- Summary:

- Ethereum price has extended its decline below the the USD 4,000 mark, and multiple on-chain data signal bearishness.

Ethereum price broke to the downside on Monday, signaling rejection at the $4,000 mark. ETH had been trading sideways in the last three sessions within small margins of $4k, and a breakout to the downside could be the onset of a consolidation. ETH price rose 30% in the last month, and momentarily spiked to near three-year highs of $4,097 on Friday.

Ethereum price sentiment turns sour

With Bitcoin struggling to break above $100k, the rest of the crypto market picked the cue over the weekend, halting the recent altcoin rally. As of this writing, IntoTheBlock data shows that 94% of ETH holders are “In the Money”. Therefore, the onset of a price decline could trigger a selloff from profit-taking, which could add to the downward pressure on Ethereum price.

Meanwhile, CoinMarketCap data shows that the 24-hour trading volume spiked by 35% in the last 24 hours. A rise in an asset’s trading volume during a price downturn signals bearishness, as more investors are most likely selling.

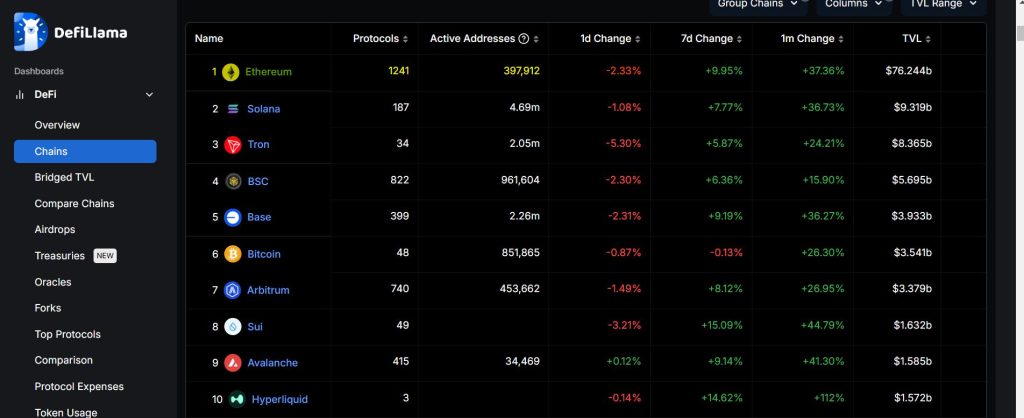

Similarly, the number of whale transactions (transactions valued at $100k or more) dropped significantly in the last seven days from 9,872 to 5,369. That signals winning investor confidence in Ethereum price in the coming days. Furthermore, Ethereum chain’s DeFi TVL declined by 2.33% in the past 24 hours. That signals declining utility for ETH, which adds downward pressure to the price.

Ethereum price prediction

Ethereum price pivots at $3,890 and resistance at that level will favour the sellers. With the sellers in control, the price will likely move to the first support at $3,860. However, if the downward momentum extends, the price could break below that level and test $3,840.

Conversely, moving above $3,890 will signal the onset of bullish control. The upward momentum will likely encounter the first barrier at $3,900. Breaking above that level will invalidate the downside narrative. Also, the momentum could extend gains to take on the second resistance at $3,940.