Tesla (NASDAQ: TSLA) shares have fallen sharply in 2024, and trade below $200, as of this writing. At $183, it has risen by 14.3% from its year-to-date low of $160.51, which was recorded on March 14th. Nonetheless, it is still 26% lower than its year-to-date high of $248. The EV stock finds itself in murky waters on stiff competition from Chinese companies, underlined by price wars. Morgan Stanley revised downwards TSLA outlook in mid-march 2024, with its analyst cutting earnings projection by 25%. Also, Q1 of 2024 seems to be an antithesis of Q1 2023, which saw a surge in delivery numbers.

TSLA share price is still below 200-SMA and could head lower if the bearish sentiment surrounding China’s EV market continues to grow. The cutthroat competition from EV manufacturers in China has seen BYD cut the price of its cheapest EV, Seagull by 5%. Furthermore, BYD surpassed Tesla as the world’s largest EV seller in the last quarter, selling 526,000 units versus the American company’s 484,507 units.

Tesla’s 2024 was foreshadowed by its weak performance in the fourth quarter of 2023. Despite seeing its deliveries rise by 20% year-on-year, the automaker saw only a 1% rise in revenue. This was reflected in the decline in gross revenue by 23% year-on-year, to $4.4 billion.

At its current price, TSLA is just about 4.7% lower year-on-year. However, the prolonged economic tightening concerns could weigh down on the company’s sales, and the outlook might flip bearish soon.

Tesla Stock Latest News

Step aside Tesla Cybertruck, enter Full Self Driving (FSD) Beta v12 , a software built with fully autonomous driving capabilities, including steering, accelerating and braking for other vehicles and pedestrians within its lane. Tesla CEO Elon Musk announced on March 26th that the company would offer its North American customers a free test on its FSD for a month. The announcement saw TSLA share climb more than 5% in the hours that followed, with more upside anticipated.

The software is prized at $12,000 a piece, but Tesla owners have the option of choosing a monthly subscription option ranging between $99-$199. The groundbreaking technology is touted for its safety-focused approach and the convenience it promises car owners. Furthermore, Musk has ordered that all prospective customers be offered demos on the software’s use.

The FSD v12 Beta had been on trial mode for a long period, with its deadlines pushed forward multiple times. Therefore its official launch is likely to bring the mojo back to TSLA, and could see shares rise significantly in the coming weeks.

Meanwhile, Tesla begun deliveries of the much-awaited futuristic cybertruck EVs in December 2023. The vehicle will come in three models-the All-Wheel Drive and Cyberbeat, coming out in 2024; and Rear-Wheel Drive, available in 2025.

According to the latest reports, Tesla Inc. is considering investing in the establishment of a new factory in India. The EV giant may invest $2 billion in the emerging economy. The same reports also suggest that the first made-in-India car may cost as low as $20,000. Tesla has been constantly lowering its prices in different regions since the start of 2023. While this has improved the company’s sales, the profit margins have also taken a big hit.

Tesla Deliveries Forecasts

Tesla delivered its highest quarterly figures in Q4 of 2023 when it sent out 484,507 vehicles worldwide. However, that figure is expected to decline to 474,000 in the first quarter of 2024, as competition in the EV market tightens. A decline in delivery figures could be reflected on its earnings down the line.

Tesla Sales Decline In China

As per the recently released stats, Tesla insurance registrations stood at 116,400, with less than a week to the end of Q1 of 2024. That is about 5% lower than the first quarter of 2023. The company is seemingly struggling to meet its delivery targets in 2024 amidst heightened competition from Chinese EV manufacturers. In the latest development, it cut its China factory production days from 6.5 days to 5 days a week.

Tesla Price Cuts 2024

In its efforts to boost sales, Tesla has already slashed car prices multiple times in 2023. Although the price cuts vary depending on the region, on average, Model S and Model X prices have been lowered by a few thousand dollars. In March 2023, the company announced a 5.2% and 4.3% discount on Model S all-wheel drive and Plaid models, respectively.

The company expects to start selling sub-$25,000 vehicle in 2025, and this could boost its sales numbers substantially. However, while the price wars might attract more buyers, they may result in reduced profit margins in the near term.

The company also cut prices in China in Q4 of 2023. It slashed the price of Model 3 BY 13.5% to 229,900 yuan, while Model Y dropped by 10% to 259,900.

Tesla Price War

Elon Musk’s electric car maker has also revised its prices in its two leading markets in recent times. In the United States, customers who trade in their old vehicle for a new Tesla by March 31 2024, will receive 5,000 free Supercharging miles. In February, the company offered a discount of $1,000 on its Model Y rear-wheel drive and Model Y Long Range.

In China, the company announced incentives worth about $4, 800 for customers buying existing stocks of Model 3 sedans and Model Y SUVs.

