- Summary:

- Alibaba has seen its stock surge past the $200 price mark in New York's pre-market trading, even as its Black Friday numbers are awaited.

Shares of e-commerce giant Alibaba have surged above $200 in pre-market trading in anticipation of this year’s Black Friday sales.

While there is a growing sentiment that Cyber Monday sales will trump Black Friday sales as was the case last year, things may be different for Alibaba.

The company’s Singles Day (11/11) sales topped $38billion, making it the largest e-commerce daily sales figure ever. Alibaba could top the 8% mark in terms of weekly gains once the Black Friday numbers start to come through.

With its feet firmly planted in Hong Kong after a 5-year wait for its Hang Seng listing, Alibaba considers the city to be the at the centre of its globalized operations under its new Chairman Daniel Zhang. Zhang has just replaced Jack Ma as the company’s chairman, after the latter stepped down from the position in September 2019.

Technical Outlook for Alibaba

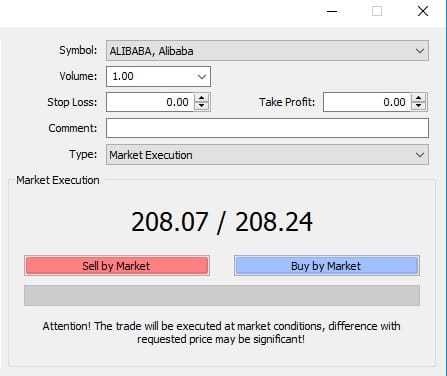

Alibaba is now trading at above $201, riding on the back of a three-day surge which was first prompted by the listing of its shares in Hong Kong.

It has now broken above the channel on the daily chart and is pushing towards previous all-time highs attained on June 12, 2018. However, Alibaba is facing resistance at current levels, with price previously being resisted on March 15 and May 24 at 210.07.

A decisive break above 210.07 is required (either with a price filter or a time filter) so as to open the door towards the attainment of all-time highs at 210.67.

If a breakout move falters at this point and traders decide to start taking profit, then a retest of 195.50 could be in the works. Price was resisted at this price level and reversed hard to the downside, as this was where the measured move from the double bottom of April 5/24.

The upper channel border is expected to intersect this price level sometime in the near future, so this area is expected to be a key test of any pullback moves from current price levels.

Below the 195.50 price level, further support areas are seen at 189.64 and 182.26, in that order.

As the sentiment for Alibaba is currently bullish, the support areas mentioned above could be viewed as possible re-entry spots with which to ride the uptrend to exhaustion.