- Summary:

- Bajaj Finance (NSE: BAJFINANCE) is set to post robust Q4 results, driven by soaring loan growth and stable asset quality.

Bajaj Finance (NSE: BAJFINANCE) is gearing up to release its highly anticipated Q4 results tomorrow. Analysts predict a double-digit rise in profit, driven by robust loan growth and stable asset quality. After a strong rally this year, the stock now faces a critical test: can it meet sky-high expectations and push toward new record highs?

Bajaj Finance Q4 Preview: Key Expectations Driving the Buzz

Market consensus points to a solid quarter for Bajaj Finance. Key expectations include:

- Net Interest Income (NII) is forecast to rise by 25-28% year-on-year, fueled by strong traction across consumer, auto, and SME lending segments.

- Profit after tax (PAT) is expected to grow strongly in double digits, reflecting steady margins and operating leverage benefits.

- Asset quality remains bright, with gross NPAs likely to stay below 1.5%, highlighting disciplined underwriting practices.

- Loan disbursements are projected to surge 20-22% YoY, boosted by festive season demand and growing penetration in tier-2 and tier-3 cities.

If Bajaj Finance meets or exceeds these estimates, it could mark another strong step in its post-pandemic growth trajectory.

Bajaj Finance Stock Analysis: Will Earnings Spark a New Breakout?

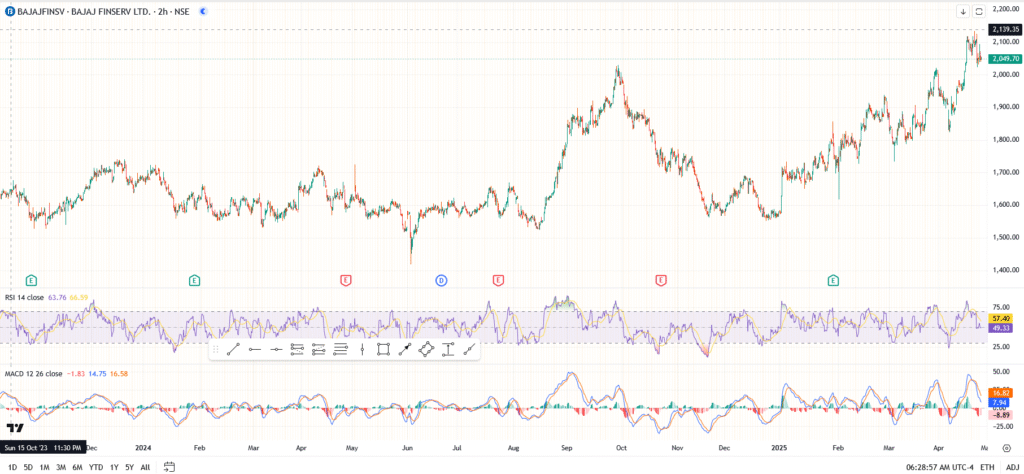

Bajaj Finance stock has been on a tear, rising over 20% year-to-date and outperforming the broader financial sector.

- Support is firmly holding at ₹2,049 — recent dips have been met with aggressive buying interest.

- Immediate resistance stands near ₹2,140 — a clean breakout above this level could unleash upside toward ₹2,200 and beyond.

If earnings go up, Bajaj Finance could rally toward ₹2,200–₹2,250. However, a miss could trigger swift profit-taking back toward the ₹2,000 psychological zone.

Final Outlook: Can Bajaj Finance Keep Its Winning Streak Alive?

With the stock reaching its all-time highs and investor expectations running hot, Bajaj Finance needs a convincing earnings beat to sustain its momentum. All indicators point to a robust Q4 performance.

However, with valuations stretched and market volatility rising, traders should brace for heightened post-earnings swings.