- Summary:

- ATFX offers a range of account types tailored to meet the needs of various traders, from beginners to experienced professionals. Their competitive spreads, fast execution, and no hidden fees contribute to a reliable trading environment.

- ATFX provides excellent customer support, available 24/5 in multiple languages, ensuring that traders receive the assistance they need promptly. The broker's educational resources are also top-notch, helping traders enhance their skills and make informed decisions.

- ATFX is regulated by multiple authorities, including the FCA, ensuring that it adheres to strict financial standards. This regulation, combined with their negative balance protection, makes trading with ATFX a secure experience.

- ATFX's advanced trading platforms, including MT4/MT5 and its web-based option, offer a seamless trading experience. The platforms are equipped with various tools and features that enhance trading precision and efficiency.

Table of Contents

- What is ATFX?

- ATFX Regulations and Licensing

- ATFX Regulatory Information

- ATFX Products and Services

- ATFX Retail Accounts

- Demo account

- ATFX Fees

- Trading accounts

- ATFX MAM and PAMM

- ATFX Trading Platforms

- ATFX MT4

- ATFX MT5

- ATFX Spreads

- Depositing funds to an ATFX account

- Trading Tools

- ATFX Introducing Broker Program

- ATFX Copy Trading

- Client Funds Insurance

- ATFX Educational Resources

- Customer Support

- ATFX versus other brokers

- Are ATFX Scammers?

- Conclusion

In this ATFX Review 2025 article, we take an in-depth look at the broker, covering the types of services and products it offers, the regions it operates in, its strengths, weaknesses, reputation, and customer perceptions. We also look at the efficiency of its tech integration and debunk some of the myths regarding the broker and give a comparative analysis with some of its competitors.

What is ATFX?

ATFX markets itself as an automation-focused broker that prioritizes its customers. Its service suite includes FX trading, CFDs, market predictions, and analysis of both technical and fundamental factors, provided by financial experts with extensive backgrounds in retail and institutional trading.

The brokerage firm reported $643 billion worth of trading volume in the final quarter of 2024, reinforcing its strong market position over the previous quarter. Furthermore, this milestone positioned it 7th overall globally throughout the period. In the ATFX review below, we look at its business model and practices that have seen it rise to that level.

Notably, AT Global Markets (UK) Limited has stopped serving retail clients and currently serves institutional clients under the brand name ATFX Connect.

ATFX Regulations and Licensing

ATFX has an expansive global reach with offices in 23 jurisdictions, including Asia, Australia, Africa, Europe, Latin America, the Middle East and the UK. The company is licensed and regulated in different jurisdictions as outlined below:

ATFX Regulatory Information

ATFX Products and Services

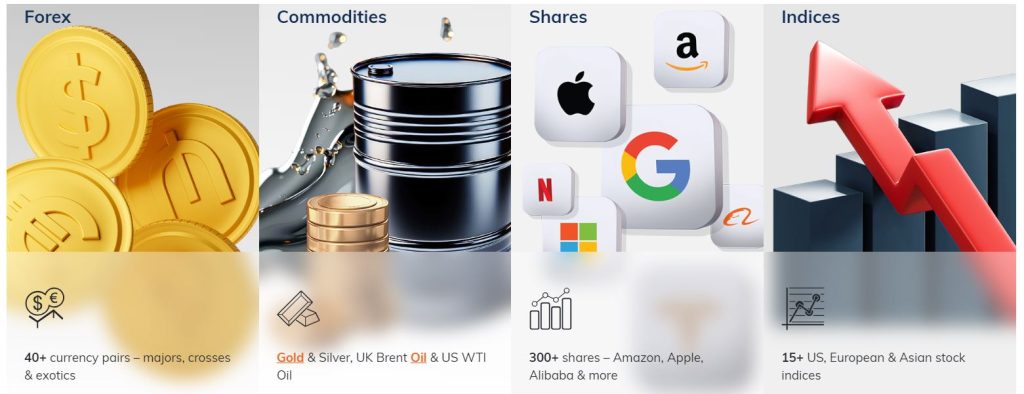

ATFX supports 43 different currency pairs in forex trading, including major pairs, minor pairs, and exotics. The broker also supports index trading, and you can trade on 15 different indices from markets in the US, Europe, and Asia, as well as commodities like crude oil, gold, and silver. CFD shares trading is available for 250+ companies listed in Hong Kong, the US and Germany.

