- Summary:

- Cardano price has been on a three-day winning streak, but the momentum seems to be waning near the $1.20 inflection point. Will ADA overcome?

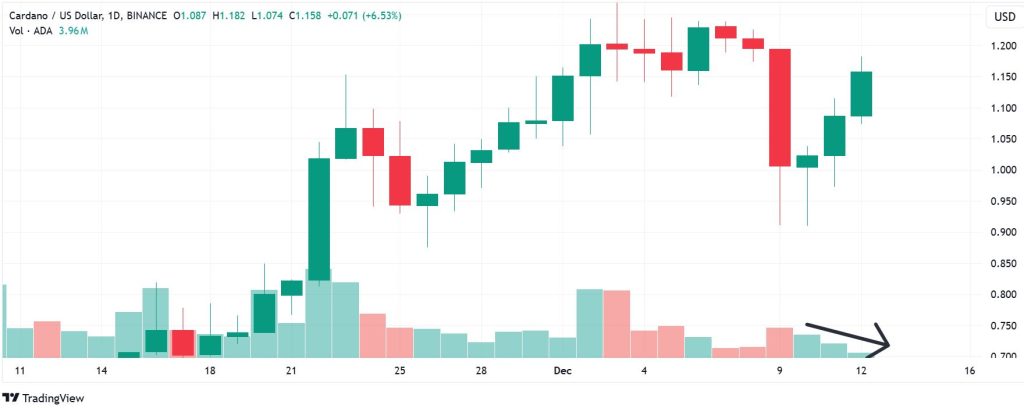

Cardano price shot up on Thursday, trading at $1.17 at the time of writing after gaining 7%. The move mirrored the resurgence by the wider crypto market, underlined by Bitcoin’s return above $100k. ADA price broke upwards two days ago, with a reversal near the psychological $1 mark. However, the coin is marginally below the $1.20 mark, the level below which it confirmed a bearish three days ago.

ADA price signals weak momentum

Despite its resurgence, ADA price could come under pressure due to decreasing trading volume. As seen on the chart below, the asset’s traded volume has been on a decline, signaling a potential weakening of the upward momentum near the $1.20 barrier.

Also, whale transactions have declined significantly in recent days. According to IntoTheBlock, the number of transactions valued at $100k or higher have declined from 2,064 to 1,229 in the last seven days. That points to declining investor confidence in the coin’s near-term potential.

Furthermore, Cardano chain’s DeFi performance declined significantly in the last week. According to DeFi analytics site, DeFiLlama, Cardano’s TVL went down by -1.83% in that period. However, the last 24 hours have seen it register some gains, with a +6.2%. However, Cardano’s $658 million DeFi TVL is a drop in the ocean relative to the total market TVL of $137 billion.

Cardano price prediction

Cardano’s price pivots at $1.15, and the upside will continue if the price action stays above that level. The bullish momentum will likely encounter the first resistance at $1.18. However, an extended control by the buyers could break above that level and test $1.20. Breaking and holding above $1.20 may signal a stronger upward potential.

On the downside, ADAUSD is likely to find initial support at $1.14. If the momentum strengthens, it could break below that level and invalidate the upside thesis. Also, the decline could extend and test the second support at $1.12.