Silver is having a moment, and it’s a big one. As of January 29, 2025, the shiny metal has surged to $36.000, a level that’s turning heads across the investment world. The XAG/USD pair has been on a wild ride, and the trend shows no signs of slowing down. Let’s break it all down—what’s driving this rally, and what’s next for silver?

Silver Price Technical Analysis

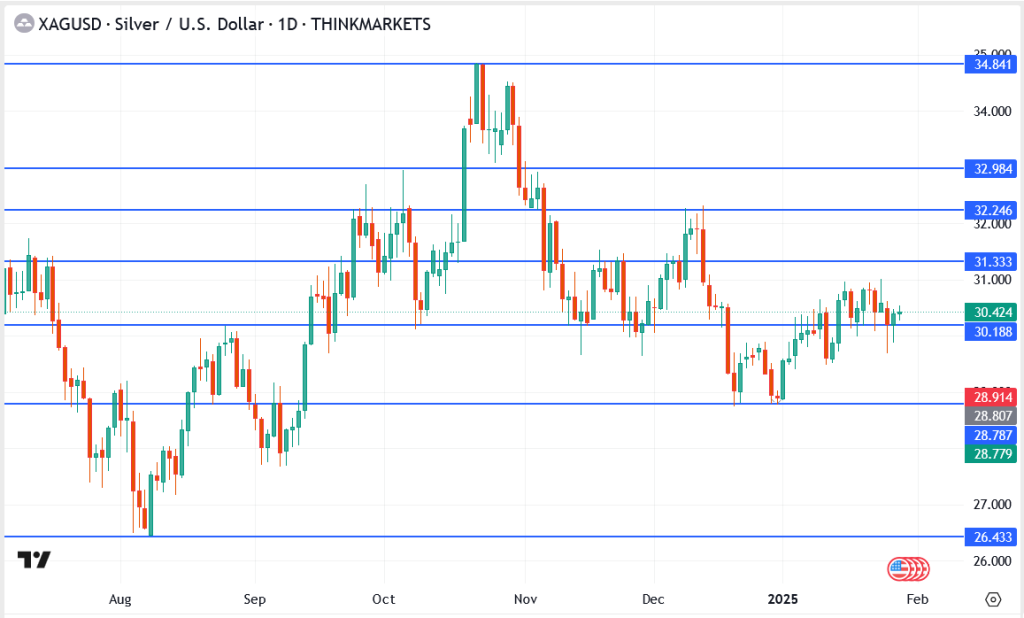

Silver’s daily chart shows a consolidation phase just above key support levels. Bulls must clear $31.33 to extend the rally, while a break below $30.18 could trigger a pullback.

Silver Key Levels to Watch

- Resistance:

- $31.33 – Immediate hurdle for bulls

- $32.25 – Next upside target

- $32.98 – Strong resistance zone

- Support:

- $30.18 – Holding above keeps bullish momentum intact

- $28.91 – Major downside level

The Relative Strength Index (RSI) remains neutral, suggesting neither overbought nor oversold conditions.

Silver Price Outlook

Silver finds itself in a tug-of-war between buyers and sellers, with $31.33 serving as a rigid ceiling and $30.18 establishing a firm floor. Should bulls succeed in surpassing $31.33, silver may attempt to reach $32.25 and further. However, if sellers gain the upper hand and drive the price below $30.18, a decline to $28.91 wouldn’t be unexpected.

Currently, silver is in a holding pattern, and traders need to monitor these critical levels closely. The upcoming major shift might be imminent—prepare for activity!