- Summary:

- Bitcoin price has declined by six percent in the last week amid FUD sentiment caused by tariff wars. Here's why a reversal is imminent.

Bitcoin price has had a torrid run in recent days, losing 6.3% in the last week. The decline is not asset-specific to BTC, but is widespread across the broader cryptocurrency market. Digital coins’ market capitalisation has declined by about $500 billion in the last seven days.

Bitcoin Price Primed For A Strong Reversal With 128k Target

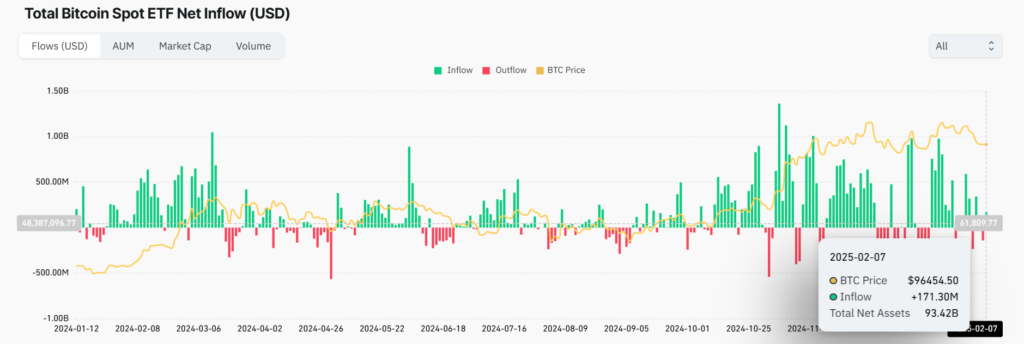

The market decline is attributed to Fear Uncertainty and Doubt (FUD) sentiment triggered by fears over brewing global trade tariffs war. That has seen investors reduce their exposure to high-risk assets like cryptocurrencies. This sentiment is reflected in the US spot ETF markets.

According to data from Coinglass, the spot Bitcoin ETFs registered $140 million in outflows on Thursday. However, there was a significant reversal to $171.30 million worth of inflows on Friday. A continuation of that trend could provide support to Bitcoin price in the new week.

Also, BTCUSD has broken upwards on the monthly chart after previously forming a bullish cup-and-handle pattern. Using the cup’s depth as the yardstick to measure the price target suggests that BTC price could rise to highs of $128,752 in the next few months. That translates to a 34% upside on the current price.

Meanwhile, Bloomberg reported this week that BlackRock, the world’s largest asset manager, intends to launch a Bitcoin Exchange Traded Product (ETP) in Switzerland. That comes on the back of a strong debut year for Bitcoin ETFs in the United States, in which $40 billion USD worth of inflows were recorded. It affirms strong institutional interest in Bitcoin, amid a crypto-friendly administration at the White House.

Elsewhere, Maryland became the 17th state in the US to file a motion for the establishment of a strategic Bitcoin reserve. Earlier this week, President Donald Trump’s crypto czar, David Sacks hinted in an interview that Bitcoin could form part of the United States’ sovereign wealth fund. According to the White House, the Trump administration intends to establish a $5.7 trillion sovereign wealth fund geared towards growing the economy, improving fiscal responsibility and reducing taxes.

Bitcoin Price Near-Term Prediction

Bitcoin price pivots at $97,010 and resistance at that level signals control by the sellers. Immediate support will likely be at $95,250. However, an extended downward momentum will break below that level and target the second support at $94,040.

On the other hand, breaking above $97,010 will signal a shift by the momentum to the upside. The first resistance is likely to be at $98,415 in that case. Breaching that level will invalidate the downside narrative and potentially test $99,735.