- Summary:

- Silver prices climb as CPI data fuels hopes for a Fed rate pause. Falling bond yields and a weaker dollar also boost XAG/USD,

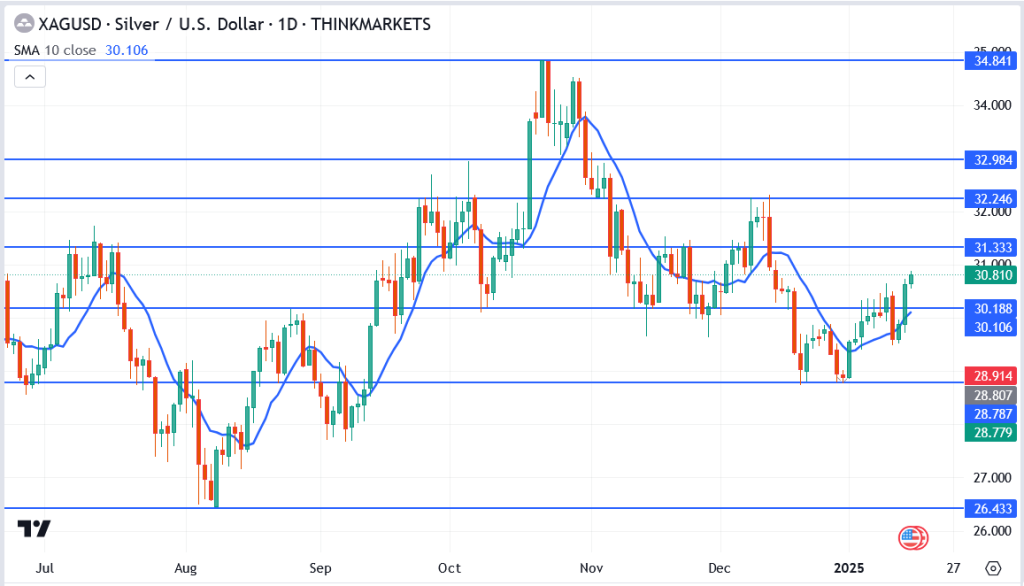

Silver prices (XAG/USD) are trading higher today, hovering near $30.81 as market participants assess U.S. inflation data and bond yield movements. The metal’s upward trajectory comes amid a broadly weaker U.S. dollar and renewed safe-haven demand.

Inflation Data Drives Silver Higher

Investors are paying attention to the recent CPI figures, suggesting moderate inflation and boosting optimism for a halt in Federal Reserve interest rate increases. This has increased the demand for silver, driven by falling U.S. Treasury yields—reducing the expense of maintaining non-yielding assets—and a weaker dollar, which makes silver more attractive to international purchasers.

Technical Analysis: Key Levels to Watch

Here’s a breakdown of critical support and resistance levels:

- Immediate Resistance:

- $31.33: A breach of this level could open the door to $32.24 and $32.98 in the short term.

- Support Levels:

- $30.18: First line of defense for bulls.

- $28.91: A drop below this could signal further downside.

- Bullish Outlook: The metal remains well-supported as long as it stays above $30.

Market Outlook

Silver’s performance this week suggests renewed optimism among investors, driven by inflation expectations and macroeconomic uncertainties. With CPI data shaping the Federal Reserve’s policy trajectory, silver could attract more buyers if rate hikes are delayed or paused altogether.

Final Thoughts

Silver is proving its strength as investors navigate a whirlwind of economic uncertainties. With inflation concerns and a potential Fed pause on the horizon, the metal is catching the eye of traders seeking stability. If prices push past $31.33, silver could shine even brighter, marking the start of an exciting new chapter in its rally. As the markets unfold, all eyes remain on silver’s next move.