- Summary:

- In this Ethereum price prediction article, we asses, the coin's upside potential above $1,800 amid amid rising institutional interest.

Ether price continues to struggle to reclaimed the $1,800 support despite gaining 13.4% in the last week. The coin was up by 0.7% on the daily chart as of this writing, a small but significant step to keep alive hope of a return to $2k.

BlackRock $54 Million ETH Buy Adds to Upside Traction

Last week was a fruitful one for Ethereum, as its spot ETF performance spiked substantially. Notably, Friday’s trading session saw the nine Ethereum spot ETFs record over $100 million worth of net inflows for the first time in 56 days. At $104.1 million, Friday’s ETF net inflows was the highest in seven weeks. In addition, asset management giant BlackRock bought $54 million worth of ETH coins last week, their biggest purchase in two months.

These developments underscore the likelihood that Ethereum has restored a significant portion of institutional investor confidence that had been lost in the last two months. Also, Ethereum chain’s DeFi TVL rose by 1.5% in the last 24 hours, pointing to increased utility for ETH.

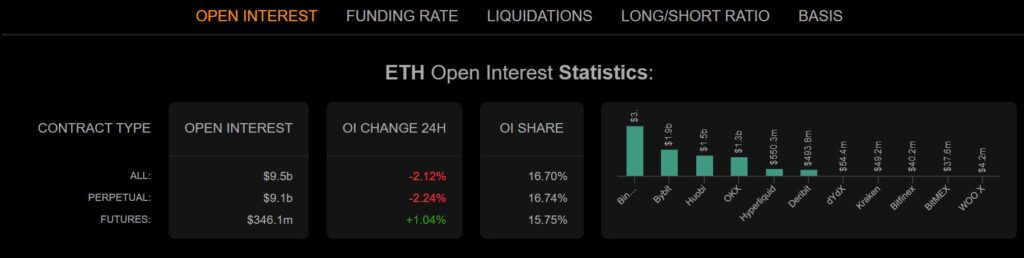

On the downside, however, Ethereum’s trading volume declined by 2.4% in the last 24 hours amid the price gains. In addition, ETH coin’s open interest value declined by 2.07% in the last 24 hours to $9.5 billion. These trends signal declining buying appetite, which will reduce the coin’s upside gains in the near-term.

ETH Open Interest performance. Source: Coinanalyze

Ethereum Price Prediction

As seen on the chart below, the momentum on Ethereum price favours the bulls to stay in control above $1,794. Primary resistance will likely be at $1,820. However, a stronger momentum will clear that barrier and test $1,844.

On the other hand, the sellers will take control if the price breaks below $1,794. In that case, the coin will likely find the first support at $1,765. The upside thesis will be invalid below that level. In addition, such momentum could result in an extended decline to find the second support level at $1,743.