- Summary:

- IAG share price rebounds after 12% drop—key resistance at 311.1p. Will bullish momentum continue,or is more downside ahead?

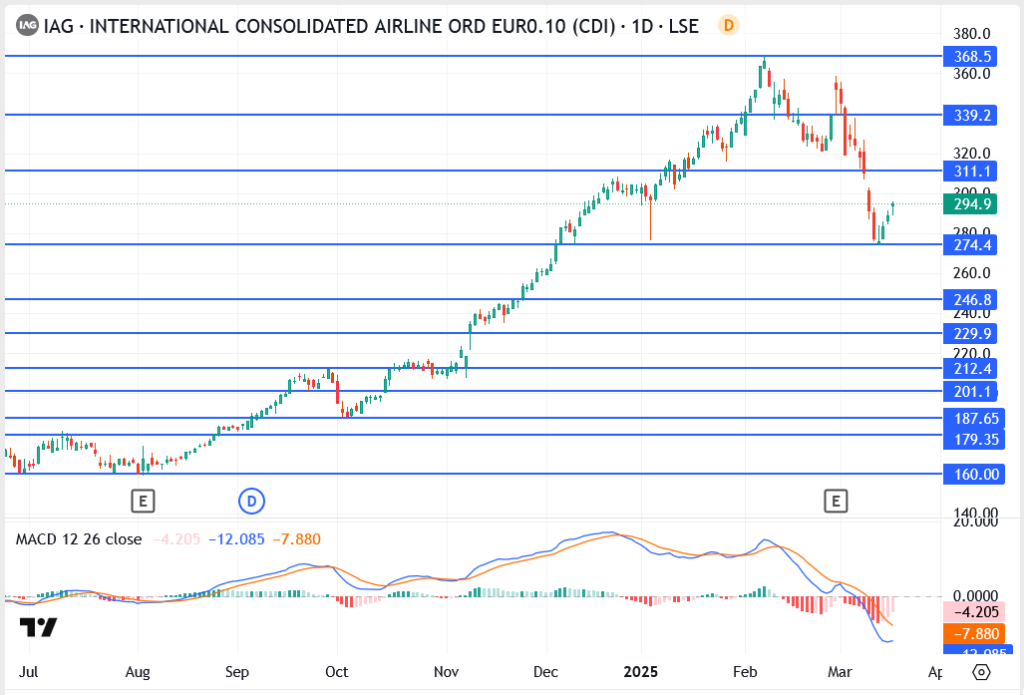

The IAG stock price is trading around 294.9p, rebounding from last week’s low of 274.4p. The stock declined by over 12% in the past month, reflecting broader market concerns, but has shown early signs of recovery. The recent bounce from key support levels suggests traders are reassessing their positions, with upcoming economic data and earnings likely to be pivotal.

Technical Analysis – Key Price Levels to Watch

- Resistance Levels:

- 311.1p – Immediate resistance; a breakout could indicate renewed bullish momentum.

- 339.2p – Strong technical barrier aligned with previous highs.

- 368.5p – A rally past this level could confirm a long-term uptrend.

- Support Levels:

- 274.4p – Short-term support; holding above this could sustain the recovery.

- 246.8p – Critical level to watch if selling pressure resumes.

- 201.1p – A major downside level if bearish sentiment intensifies.

Fundamental Outlook – Industry and IAG’s Position

Despite short-term volatility, IAG has delivered strong earnings, with 2024 full-year profits exceeding expectations. The company’s share buyback program, improved operational efficiency, and increasing passenger load factor signal confidence in long-term growth.

However, challenges remain, including rising operational costs, inflationary pressures, and interest rate uncertainties that could impact consumer travel spending.

Investment Perspective – Is IAG a Buy?

For long-term investors, IAG’s current price levels may offer a compelling entry point, especially if the airline sector continues its post-pandemic recovery. Short-term traders should focus on technical breakouts, keeping an eye on macroeconomic data that could influence sentiment.

Conclusion – IAG Stock Outlook

The IAG share price today suggests that the stock is at a pivotal stage. A confirmed breakout above 311.1p could mark the beginning of a new bullish phase, while a failure to sustain support at 274.4p might lead to further downside. Investors should remain attentive to industry trends, earnings reports, and macroeconomic shifts before making decisions.