by 25%, with the goal of safeguarding American manufacturers. Though this policy might provide a temporary advantage to U.S. manufacturers, it is also expected to increase expenses for sectors dependent on steel and aluminium.

Industry experts suggest that this might negatively impact the overall economy in the long term, particularly since steel-consuming sectors greatly surpass those that manufacture it. Investors are seeking gold as a safeguard against possible economic turmoil brought on by the tariffs.

Middle East Tensions Add More Fuel to the Fire

Besides economic issues, geopolitical threats are significantly contributing to the increase in gold prices. Recent remarks by President Trump about Gaza and Middle East strategy have increased uncertainty. His proposal for resettling Palestinian refugees in nearby nations and the threats to cut military assistance to Egypt and Jordan have unsettled markets.

The increasing tension has prompted investors to turn to gold for safety, boosting demand and pushing prices higher.

Strong U.S. Jobs Market and Rising Inflation

The U.S. Nonfarm Payrolls report released earlier this month showcased a surprisingly robust labor market. The unemployment rate fell from 4.1% to 4.0%, and wage growth surged by 0.5%, greatly surpassing forecasts.

With yearly inflation at 2.9%, many anticipated the Federal Reserve to intervene. Nonetheless, political pressure and continuous changes in important administrative positions appear to have prevented the Fed from indicating a forthcoming rate increase. This postponement in enforcing monetary policy has offered additional backing for gold prices.

Gold Price Analysis (2024–2025): Key Trends and Technical Outlook

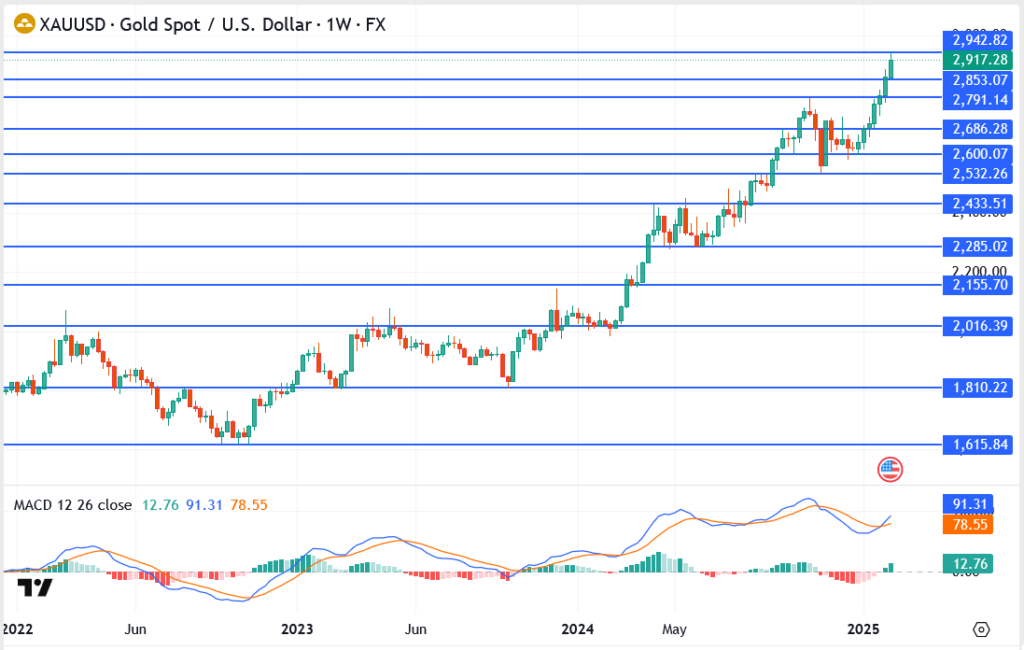

Gold prices have shown significant strength over the last year, breaking key resistance levels and hitting new all-time highs at $2,942 per ounce in early 2025. The upward trajectory highlights a bullish trend driven by global uncertainties, rising inflation, and geopolitical risks. Let’s break down the key developments and technical levels:

1. 2024: The Foundation for the Bullish Breakout

- January to June 2024: Gold traded between $1,810 and $2,200, consolidating after a strong recovery from the 2023 lows. The price repeatedly tested the $2,200 resistance, but bullish momentum was not strong enough for a breakout.

- July 2024: Gold finally broke above $2,200, triggering a sustained uptrend. This breakout marked a critical turning point as it cleared a multi-month resistance level and paved the way for higher targets.

- August to October 2024: Prices quickly climbed toward $2,433 and $2,532, consolidating in a tight range before another bullish push.

2. Late 2024 to Early 2025: The Surge to New Highs

- November 2024: Gold breached the $2,600 mark, confirming a strong bullish continuation. This move was fueled by increasing geopolitical tensions and rising inflation data from the U.S.

- December 2024 to January 2025: The bullish momentum accelerated as gold broke above the $2,686 resistance and surged toward $2,853 and $2,917. Buyers maintained control, with no significant retracement, indicating strong demand.

- February 2025: Gold hit $2,942, setting a fresh all-time high. The ongoing global uncertainty and U.S. policy changes have continued to support the rally, with traders now targeting the psychological $3,000 level.

Key Technical Levels to Watch

- Immediate Support: $2,791 – A break below this could lead to a correction toward $2,686.

- Major Support Zones: $2,532 and $2,433 – These levels represent key areas where buyers may step in if the price retraces.

- Resistance Levels: $2,942 is the immediate resistance. Beyond this, the next psychological target is $3,000.

MACD and Momentum

RSI: Currently near overbought territory, signalling the potential for short-term profit-taking before the next leg is higher.

MACD Indicator: The MACD is firmly bullish, with positive momentum intact. However, the histogram suggests some slowing momentum, indicating that consolidation or a brief pullback may be possible.

Conclusion

Gold’s performance in the past year has been truly exceptional, with the price climbing from $1,810 to $2,942. The trend continues to be positive, backed by robust technical and fundamental elements. Although a short-term pullback may happen, the overall perspective stays optimistic as long as gold remains above important support levels.

Traders need to pay attention to $2,791 as the primary key level and observe worldwide events that might affect gold’s upcoming trajectory. The $3,000 benchmark is now attainable, and surpassing it might spark a new surge of buying enthusiasm.