Pendle price was down by 4 percent early on Tuesday, trading at $5.78, after erasing most of the gains made on Monday. The token’s momentum has been blowing hot and cold in the last two trading sessions, signaling a near-equilibrium between the buying and selling appetite. My near-term Pendle price prediction is based on trading volume. It signals that a continuation of this trend could see short-term sideways movement, with investors waiting for a breakout.

Pendle has gained 10.8 percent in the last week, being among the crypto altcoins that are in the green amid a wider market decline in June. Furthermore, it is up by 362 percent year-to-date. Bitcoin, the market bellwether, has experienced a steep decline and is currently struggling to stay above the psychological support at $60k. Furthermore, it has lost 10 percent of its value in June, almost wiping out the gains made in May.

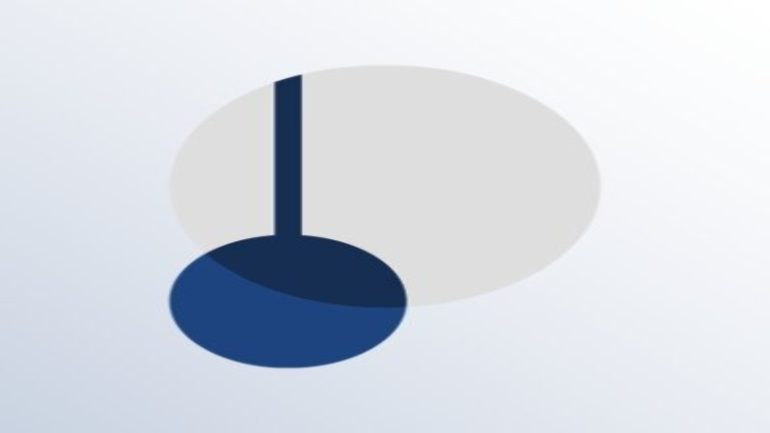

As of this writing, Pendle has $101 million in traded volume in the previous 24 hours, an increase of 41 percent. Therefore, we are likely to witness a decline in its price if the sellers continue being in control in the next 24 hours. Pendle enables investments in future yields, an attractive option in DeFi that offers investors opportunities to maximize their returns, including through cross-platform integration.

Pendle’s services are available across multiple blockchain ecosystems, including Ethereum, Arbitrum, Optimism, and BNB Chain. Essentially, investors can conduct interest rate trading across multiple platforms, enabling users to hedge against their positions.

Technical analysis

The momentum on Pendle token price favours the sellers to stay in control, if resistance persists at 5.77 and the first support will likely be at 5.65. My Pendle price prediction indicates that a break below that mark will strengthen the downside momentum to potentially test 5.52 in extension. On the other hand, a move above 5.77 will favour the buyers to take control. However, the upward momentum will likely encounter the first resistance at 5.88, beyond which the downside narrative will be invalid. Furthermore, it could strengthen the buyers to move the price higher to test 6.00.