You can also trade cryptocurrencies on ATFX if you are in its Southeast Asia and Latin American markets. However, ATFX crypto trading is not available in the Middle East and North Africa (MENA) region and Gulf Cooperation Council (GCC) countries.

Trades on ATFX are executed through Straight Through Processing (STP), which is automated and fast.

ATFX Retail Accounts

Demo account

The demo account feature at ATFX allows new traders to practice trading until they develop a strategy they feel confident with. This way, they do not risk their money but trade based on the knowledge of the fundamentals and technicalities of the market.

ATFX Fees

ATFX has no commission. Fees change depending on the instruments traded. Generally, however, when trading CFDs on shares, the broker provides some of the most attractive spreads in the market. In addition, ATFX does not charge account inactivity, withdrawal or deposit fees.

Trading accounts

The four different account types offered by ATFX are Micro, Classic, Premium, and Raw. All of the accounts have a maximum transaction size of 20 lots and leverage up to 400:1, but their minimum deposits and spreads are quite different.

| Feature | Micro Account | Classic Account | Premium Account | Raw Account |

|---|---|---|---|---|

| Minimum Deposit | Not specified | $1,000 | Not specified | $10,000 |

| Spreads | From 2.6 pips | From 1.8 pips | From 1.0 pip | From 0.0 pip |

| Leverage | Up to 1:400 | Up to 1:400 | Up to 1:400 | Up to 1:400 |

| Lot Size | From 0.01 | Not specified | From 0.01 | From 0.01 |

| Maximum Trade Lots | Not specified | 20 | 20 | 20 |

| Commissions | None | None | None | Up to $7 per lot |

| One-Click Trading | Yes | Yes | Yes | Yes |

| Chart-Based Trading | Yes | Yes | Yes | Yes |

| Unlimited Open Orders | Not specified | Yes | Yes | Yes |

| Trading Academy Access | No | Yes | Yes | Yes |

| Free VPS | No | No | Yes | Yes |

| Segregated Funds | No | No | No | Yes |

| Newsletter & Analysis | No | No | No | Yes |

Micro account

The Micro Account is designed with beginners in mind and is a great bridge from a demo to a newbie trader.

Key features

- Spreads starting at 2.6 pips

- Leverage up to 1:400

- Lot size starting at 0.01

- No commissions charged

- The ability to trade with one click and from charts

Classic account

The Classic account requires an opening minimum balance of $1,000.

Key features

- Spreads as low as 1.8

- Leverage of up to 1:400

- You can trade with a single click or from charts

- Zero commission.

- Access an unlimited number of simultaneous open orders.

- ATFX Trading Academy access

- Maximum trade lots of 20

Premium Account

Premium account holders can access one-click trading using their charts and trade without commissions. In addition, they have access to a free virtual private server (VPS).

Key features

- Leverage of up to 1:400

- Spreads from 1.0 pip.

- Easy one-click trading and chart-based trading;

- Access to free virtual private servers;

- Commission-free trading;

- Lot sizes starting at 0.01

- The unlimited number of simultaneous open orders.

- Access to ATFX Trading Academy and

- Trade with a maximum of 20 lots.

Raw Account

A minimum of $10,000 is required to open this top-tier trading account on ATFX. This is a good fit for people who usually must keep prices down and need things done quickly with tight spreads.

Key features

- Access to trading academy resources

- Access to newsletters and analyses.

- Trade with a maximum of 20 lots

- Spreads starting at 0.0 pip

- Trade lots start from 0.01

- Trade with leverage up to 1:400

- Trade from charts with one-click support

- Trade with unlimited open orders,

- Segregate your funds.

- Free virtual private server.

- Commissions of up to $7 per lot.

ATFX MAM and PAMM

ATFX Money Manager program enables experienced money managers/master traders to manage funds on behalf of investors. This is done via Multi Account Manager (MAM) and the Percent Allocation Management Model (PAMM).

With MAM, a master trader is able to access and manage their accounts and those of other investors from a central location. On the other hand, PAMM enables investors to have a manager make trades on their behalf with their allocated assets.

These strategies enable fund managers to increase their profit margins, compared to what they would get from single account trades. Terms of trade are varied and may include commissions, spread markups, account currency, performance fees, and margin/call options. ATFX’s low commission, along with tight spreads, allows trade managers to enjoy bigger margins.

