- Summary:

- EURUSD started the day lower today trading at 1.1260 after it failed yesterday to hold the 1.13 that breached after the ECB decision

EURUSD started the day lower today trading at 1.1260 after it failed yesterday to hold the 1.13 that breached after the ECB decision and comments from Mario Draghi. The ECB’s governing council extended the forward guidance by another six months, meaning that rate hikes were no longer seen rising until “at least” mid-2020. Traders following news from the U.S. – Mexican trade conflict, as US President repeat a previous threat to impose tariffs of up to 25% on goods from Mexico. The Eurozone economy expanded by 0.4% on quarter in the three months to March of 2019, matching the previous readout and the expectations, the third estimate showed. On an annualized basis, the Eurozone GDP figure arrived at 1.2%, confirming the previous 1.2% reading while matching the expectations of 1.2%.

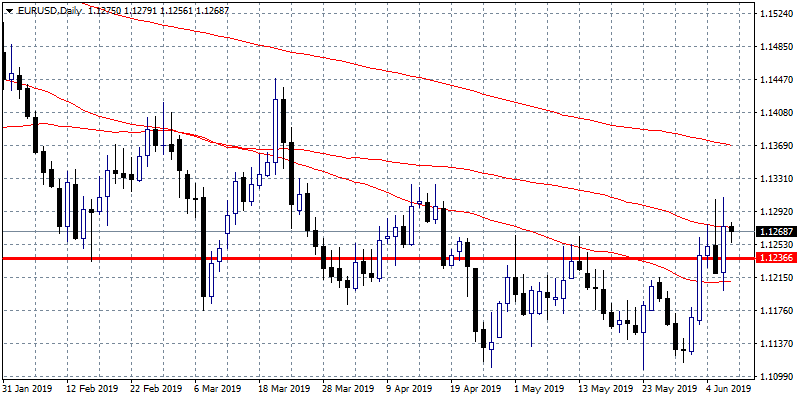

On the technical side, the pair rejected at the 1.13 level and retreated back to 1.1260 area which is just above the lower band of the channel that spend most part of the year (between 1.1236 and 1.15). The pair returns back to the well known range between the 50 and 100 day moving averages. EURUSD will meet strong support around 1.1210 and the 50 day moving average which if breached can open the way for a second test down to 1.1106 yearly low. On the upside first resistance stands at 1.1309 the high from yesterday, and then at 1.1323 the high from April 13th while more sellers will emerge at the 1.1371 the 200 day moving average. Overall the EURUSD picture is positive for the short term.