Since its November 2021 IPO (NASDAQ: RIVN), Rivian stock price has been in a downward spiral. While many analysts are calling it a classic bubble burst, some still believe in the long-term vision of the company. In this article, we’ll take a shot to predict the future price action of Rivian stock and determine if Rivian is a good buy at the current price.

It has gotten worse for Rivian as the EV market is expected to decline significantly in 2024. The stock hit new all-time lows of $8.73 on April 16,2024 and currently trades marginally above that level at $8.80. That price places it at 58% below its year-to-date highs recorded on January 1. In a rough year that has seen Tesla stock lose a third of its value hardly three months into the year, Rivian is likely to encounter even more difficult times.

What is Rivian?

Rivian is an American electric vehicle and adventure travel firm that designs and produces electric cars. It was Founded in 2009 and is located in Plymouth, Michigan. Rivian has attracted substantial investment from Amazon and Ford, among others, and aims to become a leader in sustainable transportation.

The production of its initial offerings, the Rivian R1T truck, and the Rivian R1S SUV, started in late 2021. In the long run, Rivian intends to provide mobile adventure gear and expand to a global market.

Rivian Stock Symbol

In September 2021, Rivian started delivering its R1T pickup truck. This was a massive moment for the company and an edge over its competitors like Ford and Tesla. It was the first ever completely electric pickup truck. Shortly after this feat, Rivian had a successful IPO in November 2021 at a $66.5 billion valuation. Rivian IPO price was $78, and the stock was listed as a RIVN symbol on Nasdaq.

Rivian Stock Fidelity

In July 2021, Rivian closed its private funding round with a $2.5 billion investment. This round was led by corporate giants like Amazon, Ford, and D1 Capital Partners. Other participants included Fidelity Management & Research Company, along with a few other capital management firms.

Rivian Latest news

Rivian announced in mid-April that that it laid off 1% of its workforce, the second time in 2024 that the company reduced its headcount. This is not surprising for a company that is keen on trimming costs in a market experiencing a sharp slump. Market leader, Tesla, sent home 10% of its workers in April.

As per the most recent Rivian news, the company delivered 13,588 units, having produced 13,980 units in the first quarter of 2024. Although this was a decline in production of 20% from the previous quarter’s figures, it exceeded market forecasts which expected 13,800. According to Rivian management, that figure was within its expectations. The company expects to deliver 57,000 units for the full year.

Also, Rivian announced in March that it will start producing a cheaper, smaller R2 model from 2026, and that could open up a new market. The company also paused construction of its $5 billion Georgia plant indefinitely to save cash and focus on producing the R2 model.

Rivian Stock Price Today

RIVN is trading at $19.56 today. Rivian stock price is 17.41% up from yesterday. The stock has bounced off strongly from its yearly lows of April 2023. If you’re wondering who owns Rivian, then you should know that the majority of the electric carmaker’s stock is owned by institutional investors (62%). The remaining Rivian stock is owned by the company insiders.

Rivian Stock Price Prediction 2024

NASDAQ: RIVN is down by 58% this year and it trades below the 200 MA, which is currently at 18.20. The stock made a death cross a while back, making it a risky buy in the short term. However, a return above $11.69 could build the momentum to retest the 200-MA level.

In the meantime, I’ll keep sharing updated Rivian stock price forecast and my personal trades on my Twitter where you are welcome to follow me.

If the downtrend in equities continues, then the Rivian stock price could head lower to test the critical support level of $7.55. However, this is predicated upon the macroeconomic situation in the US. If the equities market enters consolidation and interest rates remain high, the stock could go lower.

Rivian Stock Price Prediction 2025

After a successful IPO in 2021, Rivian targetted a production of 15000 vehicles by the end of 2022. However, the company fell short of this target and was able to produce only 24,337 vehicles by December 2022.

With Rivian’s latest production capacity, the EV maker will produce slightly more vehicles than last year. I expect the stock to trade sideways til 2025 without any significant price increase.

Rivian Stock Price Prediction 2030

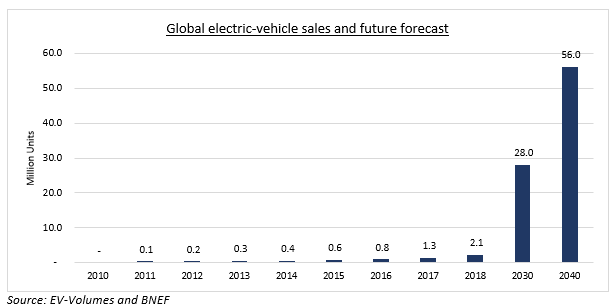

Many analysts expect a new all-time high in US equities by 2030. Although the asset prices in 2030 could be anybody’s guess but considering the current growth of Rivian Automotaive, Inc. we can take a shot. If the company keeps adding new vehicle categories in its portfolio, then I expect the Rivian stock price to retest its IPO price of $78 before 2030.