Another notable Tesla stock news was Bill Miller, a legendary investor is shorting Tesla. He warned that he would continue shorting the stock if it made more positive moves. His rationale was that Tesla was highly overvalued as it was valued at a higher valuation than the other five auto companies like General Motors, Ford, and Toyota.

What is the Tesla market cap?

The falling share prices have precipitated Tesla’s fall from the top 10 ranked companies globally by market capitalisation. The company has shed more than $220 billion worth of its value since the year began, and this could create a negative sentiment around it. There are currently 3.18 billion total outstanding shares of Tesla in the market. Multiplying the current Tesla stock price of $183 with the total outstanding shares gives a Tesla market cap of $581 billion.

Elon Musk Tesla ownership

What is Elon Musk’s net worth?

According to Bloomberg, despite liquidating some of his stake in the EV maker in the past, Elon Musk still holds 172.6 million Tesla shares. This puts the tech billionaire’s Tesla stake at 17%. At the current price of Tesla stock, this amounts to $96 billion worth of stock.

The recent surge in Tesla market cap has once again made Elon Musk the richest man in the world. According to reports, Elon Musk currently owns 172.6 million shares of the company, which translates into a 17% stake in the company.

He also has billions of dollars in cash, which he made by selling his stock last year. Notably, he has an interest in SpaceX. Elon Musk’s net worth is estimated to be over $197.7 billion, making him the third richest person globally. He has also taken loans against his shares to acquire Twitter.

Musk Donates Tesla Shares

Elon Musk has recently disclosed a Tesla stock (NASDAQ: TSLA) donation that he made in 2022 to a charity. According to the latest filing to the US regulator, the tech billionaire donated $1.95 billion in Tesla stock to charity in 2022. However, the name of the charity recipient, who received around 11.6 million shares, hasn’t been revealed.

Recently, Tesla has taken a step back from its plans to produce batteries in Germany. Instead, the EV maker will carry out the same production at its US facility due to favorable tax incentives. The discarded German battery facility was to be founded in Brandenburg, Germany.

Tesla Share Price History

Tesla launched its initial public offering in 2010. When it went public, the Tesla stock price was trading at a split-adjusted rate of $5. Since then, the TSLA stock has jumped by more than 28,000%, making it one of the best performers in the market.

While the long-term performance of the TSLA share has been good, the journey to the top has not been smooth. As shown below, the stock declined by 38% within a few months in 2015. Similarly, it then dropped by 56% within a few months in 2019. At the time, Elon Musk even warned that he had the funds secure to take the company private.

Is Tesla a good investment?

Tesla is a highly divisive company. On the one hand, there are die-hard fans like Cathie Wood who believe that the company will do well and thrive in the future. On the other side, there are analysts and investors like Scotty Kilmer and Bill Miller who believe that the promised future of EVs is only a mirage. He believes that there will be no mass demand for the company.

From a fundamental perspective, Tesla is no longer a good investment because of its valuation and competition. The company is valued at over $350 billion while companies like Toyota and Volkswagen are valued at less than $200 billion each. GM and Ford are valued at less than $50 billion. Therefore, it is hard to justify the company’s valuation.

Further, the company is facing significant competition from incumbent companies like GM and Ford and upstarts like Rivian and Lucid. Rivian and Ford are its biggest threats because it has still not launched its truck product. Also, it is unclear whether the company’s truck will be successful since it seems like a relatively niche product.

Further, high interest rates will make Tesla’s products unaffordable even with the incentives in the Inflation Reduction Act.

On the other hand, proponents say that Tesla has a strong market share in the EV industry, a strong supercharger network, and a loyal fanbase.