ATFX Trading Platforms

ATFX MT4

The MetaTrader4 (MT4) platform allows trading at ATFX and the company provides educational ‘how-to’ videos and interactive webinars for platform usage. The virtual demo account with $50,000 virtual money allows beginners to practice using MT4 without risking their funds. MetaTrader 4 stands as one of the world’s most reliable trading platforms which provides its users with numerous advanced trading tools and features. The site provides users with more than 30 indicators and chart analysis tools and expert advisors (EAs) among its numerous trading tools.

ATFX MT5

The ATFX MetaTrader 5 (MT5) trading platform is designed to allow traders to trade the financial markets with ease and precision. The MT5 is a good fit for both new and professional traders, and it comes with an intuitive interface and advanced charting tools. Also, it allows users to personalize their trading experience by changing things like display options, chart types etc.

ATFX Spreads

A spread is the difference between the buying price (Bid) and selling price (Ask) of a currency pair. In the forex market, this difference is measured in units called “pips.” Wide ATFX spreads are typically found in less liquid markets, such as in exotic currency pairs and times of high volatility. On the other hand, tight/narrow spreads are associated with highly liquid markets and major currency pairs. ATFX spreads are detailed in the table below:

| Product | Name | Minimum Spreads | 1:400 Accounts | 1:200 Accounts | Lots Size (Min/Max) | Contract Size |

| EURUSD | Euro/US Dollar | 1.8 | 250 USD | 500 USD | 0.01/30 | 100,000 EUR |

| USDJPY | US Dollar/Japanese Yen | 2.0 | 250 USD | 500 USD | 0.01/30 | 100,000 USD |

| GBPUSD | Great Britain Pound/US Dollar | 2.0 | 250 USD | 500 USD | 0.01/30 | 100,000 GBP |

| USDCHF | US Dollar/Swiss Franc | 2.2 | 250 USD | 500 USD | 0.01/30 | 100,000 USD |

| AUDUSD | Australian Dollar/US Dollar | 2.5 | 250 USD | 500 USD | 0.01/30 | 100,000 AUD |

| NZDUSD | New Zealand Dollar/US Dollar | 2.5 | 250 USD | 500 USD | 0.01/30 | 100,000 NZD |

| USDCAD | US Dollar/Canadian Dollar | 2.5 | 250 USD | 500 USD | 0.01/30 | 100,000 USD |

Depositing funds to an ATFX account

Below are the steps you should follow to fund your trading account:

1. Log into your protected client portal, which is accessible via the homepage.

2. Click on the “Deposit” button.

3. Choose your preferred option between “Bank Wire Transfer” and “Deposit Online” as your deposit method. Note that the “Deposit Online” option refers to deposits made using e-wallets or credit/debit cards.

4. Pick the mode of payment that best suits your needs and follow the on-screen prompts.

There are a number of ways to fund your account, including:

- Using Visa or Mastercard: This option gives you free deposits and withdrawals, but deposits must be at least $100 USD. Deposits are executed instantly, but withdrawal processing time will depend on your bank.

- Using Neteller or Skrill: This option also gives free deposits and withdrawals, and deposits must be at least $100 USD. With this option, withdrawals and deposits are processed instantly.

- Bank Transfer: Withdrawals and deposits are free. However, there might be some transaction charges imposed by your bank fee. With bank transfers, the processing time for both deposits and withdrawals is three to seven business days.

Trading Tools

ATFX has partnered with Trading Central & Autochartist. Trading Central is one of the foremost market analysis companies in the world. Trading Central provides analysis covering Forex, commodities, indices, and precious metals based on expert data.

Also, ATFX gives all its customers free Autochartist access. Autochartist has in-built capabilities that enable it to recognize patterns in charts and important price levels across all main markets, including foreign exchange and contracts for difference (CFD) instruments.

Furthermore, ATFX recently integrated PriceOn™ from TraderTools. The tool uses AI-driven algorithms to enhance the trading experience by bringing superior pricing and execution. Ultimately, it is built to bridge the gap between institutional and retail trading experience, while improving profitability.

ATFX Introducing Broker Program

ATFX runs an affiliate program, known as the ATFX Introducing Broker (IB) program. Using network and forex knowledge, the IB program enables users to earn passive income and earn commissions. The platform has a dedicated support system and users gain by acting as middlemen who assist customers in accessing the tools and resources required to trade effectively and offer professional guidance.

ATFX Copy Trading

ATFX CopyTrade feature is a powerful tool that allows inexperienced traders to borrow the trading strategies of expert traders. It is also quite useful when you have a busy schedule, and you want to keep trading successfully but can’t find the time to research the markets and analyze trades. There are two types of accounts involved in copy trading: a “Provider” account for the expert trader who provides the trading signals and a “Follower” account for the one copying trades.