Rivian Stock Price Prediction 2040

A lot can happen in the world till 2040, therefore, it’s very difficult to predict RIVN stock price 17 years from now. Wars, famines, recessions, and hyperinflation are like slow poison for any business. If Rivian evades all of them and keeps growing then I expect it to give Tesla a tough time by 2040. Many people are already comparing Rivian R1T with Tesla cyber truck.

Is Rivian a good investment?

Rivian stock has already plunged 90% from its November 2021 peak of $179.47. It is highly unlikely that the price can have a similar downward rally in the near future. Therefore, I consider Rivian a good investment for at least a short term in anticipation of a relief rally.

While the company has been hemorrhaging funds, its growth strategy seems to be working, and could help it start generating profits. Also, it still sits in a relatively strong position, with $9.37 billion in cash at the end of Q1 2024.

In April, the company shut down its plant in Normal, Illinois for upgrades. The company says that while it will experience downtime between April 5-April 30, the move will save it $2.25 billion and increase efficiency. Also it reduced its losses substantially in the fourth quarter of 2023, bringing down the loss per vehicle from $124,126 in Q4 of 2022 to $43,372. The company also intends to expand to external markets, which could broaden its revenue stream.

One of its key strategies in its expansion plans is the sale of the new, smaller R2 model, which is expected to be cheaper at $45,000 per unit. Rivian reported that it received 68,000 reservations within 24 hours of R2 the announcement, and expects the demand to grow to as much as a million units per year across the world.

In a surprise announcement, Rivian CEO Robert Scaringe revealed that the company will add new models, the R3 and R3X to its production line. The two will cost between $37,000-$43,000 and are expected to attract more buyers, as the company focuses on giving customers more options.

How to buy Rivian stock?

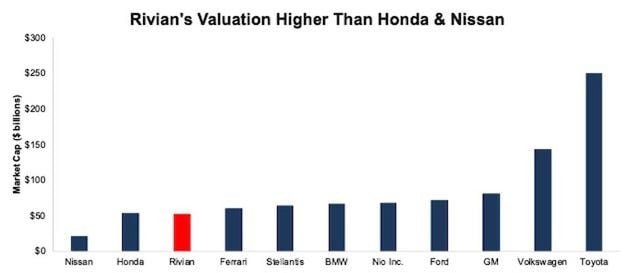

If you’re wondering how to buy Rivian stock, then you should know that it is listed on the Nasdaq stock exchange as RIVN. You can also invest in Rivian stock CFDs and derivatives on different platforms like eToro and Robinhood. The current price presents a good buying opportunity as Rivian was very overvalued at its IPO. Its IPO valuation made it even bigger than Honda and Nissan.

Should I buy Rivian stock?

If you believe in Rivian’s vision and consider its technology better than Tesla, then Rivian stock at its current price could be a nice buy. However, the stop loss must be kept under January 2023 low of $15.28. The company will announce its Q4 2022 earnings on 28th Feb. A positive earnings report can send the stock price above $25, however, a significant drop in revenue could make things really ugly.

How much is Rivian stock?

Rivian stock trades at $8.80 as of this writing. After rallying for a long period, the US equities markets are flashing signs of a potential correction, and this could increase pressure on the economy. Coupled with higher-for-longer interest rates and high inflation, Rivian sales are likely to take a hit, and this will almost certainly affect the stock price. Based on the current Rivian stock price of $8.80 and outstanding shares of 969 million, current market cap of Rivian Automotive, Inc. is $8.5 billion. At its peak, the company was valued more than $100 billion, meaning that it has lost more than 90% of its value.

When can I buy Rivian stock?

You can buy Rivian stock at the current price as it has very little downside but massive upside potential. This provides a great risk to reward ratio, which investors often consider before investing in any stock. Tesla’s current market cap is $597 billion, therefore, Rivian at $18 billion market cap, seems to be a great buy.

What is Rivian stock trading time?

As mentioned earlier, Rivian stock trades on the NASDAQ stock exchange, which is the second largest exchange in the world. NASDAQ trading hours are 9:30 am to 4:00 pm Eastern Standard Time and no trades take place over the weekend. Rivian is listed on the exchange under the ticker symbol RIVN.