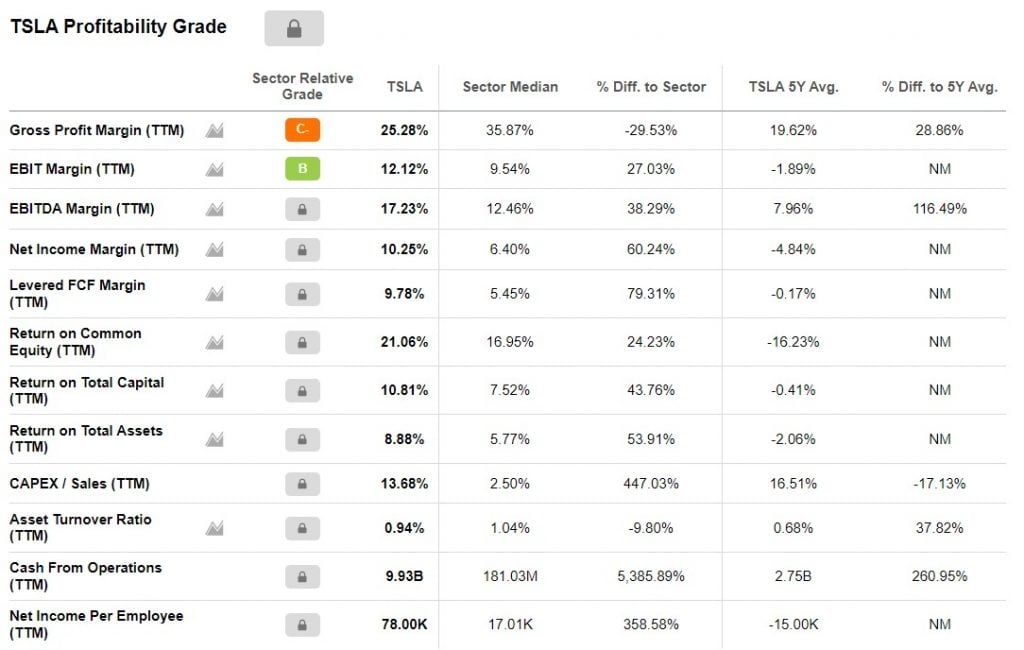

Is Tesla profitable?

A few years ago, there were concerns that Tesla would never be a profitable company. This view has changed recently when the company started making strong profits. It has a net income margin of 10%, which is expected to grow as it boosts its scale.

Tesla turned its first profit in 2020 when it made $862 million in net profit. The figure rose to more than $5.5 billion in 2021 and over $11 billion in the past four straight quarters. Tesla made a net income of $3.3 billion in Q1 of 2022 followed by $2.5 billion and $3.2 billion in the next two quarters. Also, after a 75% drawdown in 2022, Tesla stock price rebounded strongly in 2023. Therefore, we could see a repeat of the same trend in the near future.

Is Tesla overvalued?

Most analysts believe that Tesla is an overvalued company. However, most of them justify this valuation because of its market share, revenue and unit growth, and upcoming projects like semi and cybertruck. A DCF valuation on Tesla shows that the stock is highly undervalued. It has a fair valuation of $161 per share, significantly below its current level.

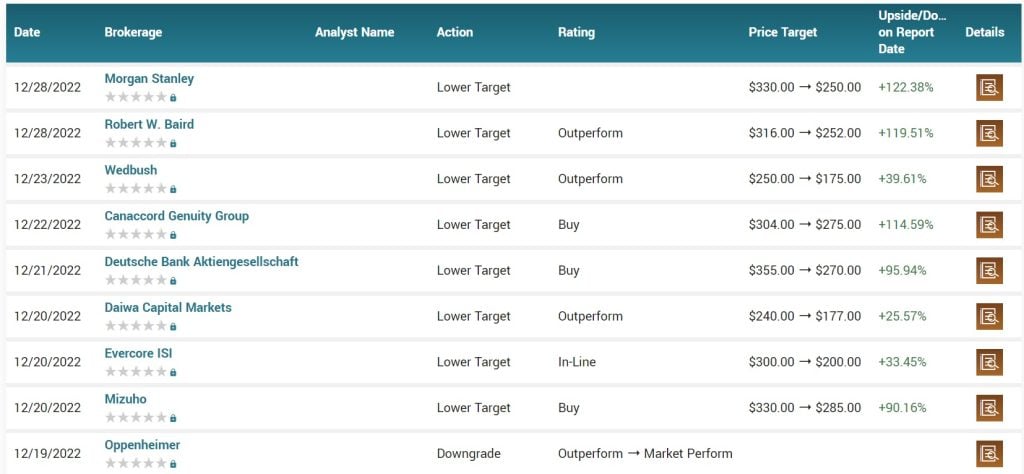

Tesla analysts forecast

Tesla Stock Price Prediction 2024

NASDAQ: TSLA has formed a death cross in early February, and has broken below a critical support as shown on the ascending channel. The latest analysis suggests a continuation of a downside price action in the near term.

Due to a lower low on the weekly chart, Tesla stock price forecast doesn’t appear to be very bullish for the next couple of months. This may change if the bulls clear the supply zone which lies above $277. Until then, there will always be another chance for the bears to make a comeback.

The upcoming CPI numbers and the rate hike decision by the US Federal Reserve will be the major factors affecting Tesla shares and other US equities over the next few months.

Tesla stock price prediction 2025 and 2030

I expect that TSLA shares will be significantly higher than where they are today by 2025 and 2030. At the time, the company will be highly profitable as the world moves to electric cars. As shown below, analysts at Wallet Investor expect that the stock will be trading at above $300 in 2025. Similarly, Cathie Wood believes that the stock will be over $3,000 by 2030. Ron Baron, who is a very successful fund manager, expects the TSLA stock price to hit $1500 by 2030.

Tesla biggest shareholders

Tesla is a publicly traded company, meaning that anyone can buy the stock. As mentioned, Elon Musk owns about 17% of the company. At the same time, there are about 1,937 institutional investors who own 41% of the company. This means that retail investors own about 42% of the company. The biggest Tesla shareholders are Blackrock, Vanguard, Capital Group, and Baillie Gifford.