To join the ATFX CopyTrade platform as a Follower, all you need to do is link your account to the expert account. Alternatively, if you are a professional trader, you can sign up as a Provider. In return, you get to earn a percentage of profits made by traders who copy & follow your trading strategy.

The ATFX CopyTrade dashboard ranks all the providers based on their earnings, risk profile, and win rate, making it easy for followers to choose their preferred copytrade providers. ATFX CopyTrade services are available in Asia, Latin America and the United Arab Emirates.

Client Funds Insurance

Things can go wrong in the world of trading, beyond making losses in your positions. Therefore, it is always important to cushion yourself against unforeseen circumstances that may befall a broker.

In view of this, ATFX signed a Client Funds Insurance with Lloyds of London, offering client fund protection valued at up to $1,000,000 per claimant. This ensures that clients’ funds are safeguarded at all times and that there’s a proper mechanism for compensation in case of third-party risks.

ATFX Educational Resources

ATFX offers its clients multiple educational resources to help them sharpen their trading skills. On the ATFX website, you will find free e-books, in-depth trading courses, MT4 and MT5 platform guideline videos, trading strategies and more.

The company also holds periodic webinars and seminars for its clients. Furthermore, it publishes several market analysis articles covering trading strategies, financial events, market news, and insights. Other useful sources of information include the Economic Calendar, the Earnings Season Calendar, and the Trader Magazine, which is a quarterly publication.

Customer Support

ATFX customer support is available 24 hours a day, five days a week, by phone, email, or live chat. It offers support in multiple languages, including Arabic, Dutch, English, Hindi, Vietnamese, Spanish, Thai, Chinese, Portuguese, and Korean.

ATFX versus other brokers

On the table below, we conduct ATFX Review against two other brokers, Exness and IG:

| ATFX | Exness | IG | |

| Licencing Financial Regulatory Bodies | MasterCard and Visa Credit/Debit Cards, Neteller, Skrill, and Bank Transfers | FCA (UK) Financial Services Authority (Seychelles), Financial Services Commission (Mauritius) Capital Markets Authority (Kenya) Financial Sector Conduct Authority (South Africa) Financial Services Commission (British Virgin Islands) Central Bank of Curaçao and Sint Maarten | FCA (UK), ASIC (Australia), Monetary Authority of Singapore (MAS), Dubai Financial Services Authority (DFSA), Financial Sector Conduct Authority (South Africa), Bermuda Monetary Authority. |

| Forex pairs supported | 43 | 100+ | 80+ |

| Markets | Forex CFD Commodities CFD Share CFD Indices CFD Crypto CFD (South East Asia and Latin America) | Forex CFD Commodities CFD Share CFD Indices CFD Crypto CFD | Forex CFD Commodities CFD Share CFD Indices CFD Crypto CFD |

| Trading Platforms | MT4, MT5, Mobile | MT4, MT5, Exness Trade App (mobile), Exness Terminal (web) | MT4, ProRealTime, Mobile App |

| Minimum Deposit | $100 | $10 for Standard Account $500 for Professional Account | $50 For Card, $0 For Bank Deposit |

| Commission Charges | NO | No Commissions on Standard, Standard Cent and Pro accounts. Commission charged on Raw Spread (up to USD 3.5 per lot per one direction) and Zero Account (from USD 0.2 for one side per lot) | Fees built into the spread For every shares CFD trade, you’ll pay a commission instead of a spread. |

| Deposit/ Withdrawal options | $10 for a Standard Account $500 for Professional Account | Credit/debit cards, global electronic payment systems, and local payment methods, depending on your region | Bank transfer, Credit/debit cards, PayPal |

| Spreads | From 1.8 pips on EUR/USD pair | From 0 pips on Raw Spread and Zero Accounts and from 0.1 Pips on Pro Account | From 0.6 on key FX pairs, 0.8 on major indices, and 0.3 on commodities. |

| Demo Account | Yes | Yes | Yes |

| Customer Support Hours | 24/5 (Monday-Friday) | 24/7 | 24/5 (Monday-Friday) |

| Website Languages | Arabic, Dutch, English, Hindi, Vietnamese, Spanish, Thai, Chinese, Portuguese, and Korean. | English, Thai, Chinese, Vietnamese, Arabic, Bengali, Hindi, Urdu and Kiswahili | English, Chinese, German, French, Italian, Arabic and Japanese. |

Are ATFX Scammers?

