- Summary:

- Bitcoin price has been on an upbeat momentum, gaining 10 percent in the last seven days. Here's why the bullishness is here for a while.

Bitcoin price has risen to eight week highs of $94,540 amid improved market outlook around US trade tariff negotiations. The crypto market bellwether is up by 10% in the last week, and is on course to register its biggest weekly gain since November 2024. In addition, BTC price trading volume has risen by 60% in the last 24 hours, signaling that the momentum is likely to stay on the ascending trajectory in the near-term.

Investor Confidence Rises as Risk Sentiment Thaws

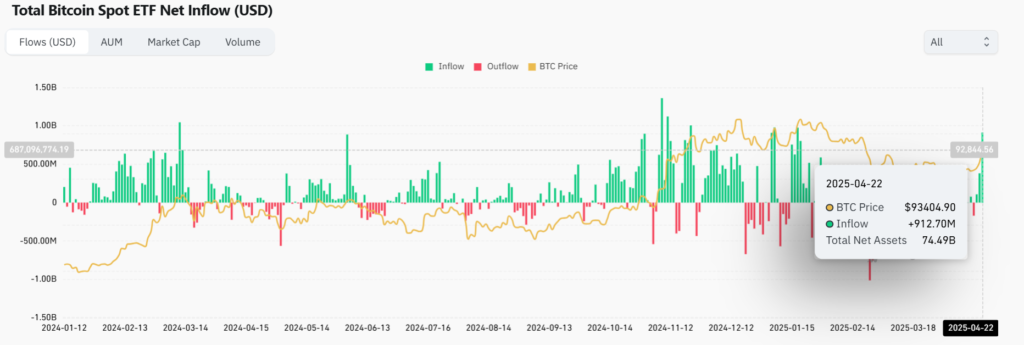

Tuesday saw the largest single-day inflows of Bitcoin spot ETFs since mid-January, underlining strong institutional appetite and adding credence to the likely continuation of gains by BTC price. The nine out of the eleven traded ETFs reported net positive inflows for a combined $912.7 million worth of purchases.

Bitcoin spot ETF. Source: Coinglass

US President Donald Trump has injected confidence in the market after stating that trade tariffs against China could come down significantly from their current 145% in the coming days. That has reduced risk aversion in the markets and seen investors increase their exposure to highly volatile assets like cryptocurrencies.

Meanwhile, the CoinMarketCap Fear and Greed Index moved out of the Fear reading for the first time in 58 days, in line with the rising investor confidence. A continuation of that sentiment will support continued gains by Bitcoin price.

Bitcoin Price Prediction

Bitcoin price pivot mark is at $92,980 and the buyers will be in control if the price action stays above that level. The upward momentum will likely meet the first barrier at $94,465. However, a stronger momentum will break above that level will signal a stronger momentum that could test $95,945.

On the other hand, going below $92,960 will shift the momentum to the downside. In that case, the first support will likely be at $91,715. The upside narrative will be invalid below that mark. In addition, an extended control by the sellers could send BTCUSD lower to test $90,120.