They say that the best form of flattery is imitation, and scammers know this all too well. If you Google words like “Is ATFX a scam?” or “ATFX scammer,” then you will have quite a number of hits on your search results. However, as shared above, ATFX is headquartered in the UK, where it is authorized and regulated by the Financial Conduct Authority (FCA). Also, it has won reputable international awards for quality customer service in different categories across the globe.

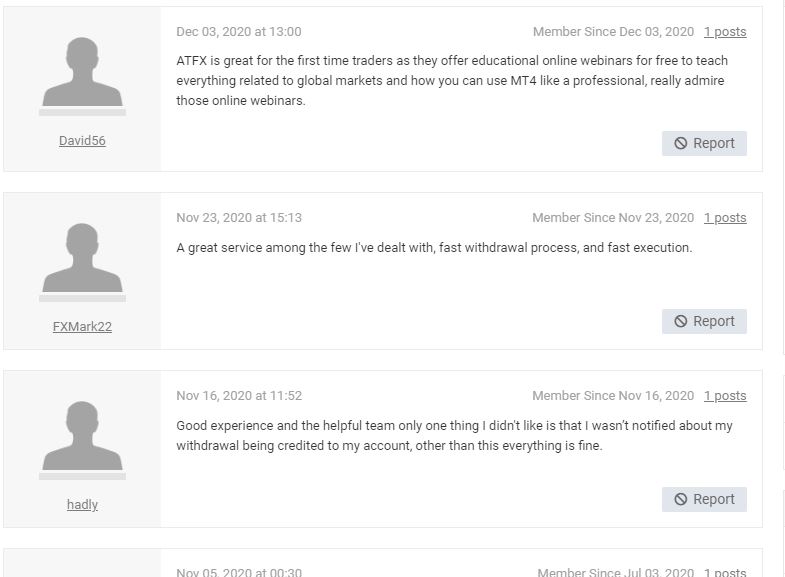

Therefore, if you have come across claims of scams on ATFX review sites out there, you might want to retrace your footsteps because you can be sure that you weren’t scammed by ATFX but by imposters. A number of ATFX review complaints are from people who were scammed by imposters. However, a look at customers who have been served by actual ATFX platforms has good testimonials. Be it ATFX review India, ATFX review Philippines, ATFX review Malaysia, ATFX review Vietnam, or a review of any other market, you hardly come across a client who complains of having been scammed by the true ATFX trading platforms. Well, there might be a few complaints regarding service experience, but none are about scamming.

ATFX Reviews on MyFXBook.com

Back in 2022, FCA placed a public notice warning that fraudsters are using the details of firms authorized by the regulator to steal from them. Known as “clone firms,” these imposters typically contact unsuspecting investors/traders out of the blue. They are often happy to share the credentials of the legit firm, such as the firm reference number (FRN). However, they are smart enough to blend legitimate details with fake ones, so it becomes difficult to detect if you are not keen.

By directing customers to the official FCA website, for instance, a clone firm by the name ATFX Global Trading attempted to mislead them into thinking it was the FCA-authorised firm when, in fact, it was attempting to usurp some legal information from AT Global Markets. Also, fake websites such as https://www.atfx.co/ and https://www.atfx.co/ have attempted to fleece money from customers while posing as ATFX. Please note that the official ATFX website is https://www.atfx.com/

In this ATFX review article, we have guided you through the services offered by ATFX, its licenses and its regulatory framework to help you make informed decisions.

Conclusion

In this ATFX Review article, we have seen that the broker is suitable for beginners and experienced traders alike. It is also one of the most reliable brokers in the market and is regulated by multiple regulatory authorities across different regions. From this perspective, clients can confidently trade with the broker without fearing the loss of their funds or unauthorized use of their personal details.

Additionally, it offers a wide range of trading instruments, some of which are not offered by other brokers. ATFX customers can trade in shares, ETFs, CFDs, precious metals, currencies, cryptocurrencies, indices, and commodities. However, adding bonds can further increase the value of its ecosystem.

Overall, ATFX is a reliable broker that is dedicated to offering its clients a platform to trade successfully. Its dealings exude reliability, honesty, and transparency. Furthermore, the broker has won multiple reputable international and domestic awards for quality service and customer support. Additionally, the recent introduction of Client Funds Insurance offers protection and peace of mind to traders.

Note that the information provides on this ATFX review article will be updated periodically as new and relevant information becomes available.